Supercuts 2011 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2011 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

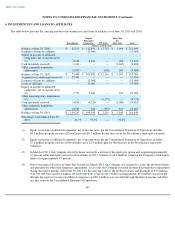

6. INVESTMENTS IN AND LOANS TO AFFILIATES (Continued)

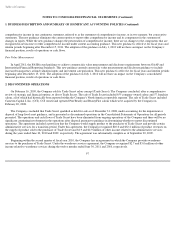

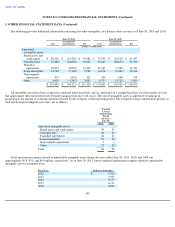

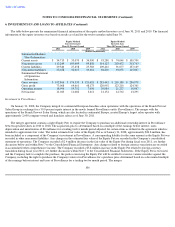

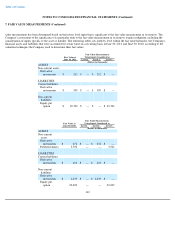

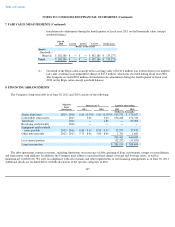

The table below presents the summarized financial information of the equity method investees as of June 30, 2011 and 2010. The financial

information of the equity investees was based on results as of and for the twelve months ended June 30.

Investment in Provalliance

On January 31, 2008, the Company merged its continental European franchise salon operations with the operations of the Franck Provost

Salon Group in exchange for a 30.0 percent equity interest in the newly formed Provalliance entity (Provalliance). The merger with the

operations of the Franck Provost Salon Group, which are also located in continental Europe, created Europe's largest salon operator with

approximately 2,600 company-owned and franchise salons as of June 30, 2011.

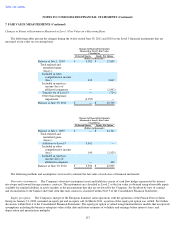

The merger agreement contains a right (Equity Put) to require the Company to purchase an additional ownership interest in Provalliance

between specified dates in 2010 to 2018. The acquisition price is determined based on a multiple of the earnings before interest, taxes,

depreciation and amortization of Provalliance for a trailing twelve month period adjusted for certain items as defined in the agreement which is

intended to approximate fair value. The initial estimated fair value of the Equity Put as of January 31, 2008, approximately $24.8 million, has

been included as a component of the Company's investment in Provalliance. A corresponding liability for the same amount as the Equity Put was

recorded in other noncurrent liabilities. Any changes in the estimated fair value of the Equity Put are recorded in the Company's consolidated

statement of operations. The Company recorded a $2.4 million decrease in the fair value of the Equity Put during fiscal year 2011, see further

discussion below and within Note 7 to the Consolidated Financial Statements. Any changes related to foreign currency translation are recorded

in accumulated other comprehensive income. The Company recorded a $3.8 million increase in the Equity Put related to foreign currency

translation during fiscal year 2011, see further discussion within Note 7 to the Consolidated Financial Statements. If the Equity Put is exercised,

and the Company fails to complete the purchase, the parties exercising the Equity Put will be entitled to exercise various remedies against the

Company, including the right to purchase the Company's interest in Provalliance for a purchase price determined based on a discounted multiple

of the earnings before interest and taxes of Provalliance for a trailing twelve month period. The merger

106

Equity Method

Investee Greater

Than 50 Percent Owned

Equity Method

Investees Less

Than 50 Percent Owned

2011

2010

2009

2011

2010

2009

(Dollars in thousands)

Summarized Balance

Sheet Information:

Current assets

$

34,715

$

35,070

$

34,990

$

93,280

$

74,040

$

109,700

Noncurrent assets

113,249

105,469

99,858

314,127

263,472

313,763

Current liabilities

29,340

27,458

25,583

109,416

91,077

137,169

Noncurrent liabilities

33,658

32,017

39,661

98,269

93,055

115,067

Summarized Statement

of Operations

Information:

Gross revenue

$

192,864

$

176,535

$

153,693

$

283,442

$

299,188

$

290,978

Gross profit

73,068

64,661

48,173

120,992

123,210

124,361

Operating income

18,994

19,752

7,656

30,084

21,227

19,047

Net income

11,023

11,082

3,611

21,154

14,763

13,295