Supercuts 2011 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2011 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

9. DERIVATIVE FINANCIAL INSTRUMENTS (Continued)

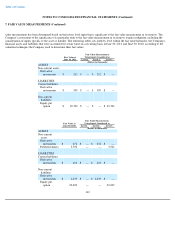

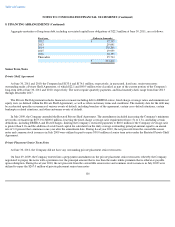

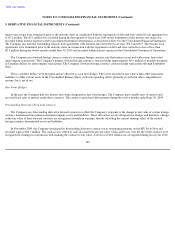

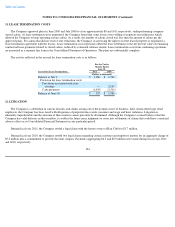

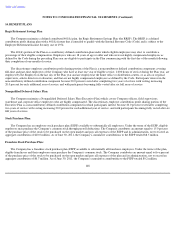

The Company had the following derivative instruments in its Consolidated Balance Sheet as of June 30, 2011 and 2010:

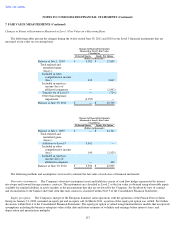

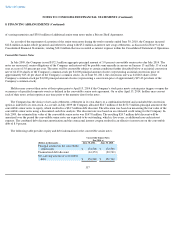

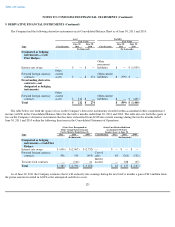

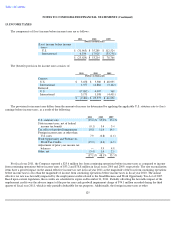

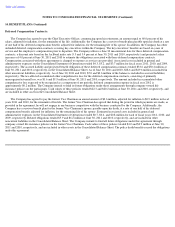

The table below sets forth the (gain) or loss on the Company's derivative instruments recorded within accumulated other comprehensive

income (AOCI) in the Consolidated Balance Sheet for the twelve months ended June 30, 2011 and 2010. The table also sets forth the (gain) or

loss on the Company's derivative instruments that has been reclassified from AOCI into current earnings during the twelve months ended

June 30, 2011 and 2010 within the following line items in the Consolidated Statement of Operations.

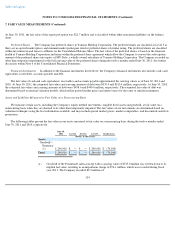

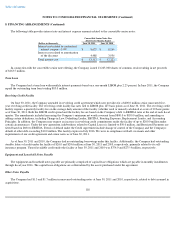

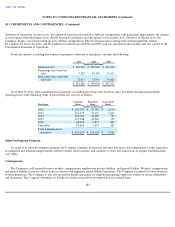

As of June 30, 2011 the Company estimates that it will reclassify into earnings during the next twelve months a gain of $0.6 million from

the pretax amount recorded in AOCI as the anticipated cash flows occur.

121

Asset

Liability

Fair Value

Fair Value

Type

Classification

June 30,

2011

June 30,

2010

Classification

June 30,

2011

June 30,

2010

(In thousands)

(In thousands)

Designated as hedging

instruments—Cash

Flow Hedges:

Interest rate swaps

—

$

—

$

—

Other

noncurrent

liabilities

$

—

$

(

1,039

)

Forward foreign currency

contracts

Other

current

assets

$

—

$

274

Other current

liabilities

$

(599

)

$

—

Freestanding derivative

contracts—not

designated as hedging

instruments:

Forward foreign currency

contracts

Other

current

assets

$

212

$

—

Other current

liabilities

$

—

$

(

401

)

Total

$

212

$

274

$

(599

)

$

(1,440

)

(Gain) Loss Recognized in

Other Comprehensive Income

Twelve Months Ended June 30,

(Gain) Loss Reclassified from

Accumulated OCI into

Income (Loss) at June 30,

Type

2011

2010

2009

Classification

2011

2010

2009

(In thousands)

(In thousands)

Designated as hedging

instruments—

Cash Flow

Hedges:

Interest rate swaps

$

(636

)

$

(2,967

)

$

(2,732

)

—

$

—

$

—

$

—

Forward foreign currency

contracts

456

519

(495

)

Cost of

sales

48

(261

)

(142

)

Treasury lock contracts

—

(

146

)

41

Interest

income

—

388

(25

)

Total

$

(180

)

$

(2,594

)

$

(3,186

)

$

48

$

127

$

(167

)