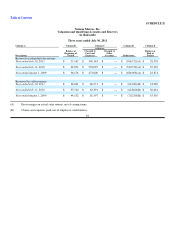

Neiman Marcus 2010 Annual Report Download - page 145

Download and view the complete annual report

Please find page 145 of the 2010 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

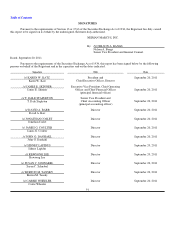

Exhibit 4.7

SECOND SUPPLEMENTAL INDENTURE

Second Supplemental Indenture (this "Second Supplemental Indenture"), dated as of August 14, 2006, between The Neiman

Marcus Group, Inc., a Delaware corporation (the "Company"), and The Bank of New York Trust Company, N.A., a national banking

association, as successor trustee (the "Trustee").

W I T N E S S E T H

WHEREAS, the Company and the Trustee previously have entered into an indenture, dated as of May 27, 1998 (the "Base

Indenture"), providing for the issuance of the Company's 7.125% Senior Debentures due 2028 (the "2028 Debentures") (the Base

Indenture together with the terms of the 2028 Debentures as established as contemplated by Section 301 thereof and the First

Supplemental Indenture thereto is referred to herein as the "Original Indenture" and the Original Indenture as it may from time to time

be supplemented or amended, including by this Second Supplemental Indenture, is referred to herein as the "Indenture");

WHEREAS, Neiman Marcus, Inc., a Delaware corporation, has guaranteed the 2028 Debentures pursuant to the First

Supplemental Indenture to the Indenture;

WHEREAS, Section 902 of the Base Indenture permits the Company, when authorized by a Board Resolution, and the Trustee to

enter into one or more indentures supplemental to the Indenture with the consent of a majority of holders of any securities issued

thereunder;

WHEREAS, pursuant to a consent solicitation statement, dated August 2, 2006 (the "Solicitation Statement"), the Company

solicited the consents (the "Consents") of the holders of the 2028 Debentures ("Holders") to amend the Indenture (the "Amendment");

WHEREAS, the Holders of a majority of the aggregate principal amount of the outstanding 2028 Debentures have validly

delivered and not validly withdrawn their Consents to the Amendment, and the Company has accepted such Consents pursuant to the

Solicitation Statement;

WHEREAS, the Company has requested that the Trustee join in the execution of this Second Supplemental Indenture; and

WHEREAS, all things necessary to make this Second Supplemental Indenture a valid agreement of the parties and a valid

supplement to the Indenture have been done.

NOW THEREFORE, in consideration of the foregoing and for other good and valuable consideration, the receipt of which is

hereby acknowledged, the parties mutually covenant and agree: