Supercuts 2011 Annual Report Download - page 131

Download and view the complete annual report

Please find page 131 of the 2011 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

13. INCOME TAXES (Continued)

than U.S. rates adversely impacted the annual effective tax rate due to a decrease in foreign income from continuing operations before income

taxes and other foreign non-deductible items.

The (5.4) percent of other, net in fiscal year 2011 includes the rate impact of meals and entertainment, donated inventory, unrecognized tax

benefits, and miscellaneous items of 2.8, (3.0), (3.7), and (1.5) percent, respectively.

During the fiscal year 2010, the Company recorded adjustments to correct its income tax balances. The adjustments increased the

Company's fiscal year 2010 income tax provision by $2.1 million and increased its effective income tax rate by 3.9 percent. Included in the

income tax provision are U.S. and international income tax adjustments resulting in a shift of the income tax provision between jurisdictions. On

a world-wide basis the adjustments are immaterial. The Company does not believe the adjustments are material to its fiscal 2010 results of

operations or its financial position or results of operations of any prior periods.

During the fourth quarter of fiscal year 2009, the Company recorded an adjustment to correct its prior year deferred income tax balances.

The adjustment increased the Company's fiscal year 2009 income tax provision by $3.8 million and increased its effective income tax rate by

4.8 percent. The Company does not believe the adjustment is material to its fiscal 2009 results of operations or its financial position or results of

operations of any prior periods.

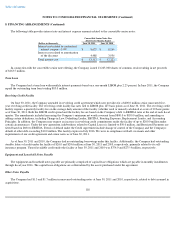

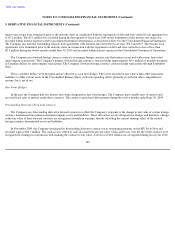

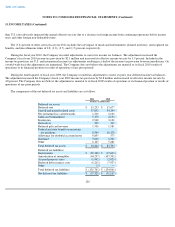

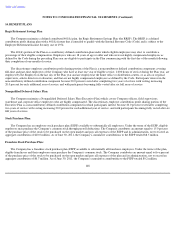

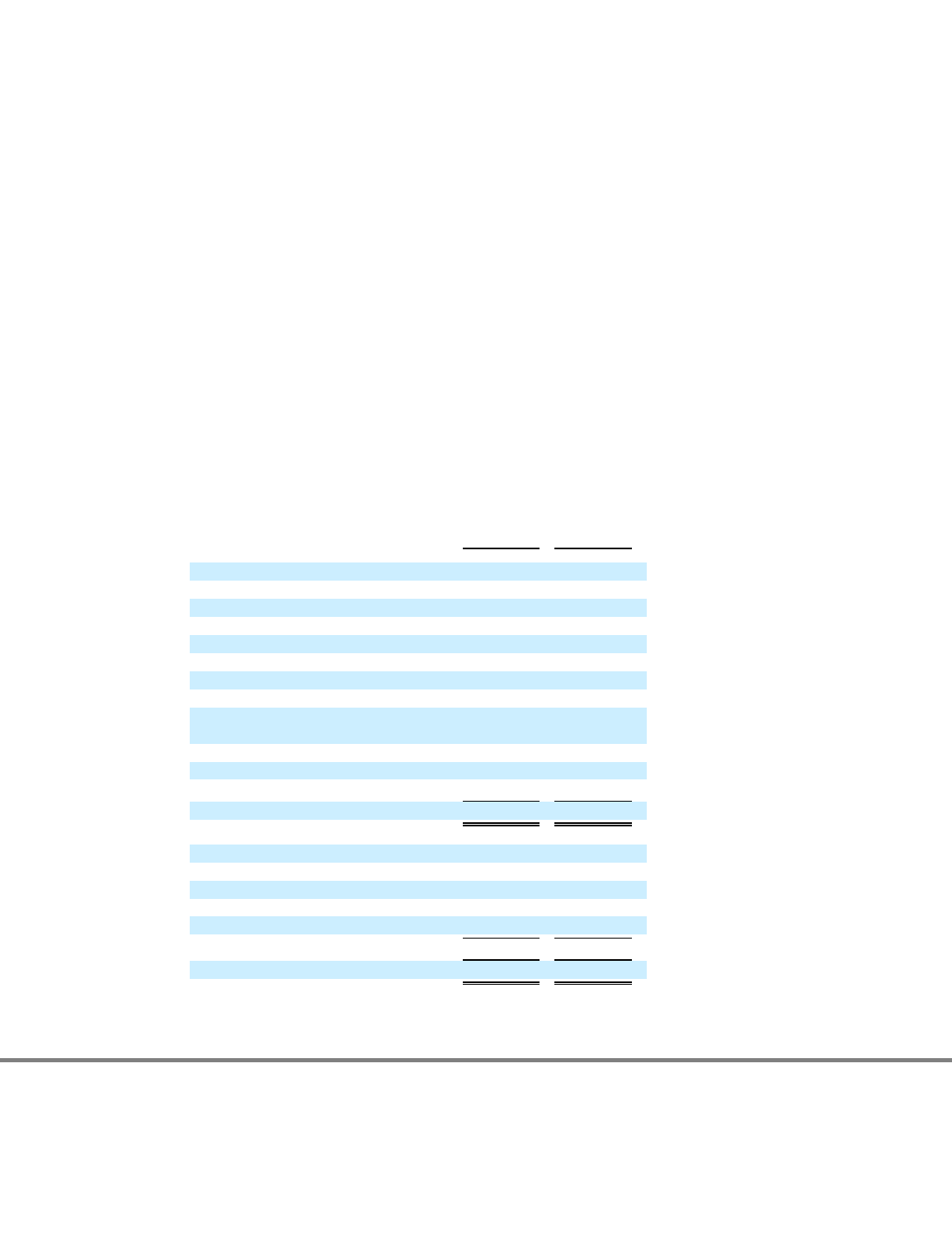

The components of the net deferred tax assets and liabilities are as follows:

126

2011

2010

(Dollars in thousands)

Deferred tax assets:

Deferred rent

$

15,233

$

15,677

Payroll and payroll related costs

37,852

34,294

Net operating loss carryforwards

1,210

2,106

Salon asset impairment

5,176

4,154

Inventories

2,968

3,136

Derivatives

229

311

Deferred gift card revenue

1,536

1,581

Federal and state benefit on uncertain

tax positions

8,549

10,178

Allowance for doubtful accounts/notes

9,855

575

Insurance

5,669

6,301

Other

6,167

5,481

Total deferred tax assets

$

94,444

$

83,794

Deferred tax liabilities:

Depreciation

$

(29,348

)

$

(17,603

)

Amortization of intangibles

(94,257

)

(107,392

)

Accrued property taxes

(1,942

)

(2,029

)

Deferred debt issuance costs

(6,215

)

(7,937

)

Other

(3

)

—

Total deferred tax liabilities

$

(131,765

)

$

(134,961

)

Net deferred tax liabilities

$

(37,321

)

$

(51,167

)