Neiman Marcus 2010 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2010 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

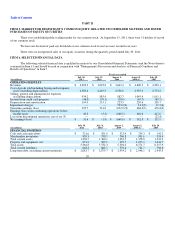

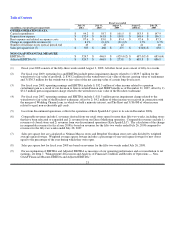

Table of Contents

sources. Accordingly, there can be no assurance that such sources will continue to meet our quality, style and volume requirements.

Moreover, nearly all of the brands of our top designers are sold by competing retailers, and many of our top designers also

have their own dedicated retail stores. If one or more of our top designers were to cease providing us with adequate supplies of

merchandise for purchase or, conversely, were to 1) increase sales of merchandise through their own stores, 2) increase the sales of

merchandise to our competitors or 3) alter the form in which their goods were made available to us for resale, our business could be

adversely affected.

As a result of recent economic conditions, some of our vendors have experienced serious cash flow issues, reductions in

available credit from banks, factors or other financial institutions, or increases in the cost of capital. In response, our vendors may

attempt to increase their prices, alter historical credit and payment terms available to us or take other actions. Any of these actions

could have an adverse impact on our relationship with the vendor or constrain the amounts or timing of our purchases from the vendor

and, ultimately, have an adverse impact on our revenues, profitability and liquidity.

Our business is affected by foreign currency fluctuations and inflation.

We purchase a substantial portion of our inventory from foreign suppliers whose costs are affected by the fluctuation of their

local currency against the dollar or who price their merchandise in currencies other than the dollar. Fluctuations in the Euro-U.S.

dollar exchange rate affect us most significantly; however, we source goods from numerous countries and thus are affected by changes

in numerous currencies and, generally, by fluctuations in the U.S. dollar relative to such currencies. Accordingly, changes in the value

of the dollar relative to foreign currencies may increase the retail prices of goods offered for sale and/or increase our cost of goods

sold.

Further, we have experienced certain inflationary conditions in our cost base due to increases in selling, general and

administrative expenses, particularly with regard to employee benefits, and increases in fuel prices and costs impacted by increases in

fuel prices, such as freight and transportation costs. Inflation can harm our margins and profitability if we are unable to increase

prices or cut costs enough to offset the effects of inflation in our cost base.

If our customers reduce their levels of spending in response to increases in retail prices and/or we are unable to pass such cost

increases to our customers, our revenues and our profit margins may decrease. Accordingly, foreign currency fluctuations and

inflation could have a material adverse effect on our business, financial condition and results of operations in the future.

Our business and performance may be affected by our ability to implement our expansion and growth strategies.

In order to maintain and grow our position as a leading luxury retailer, we must make investments annually to support our

business goals and objectives. We make capital investments in our new and existing stores, websites, and distribution and support

facilities as well as information technology. We also incur expenses for headcount, advertising and marketing, professional fees and

other costs in support of our growth initiatives. Costs incurred in connection with our business goals and objectives require us to

anticipate our customers' needs, trends within our industry and our competitors' actions. In addition, we must successfully execute the

strategies identified to support our business goals and objectives. If we fail to identify appropriate business goals and objectives or if

we fail to execute the actions required to accomplish these goals and objectives, our revenues, customer base and results of operations

could be materially adversely affected.

New store openings involve certain risks, including constructing, furnishing and supplying a store in a timely and cost

effective manner, accurately assessing the demographic or retail environment at a given location, negotiating favorable lease terms,

hiring and training quality staff, obtaining necessary permits and zoning approvals, obtaining commitments from a core group of

vendors to supply the new store, integrating the new store into our distribution network and building customer awareness and loyalty.

We routinely evaluate the need to remodel our existing stores. In undertaking store remodels, we must complete the remodel

in a timely, cost effective manner, minimize disruptions to our existing operations, and succeed in creating an improved shopping

environment. If we fail to execute on these or other aspects of our store expansion and remodeling strategy, we could suffer harm to

our sales, an increase in costs and expenses and an adverse effect on our business.

Further, to keep pace with changing technology, we must continuously implement new information technology systems as

well as enhance our existing systems. Any failure to adequately maintain and update the information technology

14