Supercuts 2011 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2011 Supercuts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

2. DISCONTINUED OPERATIONS (Continued)

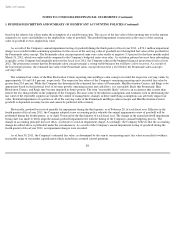

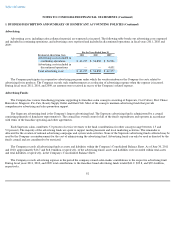

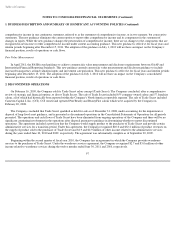

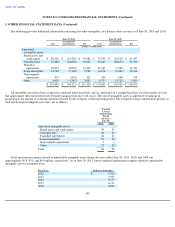

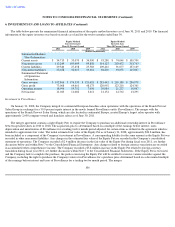

The following table provides the amounts due to the Company from the purchaser of Trade Secret:

During fiscal year 2010, the Company entered into a formal note receivable agreement with the purchaser of Trade Secret. On July 6, 2010,

the purchaser of Trade Secret filed for Chapter 11 bankruptcy. The purchaser of Trade Secret emerged from bankruptcy in October 2010 and in

conjunction, the note receivable agreement was amended. The note receivable agreement accrues interest at 8.0 percent which is payable

quarterly beginning in December 2010. Principal payments of $0.5 million are due quarterly beginning in December 2011 with the remainder of

the principal due in September 2015.

During the third quarter of fiscal year 2011, the Company did not receive a scheduled interest payment related to the outstanding note

receivable with the purchaser of Trade Secret, the fair value of the collateral decreased to a level below the carrying value of the outstanding note

receivable, and the purchaser of Trade Secret provided the Company with a new five year business plan that was well below the purchaser of

Trade Secret's original projections. Due to these factors that occurred during the third quarter of fiscal year 2011, the Company evaluated the

note receivable for realizability based on a probability weighted expected future cash flow analysis. During the third quarter of fiscal year 2011,

the Company recorded a $9.0 million valuation reserve for the excess of the carrying value of the note receivable over the present value of

expected future cash flows.

During the fourth quarter of fiscal year 2011, the Company did not receive a scheduled interest payment related to the outstanding note

receivable with the purchaser of Trade Secret and the fair value of the collateral continued to decrease and was at a level significantly below the

carrying value of the outstanding note receivable. In addition, the Company received updated financial projections that were below the

projections received during the third quarter of fiscal year 2011. Due to these negative financial events in the fourth quarter of fiscal year 2011,

the Company performed an extensive evaluation on the Company's option to realize the collateral under the note receivable and recorded an

additional $22.2 million valuation reserve that fully reserved the carrying value of the note receivable as of June 30, 2011.

The Company has determined the collectibility of accrued interest on the note receivable to be less than probable. The Company suspended

recognition of interest income effective April 2010, has recorded a valuation allowance of $2.5 million as of June 30, 2011 related to the accrued

interest, and will use the cash basis method for recognizing future interest income. During fiscal year 2011, the Company received interest

payments from the purchaser of Trade Secret totaling $0.8 million.

98

Classification

June 30,

2011

June 30,

2010

(Dollars in thousands)

Carrying value:

Warehouse services

Receivables, net

$

320

$

359

Note receivable, current

Other current assets

2,607

2,838

Note receivable, current valuation allowance

Other current assets

(2,607

)

(611

)

Note receivable, long

-

term

Other assets

31,086

29,000

Note receivable, long

-

term valuation allowance

Other assets

(31,086

)

—

Total note receivable, net

$

320

$

31,586