Neiman Marcus 2010 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2010 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

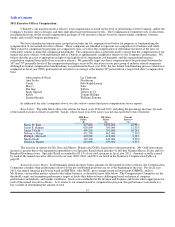

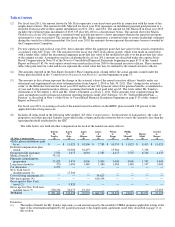

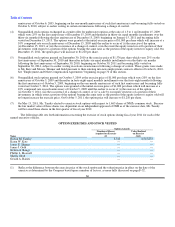

(5)

For new option awards in fiscal year 2011, these amounts reflect the aggregate grant date fair value for the awards computed in

accordance with ASC Topic 718. The assumptions used in calculating these amounts are described under the caption Stock-

Based Compensation in Note 10 of the Notes to Consolidated Financial Statements beginning on page F-31 of this Annual

Report on Form 10-K.

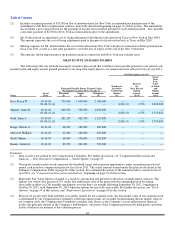

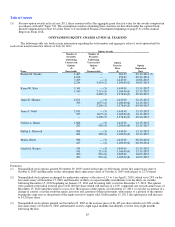

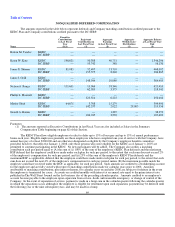

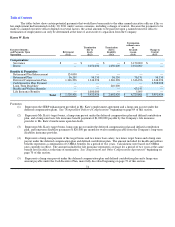

OUTSTANDING EQUITY AWARDS AT FISCAL YEAR END

The following table sets forth certain information regarding the total number and aggregate value of stock options held by

each of our named executive officers at July 30, 2011.

Option Awards

Name

Number of

Securities

Underlying

Unexercised

Options

(#)

Exercisable

Number of

Securities

Underlying

Unexercised

Options

(#)

Unexercisable

Option

Exercise

Price

($)

Option

Expiration

Date

Burton M. Tansky 1,465 — 361.25 05-15-2011 (7)

2,076 — 354.03 09-22-2011

7,269 — (1) 1,445.00 10-06-2015

2,244 3,424 (2) 1,100.00(2) 10-05-2015

Karen W. Katz 5,341 — (3) 1,445.00 12-15-2017

1,410 2,151 (4) 1,100.00(4) 12-15-2017

— 4,300 (5) 1,576.00(5) 09-30-2017

James E. Skinner 2,671 — (3) 1,445.00 12-15-2017

705 1,075 (4) 1,100.00(4) 12-15-2017

— 2,200 (5) 1,576.00(5) 09-30-2017

James J. Gold 2,671 — (3) 1,445.00 12-15-2017

705 1,075 (4) 1,100.00(4) 12-15-2017

— 2,200 (5) 1,576.00(5) 09-30-2017

Nelson A. Bangs 1,068 — (3) 1,445.00 12-15-2017

282 430 (4) 1,100.00(4) 12-15-2017

Phillip L. Maxwell 988 — (3) 1,445.00 12-15-2017

261 398 (4) 1,100.00(4) 12-15-2017

Marita Glodt 988 — (3) 1,445.00 06-30-2014

247 — (4) 1,100.00(4) 06-30-2014

Gerald A. Barnes 534 — (3) 1,445.00 12-15-2017

141 215 (4) 1,100.00(4) 12-15-2017

490 910 (6) 1,000.00 10-05-2017

490 910 (6) 1,100.00(6) 10-05-2017

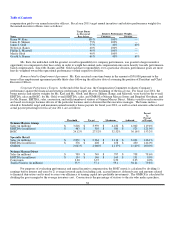

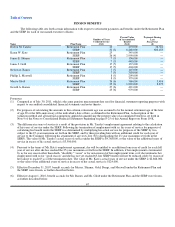

Footnotes:

(1)

Nonqualified stock options granted November 29, 2005 vested with respect to 460 shares on the first anniversary date of

October 6, 2005 and thereafter on the subsequent three anniversary dates of October 6, 2005 with respect to 2,270 shares.

(2)

Nonqualified stock options exchanged for underwater options at the ratio of 1.5 to 1 on April 1, 2010, which vests 25% on the

first anniversary of December 15, 2010 and thereafter in thirty-six equal monthly installments over the thirty-six months

following December 15, 2010 beginning on January 15, 2011 and becoming fully vested on December 15, 2013. The options

were granted at the initial exercise price of $1,000 per share which will increase at a 10% compound rate on each anniversary of

December 15, 2010 until the earlier to occur of (i) the exercise of the option, (ii) December 15, 2013, or (iii) the occurrence of a

change of control, or in the event the equity investors sell a portion of their investment, with respect to a portion of the options

bearing the same ratio as the portion of the equity investor's equity sold. On December 15, 2011, the option price will increase

to $1,210 per share.

(3)

Nonqualified stock options granted on November 29, 2005 at the exercise price of $1,445 per share which vests 20% on the

first anniversary of October 6, 2005 and thereafter in forty-eight equal monthly installments over the forty-eight months

following the first

65