Neiman Marcus 2010 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2010 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

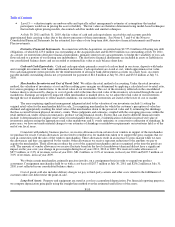

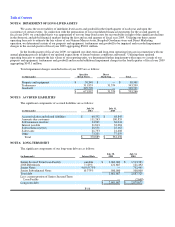

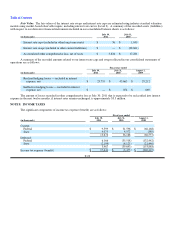

NOTE 4. IMPAIRMENT OF LONG-LIVED ASSETS

We assess the recoverability of indefinite-lived assets and goodwill in the fourth quarter of each year and upon the

occurrence of certain events. In connection with the preparation of our consolidated financial statements for the second quarter of

fiscal year 2009, we concluded that it was appropriate to test our long-lived assets for recoverability in light of the significant declines

in the domestic and global financial markets during the first and second quarters of fiscal year 2009. Utilizing our then-current

operating forecasts to estimate the fair values of our Neiman Marcus stores, Bergdorf Goodman stores and Direct Marketing

operation, we determined certain of our property and equipment, tradenames and goodwill to be impaired and recorded impairment

charges in the second quarter of fiscal year 2009 aggregating $560.1 million.

In the fourth quarter of fiscal year 2009, we updated our short-term and long-term operating forecasts in connection with our

annual planning process in light of our updated expectations of future business conditions and trends. Utilizing these updated

operating forecasts to estimate the fair values of our reporting units, we determined further impairment with respect to certain of our

property and equipment, tradenames and goodwill and recorded additional impairment charges in the fourth quarter of fiscal year 2009

aggregating $143.1 million.

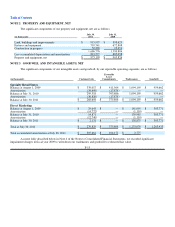

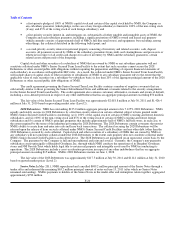

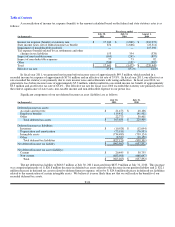

Total impairment charges recorded in fiscal year 2009 are as follows:

(in thousands)

Specialty

Retail Stores

Direct

Marketing Total

Property and equipment $ 30,348 $ — $ 30,348

Tradenames 311,835 31,374 343,209

Goodwill 329,709 — 329,709

$ 671,892 $ 31,374 $ 703,266

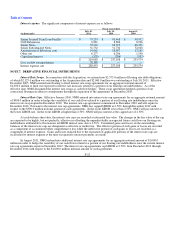

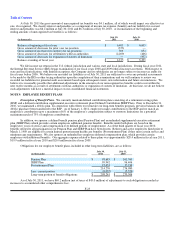

NOTE 5. ACCRUED LIABILITIES

The significant components of accrued liabilities are as follows:

(in thousands)

July 30,

2011

July 31,

2010

Accrued salaries and related liabilities $ 69,352 $ 68,845

Amounts due customers 111,263 100,855

Self-insurance reserves 34,969 36,041

Interest payable 31,813 32,081

Sales returns reserves 28,558 25,167

Sales taxes 21,733 21,408

Other 73,201 77,059

Total $ 370,889 $ 361,456

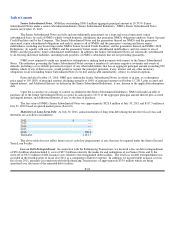

NOTE 6. LONG-TERM DEBT

The significant components of our long-term debt are as follows:

(in thousands) Interest Rate

July 30,

2011

July 31,

2010

Senior Secured Term Loan Facility variable $ 2,060,000 $ 1,513,383

2028 Debentures 7.125% 121,687 121,492

Senior Notes 9.0%/9.75% — 752,445

Senior Subordinated Notes 10.375% 500,000 500,000

Total debt 2,681,687 2,887,320

Less: current portion of Senior Secured Term

Loan Facility — (7,648)

Long-term debt $ 2,681,687 $ 2,879,672

F-16