Supercuts 2011 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2011 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

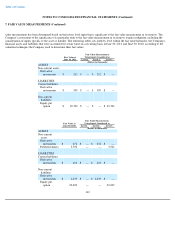

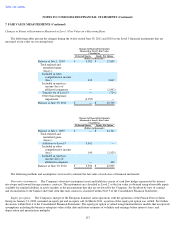

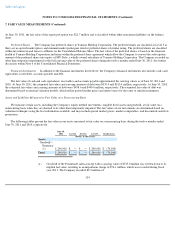

7. FAIR VALUE MEASUREMENTS (Continued)

8. FINANCING ARRANGEMENTS

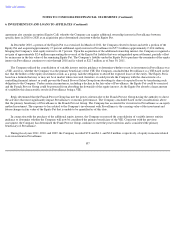

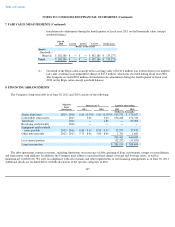

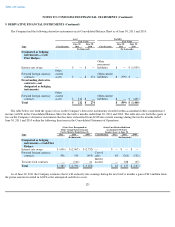

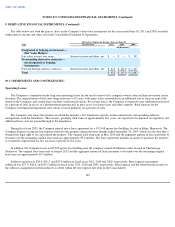

The Company's long-term debt as of June 30, 2011 and 2010 consists of the following:

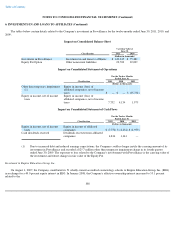

The debt agreements contain covenants, including limitations on incurrence of debt, granting of liens, investments, merger or consolidation,

and transactions with affiliates. In addition, the Company must adhere to specified fixed charge coverage and leverage ratios, as well as

minimum net worth levels. We were in compliance with all covenants and other requirements of our financing arrangements as of June 30, 2011.

Additional details are included below with the discussion of the specific categories of debt.

115

translation rate adjustments during the fourth quarter of fiscal year 2011 on the Promenade salon concept

goodwill balance.

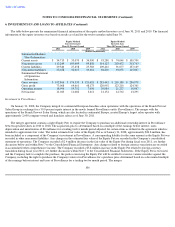

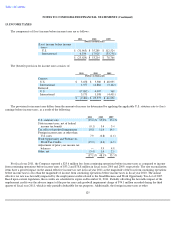

June 30,

2010

Level 1

Level 2

Level 3

Total Losses

(Dollars in thousands)

Assets

Goodwill

—

Regis(1)

$

102,180

$

—

$

—

$

102,180

$

(35,277

)

Total

$

102,180

$

—

$

—

$

102,180

$

(35,277

)

(1)

Goodwill of the Regis salon concept with a carrying value of $136.6 million was written down to its implied

fair value, resulting in an impairment charge of $35.3 million, which was recorded during fiscal year 2010.

The Company recorded $0.8 million of translation rate adjustments during the fourth quarter of fiscal year

2010 on the Regis salon concept goodwill balance.

Interest rate %

Amounts outstanding

Maturity

Dates

(fiscal year)

2011

2010

2011

2010

(Dollars in thousands)

Senior term notes

2013

-

2018

6.69

-

8.50

%

5.65

-

8.39

%

$

133,571

$

174,107

Convertible senior notes

2015

5.00

5.00

156,248

151,760

Term loan

2011

—

2.86

—

85,000

Revolving credit facility

2016

—

—

—

—

Equipment and leasehold

notes payable

2015

-

2016

8.80

-

9.14

8.93

-

9.35

22,273

27,473

Other notes payable

2012

-

2013

5.75

-

8.00

3.00

-

8.00

1,319

1,689

313,411

440,029

Less current portion

(32,252

)

(51,629

)

Long

-

term portion

$

281,159

$

388,400