Neiman Marcus 2010 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2010 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

At July 30, 2011, Accreting Options were outstanding for 25,207 shares and Fixed Price Options were outstanding for 49,080

shares. The total grant date fair value of stock options that vested during the year was $5.7 million in fiscal year 2011, $2.6 million in

fiscal year 2010 and $5.3 million in fiscal year 2009.

Grant Date Fair Value of Stock Options. All grants of stock options have an exercise price equaling or exceeding the fair

market value of our common stock on the date of grant. Because we are privately held and there is no public market for our common

stock, the fair market value of our common stock is determined by our Compensation Committee at the time option grants are awarded

(Level 3 determination of fair value). In determining the fair value of our common stock, the Compensation Committee considers

such factors as the Company's actual and projected financial results, the principal amount of the Company's indebtedness, valuations

of the Company performed by third parties and other factors it believes are material to the valuation process.

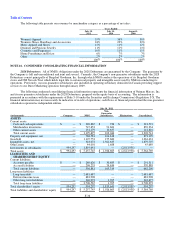

We use the Black-Scholes option-pricing model to determine the fair value of our options as of the date of grant. There were

no stock option grants during fiscal year 2009. We used the following assumptions to estimate the fair value for stock options at grant

date:

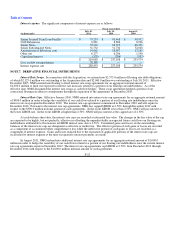

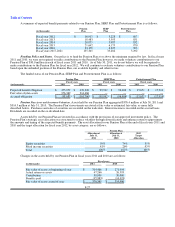

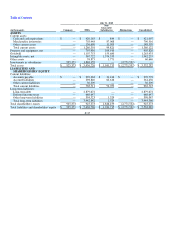

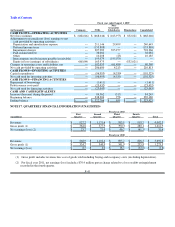

Fiscal year ended

July 30, 2011 July 31, 2010

Fixed Price

Options

Accreting

Options

Fixed Price

Options

Accreting

Options

Options granted 10,000 650 4,773 26,806

Weighted average exercise price $ 1,576 $ 1,576 $ 1,128 $ 1,100

Weighted term in years 7 8 8 8

Weighted average volatility 47.6% 47.9% 53.4% 53.8%

Risk-free interest rate 1.9% - 2.5% 2.5% 3.3% 2.3% - 3.3%

Dividend yield — — — —

Weighted average fair value $ 807 $ 720 $ 519 $ 442

Expected volatility is based on a combination of NMG's historical volatility adjusted for our leverage and estimates of

implied volatility of our peer group.

We recognize compensation expense for stock options on a straight-line basis over the vesting period. We recognized non-

cash stock compensation expense of $3.9 million in fiscal year 2011, $5.0 million in fiscal year 2010 (excluding the compensation

charges recorded in connection with the Modification Transactions) and $5.8 million in fiscal year 2009, which is included in selling,

general and administrative expenses. At July 30, 2011, unearned non-cash stock-based compensation that we expect to recognize as

expense through fiscal year 2015 aggregates approximately $9.8 million.

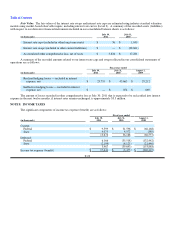

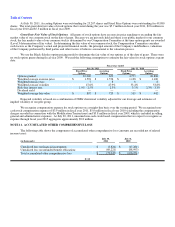

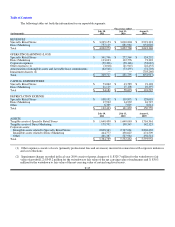

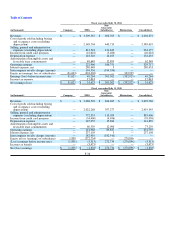

NOTE 11. ACCUMULATED OTHER COMPREHENSIVE LOSS

The following table shows the components of accumulated other comprehensive loss (amounts are recorded net of related

income taxes):

(in thousands)

July 30,

2011

July 31,

2010

Unrealized loss on financial instruments $ (3,824) $ (17,281)

Unrealized loss on unfunded benefit obligations (69,221)(88,993)

Total accumulated other comprehensive loss $ (73,045)$ (106,274)

F-32