Neiman Marcus 2010 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2010 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

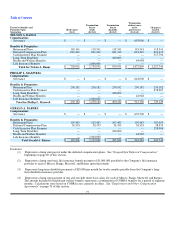

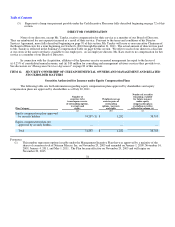

Table of Contents

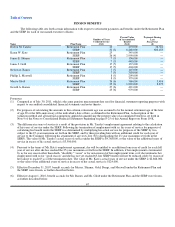

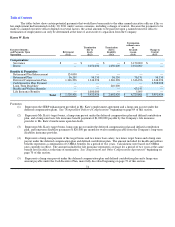

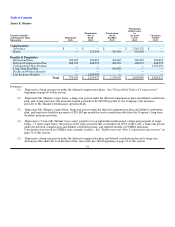

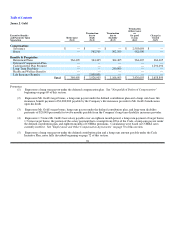

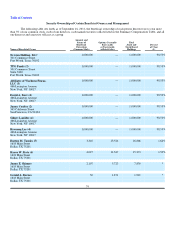

James J. Gold

Executive Benefits

and Payments Upon

Separation

Retirement

($)(1)

Termination

due to

death

($)(2)

Termination

due to

disability

($)(3)

Termination

without cause

or

for good

reason

($)(4)

Change in

Control

($)(5)

Compensation:

Severance $ — $ — $ — $ 2,503,698 $ —

Bonus — 562,500 562,500 562,500 —

Benefits & Perquisites:

Retirement Plans 364,405 364,405 364,405 364,405 364,405

Deferred Compensation Plan — — — — —

Cash Incentive Plan Payment — — — — 1,294,494

Long-Term Disability — — 240,000 — —

Health and Welfare Benefits — — — — —

Life Insurance Benefits — 1,000,000 — — —

Total $ 364,405 $ 1,926,905 $ 1,166,905 $ 3,430,603 $ 1,658,899

Footnotes:

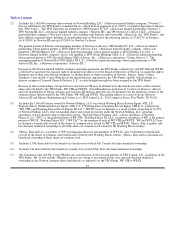

(1) Represents a lump sum payout under the deferred compensation plan. See "Nonqualified Deferred Compensation"

beginning on page 69 of this section.

(2) Represents Mr. Gold's target bonus, a lump sum payout under the defined contribution plan and a lump sum basic life

insurance benefit payment of $1,000,000 payable by the Company's life insurance provider to Mr. Gold's beneficiaries

upon his death.

(3) Represents Mr. Gold's target bonus, lump sum payout under the defined contribution plan, and long-term disability

payments of $20,000 per month for twelve months payable from the Company's long-term disability insurance provider.

(4) Represents 1.5 times Mr. Gold's base salary payable over an eighteen month period, a lump sum payment of target bonus,

1.5 times target bonus, the portion of the salary payment that is exempt from 409A of the Code, a lump sum payout under

the defined contribution plan, and eighteen months of COBRA premiums. Calculations were based on COBRA rates

currently in effect. See "Employment and Other Compensation Agreements" on page 70 of this section.

(5) Represents a lump sum payout under the defined contribution plan and a lump sum amount payable under the Cash

Incentive Plan, more fully described beginning on page 72 of this section.

76