Supercuts 2011 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2011 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

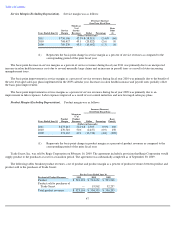

The basis point increase in D&A as a percent of consolidated revenues during fiscal year 2009 was primarily due to the decrease in same-

store sales. In addition, the Company recorded impairment charges of $10.2 million related to the impairment of property and equipment at

underperforming locations, including those salons under the Company approved plan to close up to 80 underperforming United Kingdom

company-owned salons.

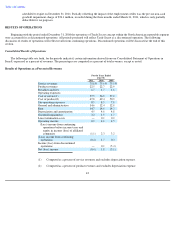

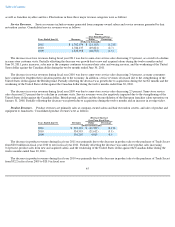

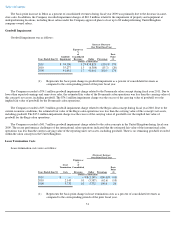

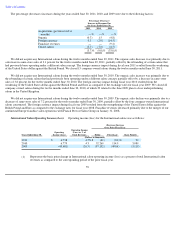

Goodwill Impairment

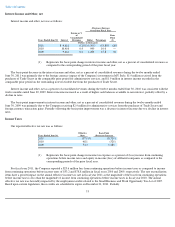

Goodwill impairment was as follows:

The Company recorded a $74.1 million goodwill impairment charge related to the Promenade salon concept during fiscal year 2011. Due to

lower than expected earnings and same-

store sales, the estimated fair value of the Promenade salon operations was less than the carrying value of

this concept's net assets, including goodwill. The $74.1 million impairment charge was the excess of the carrying value of goodwill over the

implied fair value of goodwill for the Promenade salon operations.

The Company recorded a $35.3 million goodwill impairment charge related to the Regis salon concept during fiscal year 2010. Due to the

current economic conditions, the estimated fair value of the Regis salon operations was less than the carrying value of this concept's net assets,

including goodwill. The $35.3 million impairment charge was the excess of the carrying value of goodwill over the implied fair value of

goodwill for the Regis salon operations.

The Company recorded a $41.7 million goodwill impairment charge related to the salon concepts in the United Kingdom during fiscal year

2009. The recent performance challenges of the international salon operations indicated that the estimated fair value of the international salon

operations was less than the current carrying value of the reporting unit's net assets, including goodwill. There is no remaining goodwill recorded

within the salon concepts in the United Kingdom.

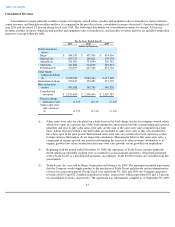

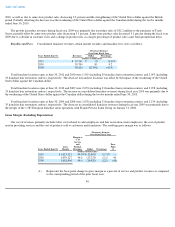

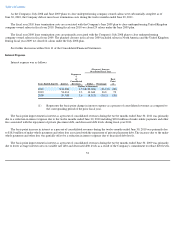

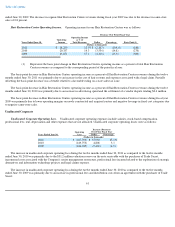

Lease Termination Costs

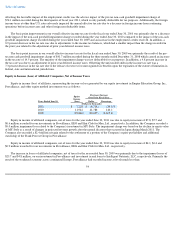

Lease termination costs were as follows:

51

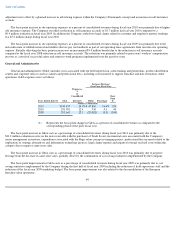

Increase (Decrease)

Over Prior Fiscal Year

Years Ended June 30,

Goodwill

Impairment

Expense as

%

of

Consolidated

Revenues Dollar

Percentage

Basis

Point

(1)

(Dollars in thousands)

2011

$

74,100

3.2

%

$

38,823

110.1

%

170

2010

35,277

1.5

(6,384

)

(15.3

)

(20

)

2009

41,661

1.7

41,661

100.0

170

(1) Represents the basis point change in goodwill impairment as a percent of consolidated revenues as

compared to the corresponding period of the prior fiscal year.

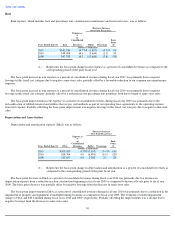

(Decrease) Increase

Over Prior Fiscal Year

Years Ended June 30,

Lease

Termination

Costs

Expense as

%

of

Consolidated

Revenues Dollar

Percentage

Basis

Point

(1)

(Dollars in thousands)

2011

$

—

—

%

$

(

2,145

)

(100.0

)%

(10

)

2010

2,145

0.1

(3,587

)

(62.6

)

(10

)

2009

5,732

0.2

5,732

100.0

20

(1) Represents the basis point change in lease termination costs as a percent of consolidated revenues as

compared to the corresponding periods of the prior fiscal year.