Neiman Marcus 2010 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2010 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

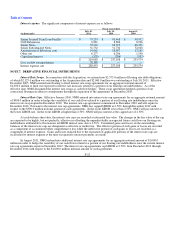

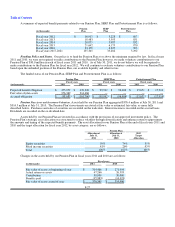

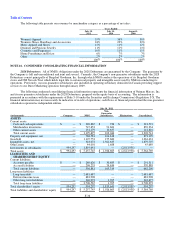

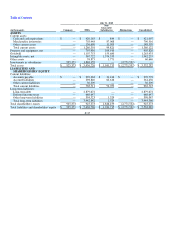

Pension Plan investments in common corporate stock, preferred corporate stock, mutual funds, certain U.S. government

securities and certain other investments are classified as Level 1 investments within the fair value hierarchy. Common and preferred

corporate stocks and certain U.S. government securities are stated at fair value as determined by quoted market prices. Investments in

mutual funds are valued at fair value based on quoted market prices, which represent the net asset value of the shares held by the

Pension Plan at year-end.

Pension Plan investments in corporate debt securities, certain U.S. government securities, common/collective trusts, and

certain other investments are classified as Level 2 investments within the fair value hierarchy. Common/collective trusts are valued at

net asset value based on the underlying investments of such trust as determined by the sponsor of the trust. Common/ collective trusts

can be redeemed daily. Other Level 2 investments are valued using updated quotes from market makers or broker-dealers recognized

as market participants, information from market sources integrating relative credit information, observed market movements, and

sector news, all of which is applied to pricing applications and models.

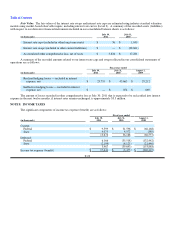

Pension Plan investments in hedge funds and limited partnership interests are classified as Level 3 investments within the fair

value hierarchy. Hedge funds are valued at estimated fair value based on net asset value as determined by the respective fund

manager based on the valuation of the underlying securities. Limited partnership interests in venture capital investments are valued at

estimated fair value based on net asset value as determined by the respective fund investment manager. The hedge funds and limited

partnerships allocate gains, losses and expenses to the Pension Plan as described in the agreements.

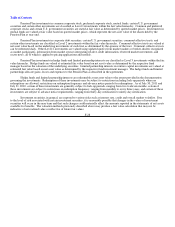

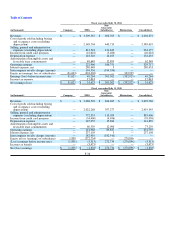

Hedge funds and limited partnership interests are redeemable at net asset value to the extent provided in the documentation

governing the investments. Redemption of these investments may be subject to restrictions including lock-up periods where no

redemptions are allowed, restrictions on redemption frequency and advance notice periods for redemptions. As of July 30, 2011 and

July 31, 2010, certain of these investments are generally subject to lock-up periods, ranging from two to eleven months, certain of

these investments are subject to restrictions on redemption frequency, ranging from monthly to every three years, and certain of these

investments are subject to advance notice requirements, ranging from thirty-day notification to ninety-day notification.

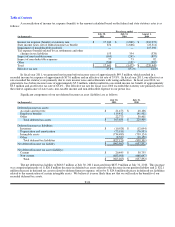

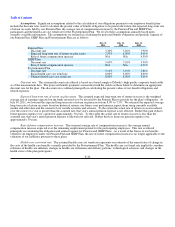

Investment securities, in general, are exposed to various risks such as interest rate, credit and overall market volatility. Due

to the level of risk associated with certain investment securities, it is reasonably possible that changes in the values of investment

securities will occur in the near term and that such changes could materially affect the amounts reported in the statements of net assets

available for benefits. The valuation methods previously described above may produce a fair value calculation that may not be

indicative of net realized value or reflective of future fair values.

F-28