Neiman Marcus 2010 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2010 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

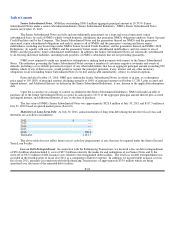

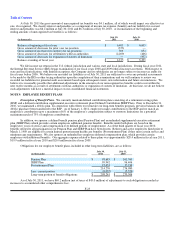

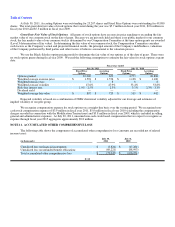

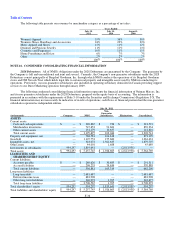

A summary of expected benefit payments related to our Pension Plan, SERP Plan and Postretirement Plan is as follows:

(in thousands)

Pension

Plan

SERP

Plan

Postretirement

Plan

Fiscal year 2012 $ 16,913 $ 5,228 $ 807

Fiscal year 2013 18,483 5,593 851

Fiscal year 2014 20,075 5,987 852

Fiscal year 2015 21,642 6,175 870

Fiscal year 2016 23,178 6,327 903

Fiscal years 2017-2021 135,345 35,282 5,292

Funding Policy and Status. Our policy is to fund the Pension Plan at or above the minimum required by law. In fiscal years

2011 and 2010, we were not required to make contributions to the Pension Plan; however, we made voluntary contributions to our

Pension Plan of $30.0 million in each of fiscal years 2011 and 2010. As of July 30, 2011, we do not believe we will be required to

make contributions to the Pension Plan for fiscal year 2012. We will continue to evaluate voluntary contributions to our Pension Plan

based upon the unfunded position of the Pension Plan, our available liquidity and other factors.

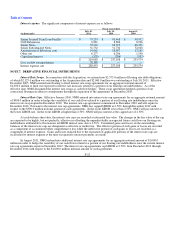

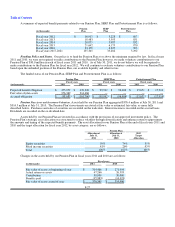

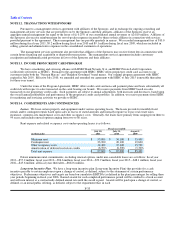

The funded status of our Pension Plan, SERP Plan and Postretirement Plan is as follows:

Pension Plan SERP Plan Postretirement Plan

Fiscal years Fiscal years Fiscal years

(in thousands) 2011 2010 2011 2010 2011 2010

Projected benefit obligation $ 475,052 $ 476,226 $ 99,942 $ 96,406 $ 15,651 $ 17,914

Fair value of plan assets 376,369 314,466 — — — —

Accrued obligation $ (98,683)$ (161,760)$ (99,942)$ (96,406)$ (15,651)$ (17,914)

Pension Plan Assets and Investment Valuations. Assets held by our Pension Plan aggregated $376.4 million at July 30, 2011 and

$314.5 million at July 31, 2010. The Pension Plan's investments are stated at fair value or estimated fair value, as more fully

described below. Purchases and sales of securities are recorded on the trade date. Interest income is recorded on the accrual basis.

Dividends are recorded on the ex-dividend date.

Assets held by our Pension Plan are invested in accordance with the provisions of our approved investment policy. The

Pension Plan's strategic asset allocation was structured to reduce volatility through diversification and enhance return to approximate

the amounts and timing of the expected benefit payments. The asset allocation for our Pension Plan at the end of fiscal years 2011 and

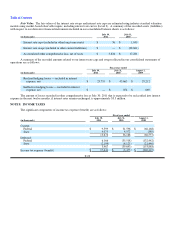

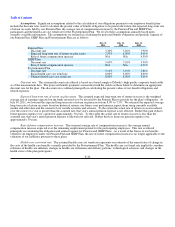

2010 and the target allocation for fiscal year 2012, by asset category, are as follows:

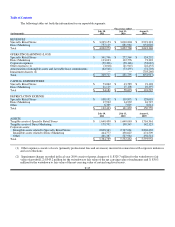

Pension Plan

Allocation at

July 31,

2011

Allocation at

July 31,

2010

2012

Target

Allocation

Equity securities 59% 74% 55%

Fixed income securities 41%26%45%

Total 100%100%100%

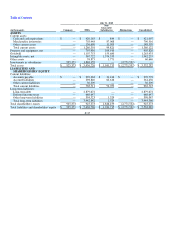

Changes in the assets held by our Pension Plan in fiscal years 2011 and 2010 are as follows:

Fiscal years

(in thousands) 2011 2010

Fair value of assets at beginning of year $ 314,466 $ 271,994

Actual return on assets 47,266 26,593

Contribution 30,000 30,000

Benefits paid (15,363)(14,121)

Fair value of assets at end of year $ 376,369 $ 314,466

F-27