Supercuts 2011 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2011 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

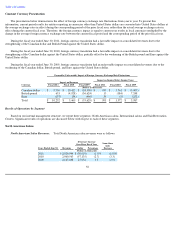

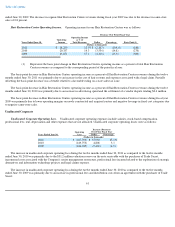

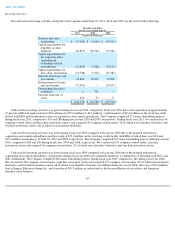

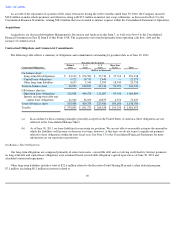

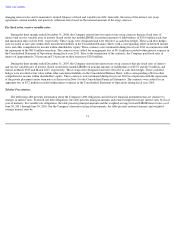

The company-owned constructed and acquired locations (excluding franchise buybacks) consisted of the following number of locations in

each concept:

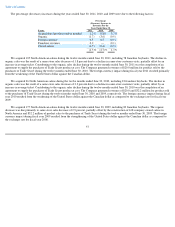

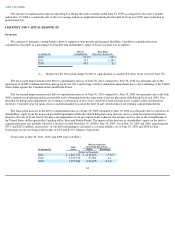

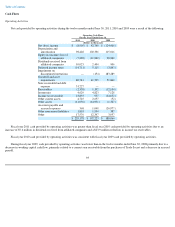

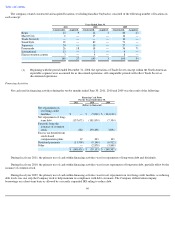

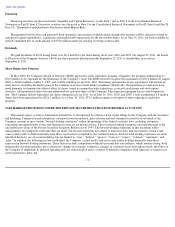

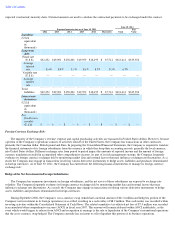

Financing Activities

Net cash used in financing activities during the twelve months ended June 30, 2011, 2010 and 2009 was the result of the following:

During fiscal year 2011, the primary use of cash within financing activities was for repayments of long-term debt and dividends.

During fiscal year 2010, the primary use of cash within financing activities was for net repayments of long-term debt, partially offset by the

issuance of common stock.

During fiscal year 2009, the primary use of cash within financing activities was for net repayments on revolving credit facilities as reducing

debt levels was one step the Company took to help maintain its compliance with debt covenants. The Company utilized intercompany

borrowings on a short-term basis as allowed by a recently expanded IRS ruling to reduce debt.

66

Years Ended June 30,

2011

2010

2009

Constructed

Acquired

Constructed

Acquired

Constructed

Acquired

Regis

12

9

14

3

20

23

MasterCuts

6

—

15

—

14

—

Trade Secret(1)

—

—

—

—

10

—

SmartStyle

65

—

80

—

71

—

Supercuts

24

—

10

—

27

—

Promenade

26

18

18

—

36

71

International

13

—

2

—

4

—

Hair restoration centers

3

—

4

—

8

—

149

27

143

3

190

94

(1) Beginning with the period ended December 31, 2008, the operations of Trade Secret concept within the North American

reportable segment were accounted for as discounted operations. All comparable periods will reflect Trade Secret as

discontinued operations.

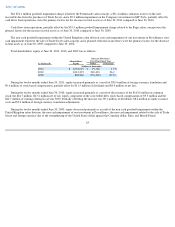

Financing Cash Flows

For the Years Ended June 30,

2011

2010

2009

(Dollars in thousands)

Net repayments on

revolving credit

facilities

$

—

$

(

5,000

)

$

(134,100

)

Net repayments of long

-

term debt

(137,671

)

(181,850

)

(7,504

)

Proceeds from the

issuance of common

stock

682

159,498

3,894

Excess tax benefit from

stock-based

compensation plans

67

243

163

Dividend payments

(11,509

)

(9,146

)

(6,912

)

Other

—

(

2,878

)

(3,848

)

$

(148,431

)

$

(39,133

)

$

(148,307

)