Neiman Marcus 2010 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2010 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

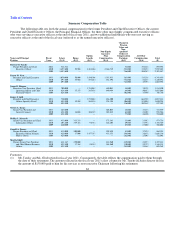

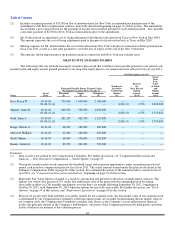

2011 Annual Incentive Bonus. As actual operating performance for fiscal year 2011 exceeded the performance targets set at

the beginning of the year (as shown in the table above), annual incentive amounts were paid to each of the named executive officers

based upon the actual target percentages. The Compensation Committee did not exercise their discretion to adjust the actual payout

amounts. Actual amounts paid are listed in the Summary Compensation Table under the heading "Non-Equity Incentive Plan

Compensation" on page 62.

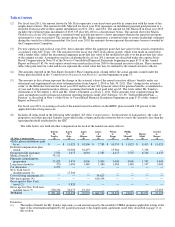

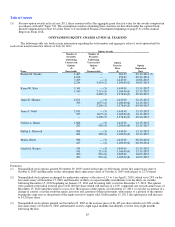

Stock Options. Pursuant to their promotions and terms and conditions of their employment contracts, the Compensation

Committee approved the grant of Fair Value options to Ms. Katz and Messrs. Skinner and Gold. The options vest twenty-five percent

(25%) on the first anniversary date of the grant with the remaining portion becoming exercisable in thirty-six (36) monthly

installments over the thirty-six months following September 30, 2011, beginning on October 30, 2011, until September 30, 2014 when

the options become fully exercisable. Upon determining the awards exceeded certain limits under the Management Equity Incentive

Plan, the Compensation Committee amended the plan and ratified the awards effective as of the original grant date. No other options

were awarded to the other named executive officers.

Other Compensation Components

We maintain the following compensation components in order to provide a competitive total rewards package that supports

retention of key executives.

Health and Welfare Benefits. Executive officers are eligible to participate under the same plans as all other eligible

employees for medical, dental, vision, disability, and life insurance. These benefits are intended to be competitive with benefits

offered in the retail industry.

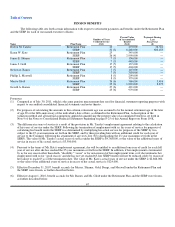

Retirement Plan. Prior to 2008, most non-union employees over age 21 who had completed one year of service with 1,000 or

more hours participated in The Neiman Marcus Group, Inc. Retirement Plan (referred to as the Retirement Plan), which paid benefits

upon retirement or termination of employment. The Retirement Plan is a "career-accumulation" plan, under which a participant earns

each year a retirement annuity equal to one percent of his or her compensation for the year up to the Social Security wage base and 1.5

percent of his or her compensation for the year in excess of such wage base. A participant becomes fully vested after five years of

service with us. Effective as of December 31, 2007, eligibility and benefit accruals under the Retirement Plan were frozen for all

participants except for those "Rule of 65" employees who elected to continue participation in the Retirement Plan. "Rule of 65"

employees included only those active employees who had completed at least 10 years of service and whose combined years of service

and age equaled at least 65 as of December 31, 2007. Mr. Tansky, Ms. Katz, Ms. Glodt, and Mr. Barnes were "Rule of 65" employees

as of December 31, 2007, and elected to continue participation in the Retirement Plan. For Messrs. Skinner and Gold, benefits and

accruals under the Retirement Plan were frozen effective as of December 31, 2007. Effective August 1, 2010, all benefits and accruals

under the Retirement Plan were frozen and all remaining participants, including Ms. Katz, Mr. Tansky, and Mr. Barnes, were moved

into The Neiman Marcus Group, Inc. Retirement Savings Plan.

Savings Plans. Effective January 1, 2008, a new enhanced 401(k) plan, The Neiman Marcus Group, Inc. Retirement Savings

Plan (referred to as the RSP) was established and offered to all employees, including the named executive officers, as the primary

retirement plan. Benefits and accruals under a previous 401(k) plan, The Neiman Marcus Group, Inc. Employee Savings Plan

(referred to as the ESP), were frozen as well as benefits and accruals under the Retirement Plan. All future and current employees

who were not already enrolled in the ESP were automatically enrolled in the RSP. "Rule of 65" employees, as described above, were

given a choice to either continue participation in the Retirement Plan and the ESP or freeze what was earned under those plans through

December 31, 2007 and participate in the RSP. The RSP is a tax-qualified defined contribution 401(k) plan that allows participants to

contribute up to the limit prescribed by the Internal Revenue Service on a pre-tax basis. The Company matches 100% of the first 3%

and 50% of the next 3% of pay that is contributed to the RSP after the first year of employment. All employee contributions to the

RSP are fully vested upon contribution. Company matching contributions vest after two years of service. The Company matched

100% of the first 2% and 25% of the next 4% of pay that was contributed to the ESP. All employee contributions to the ESP were

fully vested upon contribution. Company matching contributions vested after three years of service. Effective August 1, 2010,

benefits and accruals under the ESP were frozen for the remaining "Rule of 65" active employees and such participants were moved

into the RSP.

Supplemental Retirement Plan and Key Employee Deferred Compensation Plan. U.S. tax laws limit the amount of benefits

that we can provide under our tax-qualified plans. We maintain The Neiman Marcus Group, Inc. Supplemental Executive Retirement

Plan (referred to as the SERP) and the Neiman Marcus Group, Inc. Key Employee Deferred Compensation Plan (referred to as the

KEDC Plan), which are unfunded, nonqualified arrangements intended to provide named executive officers and certain other key

employees with additional benefits, including the benefits that they would

59