Supercuts 2011 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2011 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

9. DERIVATIVE FINANCIAL INSTRUMENTS

The Company's primary market risk exposures in the normal course of business are changes in interest rates and foreign currency exchange

rates. The Company has established policies and procedures that govern the management of these exposures through the use of a variety of

strategies, including the use of derivative financial instrument contracts. By policy, the Company does not enter into such contracts for the

purpose of speculation or trading. Hedging transactions are limited to an underlying exposure. The Company has established an interest rate

management policy that manages the interest rate mix of its total debt portfolio and related overall cost of borrowing. The Company's foreign

currency exchange rate risk management policy includes frequently monitoring market data and external factors that may influence exchange

rate fluctuations in order to minimize fluctuation in earnings due to changes in exchange rates. The Company enters into arrangements with

counterparties that the Company believes are creditworthy. Generally, derivative contract arrangements settle on a net basis. The Company

assesses the effectiveness of its hedges on a quarterly basis using the critical terms method in accordance with guidance for accounting for

derivative instruments and hedging activities.

The Company has primarily utilized derivatives which are designated as either cash flow or fair value hedges and qualify for hedge

accounting treatment. For cash flow hedges and fair value hedges, changes in fair value are deferred in accumulated other comprehensive

income (loss) within shareholders' equity until the underlying hedged item is recognized in earnings. Any hedge ineffectiveness is recognized

immediately in current earnings. To the extent the changes offset, the hedge is effective. Any hedge ineffectiveness the Company has historically

experienced has not been material. By policy, the Company designs its derivative instruments to be effective as hedges and aims to minimize

fluctuations in earnings due to market risk exposures. If a derivative instrument is terminated prior to its contract date, the Company continues to

defer the related gain or loss and recognizes it in current earnings over the remaining life of the related hedged item.

The Company also utilizes freestanding derivative contracts which do not qualify for hedge accounting treatment. The Company marks to

market such derivatives with the resulting gains and losses recorded within current earnings in the Consolidated Statement of Operations. For

purposes of the Consolidated Statement of Cash Flows, cash flows associated with all derivatives (designated as hedges or freestanding

economic hedges) are classified in the same category as the related cash flows subject to the hedging relationship.

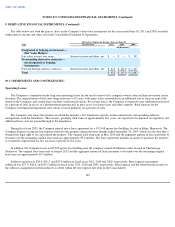

Cash Flow Hedges

As of June 30, 2011, the Company's cash flow hedges consist of forward foreign currency contracts.

In the past, the Company used interest rate swaps to maintain its variable to fixed rate debt ratio in accordance with its established policy.

The Company repaid variable and fixed rate debt during the twelve months ended June 30, 2011. Prior to the repayments, the Company had two

outstanding interest rate swaps totaling $40.0 million on $85.0 million aggregate variable rate debt with maturity dates in fiscal year 2012. The

interest rate swaps were terminated prior to the maturity dates in conjunction with the repayments of debt and were settled for an aggregate loss

of $0.1 million. The $0.1 million loss was recorded during the fourth quarter of fiscal year 2011 on the termination of the interest rate swaps and

was recorded within interest expense in the Consolidated Statement of Operations.

The Company repaid variable and fixed rate debt during the twelve months ended June 30, 2010. Prior to the repayments, the Company had

two outstanding interest rate swaps totaling $50.0 million on $100.0 million aggregate variable rate debt with maturity dates between fiscal years

2013 and 2015. The

119