Neiman Marcus 2010 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2010 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185

|

|

Table of Contents

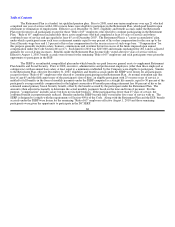

Other

The Company has change of control provisions in its Management Incentive Plan that may provide for accelerated vesting

and/or distributions in certain circumstances and these provisions apply equally to all participants in the plans, including the named

executive officers, except to the extent an executive is party to an individual agreement that provides otherwise.

Consideration of Tax and Accounting Treatment of Compensation

Internal Revenue Code §409A

The American Jobs Creation Act of 2004 added a new Section 409A to the Internal Revenue Code, as amended (the "Code"),

which applies to compensation deferred under a nonqualified deferred compensation plan after December 31, 2004. Compliance with

the new Section 409A became fully effective on January 1, 2009. Section 409A imposes restrictions on funding, distributions, and

election to participate in the affected plans. We believe our executive compensation plans and arrangements comply with

Section 409A.

Accounting for Stock-Based Compensation

We began accounting for stock-based payments in accordance with the provisions of ASC Topic 718, "Compensation —

Stock Compensation" on July 31, 2005. When setting equity compensation, the Compensation Committee considers the estimated

cost for financial reporting purposes of any equity compensation it is considering. However, the accounting impact does not have a

material impact on the design of our equity compensation plan.

Compensation Committee Report

The Compensation Committee has reviewed and discussed the Compensation Discussion and Analysis required by Item

402(b) of Regulation S-K with management and, based on such review and discussions, the Compensation Committee recommended

to the Board of Directors that the Compensation Discussion and Analysis be included in this Annual Report on Form 10-K.

THE COMPENSATION COMMITTEE

Jonathan J. Coslet, Chairman

Kewsong Lee

John G. Danhakl

61