Supercuts 2011 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2011 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

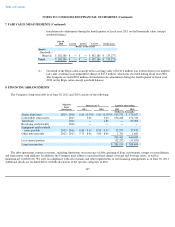

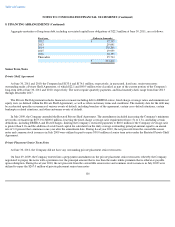

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

7. FAIR VALUE MEASUREMENTS (Continued)

At June 30, 2011, the fair value of the equity put option was $22.7 million and is classified within other noncurrent liabilities on the balance

sheet.

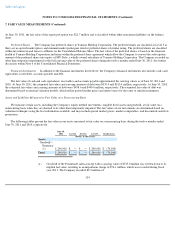

Preferred Shares. The Company has preferred shares in Yamano Holding Corporation. The preferred shares are classified as Level 3 as

there are no quoted market prices and minimal market participant data for preferred shares of similar rating. The preferred shares are classified

within investment in and loans to affiliates on the Consolidated Balance Sheet. The fair value of the preferred shares is based on the financial

health of Yamano Holding Corporation and terms within the preferred share agreement which allow the Company to convert the subscription

amount of the preferred shares into equity of MY Style, a wholly owned subsidiary of Yamano Holding Corporation. The Company recorded an

other than temporary impairment for the full carrying value of the preferred shares during the twelve months ended June 30, 2011. See further

discussion within Note 6 to the Consolidated Financial Statements.

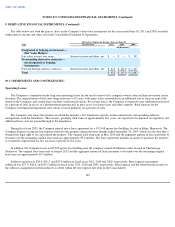

Financial Instruments. In addition to the financial instruments listed above, the Company's financial instruments also include cash, cash

equivalents, receivables, accounts payable and debt.

The fair value of cash and cash equivalents, receivables and accounts payable approximated the carrying values as of June 30, 2011 and

2010. At June 30, 2011, the estimated fair values and carrying amounts of debt were $335.4 and $313.4 million, respectively. At June 30, 2010,

the estimated fair values and carrying amounts of debt were $458.6 and $440.0 million, respectively. The estimated fair value of debt was

determined based on internal valuation models, which utilize quoted market prices and interest rates for the same or similar instruments.

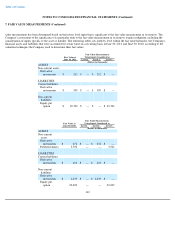

Assets and Liabilities Measured at Fair Value on a Nonrecurring Basis

We measure certain assets, including the Company's equity method investments, tangible fixed assets and goodwill, at fair value on a

nonrecurring basis when they are deemed to be other than temporarily impaired. The fair values of our investments are determined based on

valuation techniques using the best information available, and may include quoted market prices, market comparables, and discounted cash flow

projections.

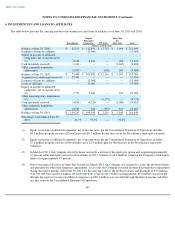

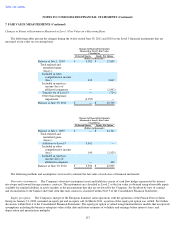

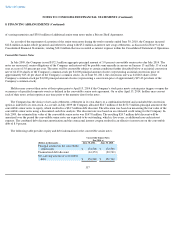

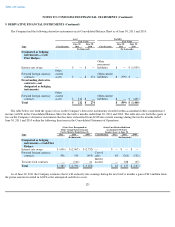

The following tables present the fair value in our assets measured at fair value on a nonrecurring basis during the twelve months ended

June 30, 2011 and 2010, respectively:

114

June 30,

2011

Level 1

Level 2

Level 3

Total Losses

(Dollars in thousands)

Assets

Goodwill—

Promenade

(1)

$

240,910

$

—

$

—

$

240,910

$

(74,100

)

Total

$

240,910

$

—

$

—

$

240,910

$

(74,100

)

(1) Goodwill of the Promenade salon concept with a carrying value of $315.0 million was written down to its

implied fair value, resulting in an impairment charge of $74.1 million, which was recorded during fiscal

year 2011. The Company recorded $0.3 million of