Supercuts 2011 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2011 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

9. DERIVATIVE FINANCIAL INSTRUMENTS (Continued)

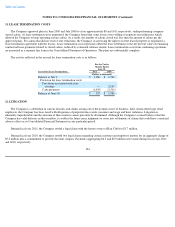

interest rate swaps were terminated prior to the maturity dates in conjunction with the repayments of debt and were settled for an aggregate loss

of $5.2 million. The $5.2 million loss recorded during the first quarter of fiscal year 2010 on the termination of the interest rate swaps was

recorded within interest expense in the Consolidated Statement of Operations as described in Note 8 to the Consolidated Financial Statements.

The Company also had two outstanding treasury lock agreements with maturity dates between fiscal years 2013 and 2015. The treasury lock

agreements were terminated prior to the maturity dates in conjunction with the repayments of debt and were settled for a loss of less than

$0.1 million during the twelve months ended June 30, 2010 and recorded within interest expense in the Consolidated Statement of Operations.

The Company uses forward foreign currency contracts to manage foreign currency rate fluctuations associated with certain forecasted

intercompany transactions. The Company's primary forward foreign currency contracts hedge approximately $0.6 million of monthly payments

in Canadian dollars for intercompany transactions. The Company's forward foreign currency contracts hedge transactions through September

2012.

These cash flow hedges were designed and are effective as cash flow hedges. They were recorded at fair value within other noncurrent

liabilities or other current assets in the Consolidated Balance Sheet, with corresponding offsets primarily recorded in other comprehensive

income (loss), net of tax.

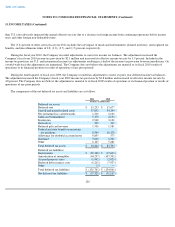

Fair Value Hedges

In the past, the Company had two interest rate swaps designated as fair value hedges. The Company paid variable rates of interest and

received fixed rates of interest under these contracts. The contracts and related debt matured during the twelve months ended June 30, 2009.

Freestanding Derivative Forward Contracts

The Company uses freestanding derivative forward contracts to offset the Company's exposure to the change in fair value of certain foreign

currency denominated investments and intercompany assets and liabilities. These derivatives are not designated as hedges and therefore, changes

in the fair value of these forward contracts are recognized currently in earnings, thereby offsetting the current earnings effect of the related

foreign currency denominated assets and liabilities.

In November 2009, the Company terminated its freestanding derivative contract on its remaining payments on the MY Style Note and

recorded a gain of $0.7 million. The contract was settled in cash, discounted to present value. Gains and losses over the life of the contract were

recognized in earnings in conjunction with marking the contract to fair value. A net loss of $0.2 million was recognized during fiscal year 2010.

120