Supercuts 2011 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2011 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

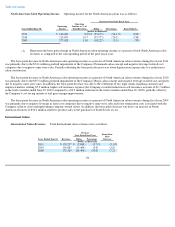

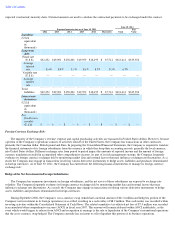

Investing Activities

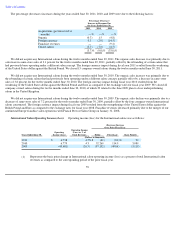

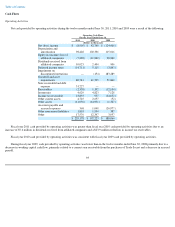

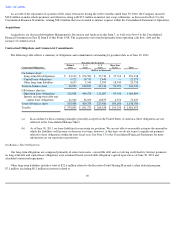

Net cash used in investing activities during the twelve months ended June 30, 2011, 2010 and 2009 was the result of the following:

Cash used by investing activities was greater during fiscal year 2011 compared to fiscal year 2010 due to the acquisition of approximately

17 percent additional equity interest in Provalliance for $57.3 million (€ 40.4 million), a disbursement of $15.0 million on the revolving credit

facility with EEG and the planned increase in acquisitions and capital expenditures. The Company completed 271 major remodeling projects

during fiscal year 2011, compared to 333 and 280 during fiscal years 2010 and 2009, respectively. During fiscal year 2011, we constructed 146

company-owned salons and three hair restoration centers, and acquired 105 company-owned salons (78 of which were franchise buybacks) and

four hair restoration centers (all of which were franchise buybacks).

Cash used by investing activities was lower during fiscal year 2010 compared to fiscal year 2009 due to the planned reduction in

acquisitions and capital expenditures and the receipt of $15.0 million on the revolving credit facility with EEG of which there was $0.0 and

$15.0 million outstanding as of June 30, 2010 and 2009, respectively. The Company completed 333 major remodeling projects during fiscal year

2010, compared to 280 and 186 during fiscal years 2009 and 2008, respectively. We constructed 139 company-owned salons, four hair

restoration centers and acquired 26 company-owned salons (23 of which were franchise buybacks) and zero hair restoration centers.

Cash used by investing activities was lower during fiscal year 2009 compared to fiscal year 2008 due to the planned reduction in

acquisitions and capital expenditures. Acquisitions during fiscal year 2009 were primarily funded by a combination of operating cash flows and

debt. Additionally, the Company completed 280 major remodeling projects during fiscal year 2009, compared to 186 during fiscal year 2008.

We constructed 182 company-owned salons, eight hair restoration centers and acquired 177 company-owned salons (83 of which were franchise

buybacks) and two hair restoration centers, all of which were franchise buybacks. In addition during fiscal year 2008, there was a $36.4 million

loan to Empire Education Group, Inc. and a transfer of $10.9 million in cash related to the deconsolidation of our schools and European

franchise salon business.

65

Investing Cash Flows

For the Years Ended June 30,

2011 2010 2009

(Dollars in thousands)

Business and salon

acquisitions

$

(17,990

)

$

(3,664

)

$

(40,051

)

Capital expenditures for

remodels or other

additions

(44,855

)

(40,561

)

(35,081

)

Capital expenditures for

the corporate office

(including all

technology-related

expenditures)

(13,826

)

(7,828

)

(13,113

)

Capital expenditures for

new salon construction

(12,788

)

(9,432

)

(25,380

)

Proceeds from loans and

investments

16,804

16,099

19,008

Disbursements for loans

and investments

(72,301

)

—

(

20,971

)

Freestanding derivative

settlement

—

736

—

Proceeds from sale of

assets

626

70

77

$

(144,330

)

$

(44,580

)

$

(115,511

)