Neiman Marcus 2010 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2010 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

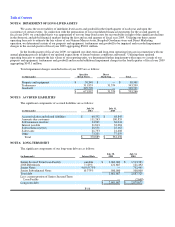

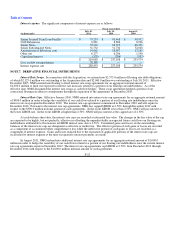

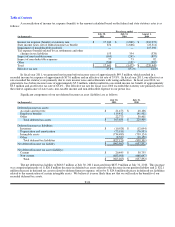

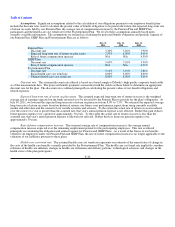

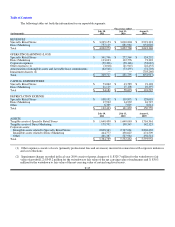

Costs of Benefits. The components of the expenses we incurred under our Pension Plan, SERP Plan and Postretirement Plan

are as follows:

Fiscal year ended

(in thousands)

July 30,

2011

July 31,

2010

August 1,

2009

Pension Plan:

Service cost $ — $ 5,687 $ 6,057

Interest cost 24,215 25,230 24,361

Expected return on plan assets (26,210) (26,340) (26,048)

Net amortization of losses 2,176 752 —

Pension Plan expense $ 181 $ 5,329 $ 4,370

SERP Plan:

Service cost $ — $ 680 $ 689

Interest cost 4,919 5,399 5,312

SERP Plan expense $ 4,919 $ 6,079 $ 6,001

Curtailment gain $ — $ 1,479 $ —

Postretirement Plan:

Service cost $ 61 $ 72 $ 92

Interest cost 871 1,017 1,343

Net amortization of prior service credit (1,556) (686) —

Net amortization of losses 690 358 282

Postretirement Plan expense $ 66 $ 761 $ 1,717

For purposes of determining pension expense, the expected return on plan assets is calculated using the market related value

of plan assets. The market related value of plan assets does not immediately recognize realized gains and losses. Rather, these effects

of realized gains and losses are deferred initially and amortized over three years in the determination of the market related value of

plan assets. At July 30, 2011, the fair value of plan assets exceeded the market related value by $12.8 million.

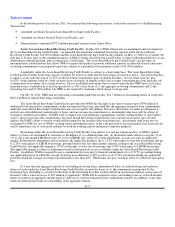

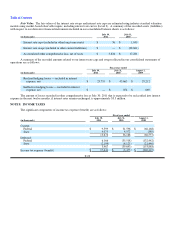

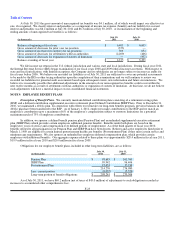

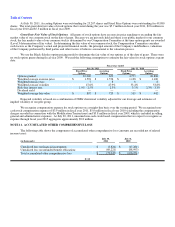

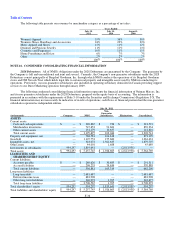

Benefit Obligations. Our obligations for the Pension Plan, SERP Plan and Postretirement Plan are valued annually as of the

end of each fiscal year. Changes in our obligations pursuant to our Pension Plan, SERP Plan and Postretirement Plan during fiscal

years 2011 and 2010 are as follows:

Pension Plan SERP Plan Postretirement Plan

Fiscal years Fiscal years Fiscal years

(in thousands) 2011 2010 2011 2010 2011 2010

Projected benefit obligations:

Beginning of year $ 476,226 $ 427,995 $ 96,406 $ 92,152 $ 17,914 $ 17,920

Service cost — 5,687 — 680 61 72

Interest cost 24,215 25,230 4,919 5,399 871 1,017

Actuarial (gain) loss (10,026) 48,041 2,153 9,206 (2,335) 3,382

Curtailment — (16,606) — (8,426) — —

Plan amendments — — — — — (3,359)

Benefits paid, net (15,363)(14,121)(3,536)(2,605)(860)(1,118)

End of year $ 475,052 $ 476,226 $ 99,942 $ 96,406 $ 15,651 $ 17,914

In connection with the actions in the third quarter of fiscal year 2010 to freeze benefits offered under our Pension Plan and

SERP Plan, we recognized a gain of $25.0 million. Of the aggregate gain, $23.5 million was recorded as a reduction of accumulated

other comprehensive loss and $1.5 million was recorded as a curtailment gain.

F-26