Neiman Marcus 2010 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2010 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185

|

|

Table of Contents

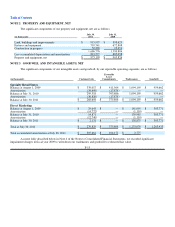

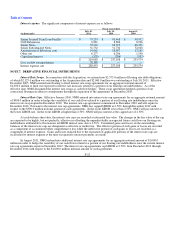

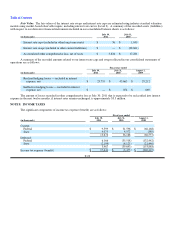

NOTE 2. PROPERTY AND EQUIPMENT, NET

The significant components of our property and equipment, net are as follows:

(in thousands)

July 30,

2011

July 31,

2010

Land, buildings and improvements $ 915,997 $ 898,625

Fixtures and equipment 718,541 672,808

Construction in progress 52,238 19,451

1,686,776 1,590,884

Less accumulated depreciation and amortization 813,577 685,058

Property and equipment, net $ 873,199 $ 905,826

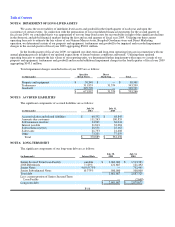

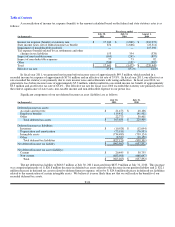

NOTE 3. GOODWILL AND INTANGIBLE ASSETS, NET

The significant components of our intangible assets and goodwill, by our reportable operating segments, are as follows:

(in thousands) Customer Lists

Favorable

Lease

Commitments Tradenames Goodwill

Specialty Retail Stores

Balance at August 1, 2009 $ 339,017 $ 411,564 $ 1,094,195 $ 959,662

Amortization (39,499)(17,878)— —

Balance at July 31, 2010 299,518 393,686 1,094,195 959,662

Amortization (30,820)(17,878)— —

Balance at July 30, 2011 $ 268,698 $ 375,808 $ 1,094,195 $ 959,662

Direct Marketing

Balance at August 1, 2009 $ 29,643 $ — $ 141,095 $ 303,771

Amortization (14,772)— (1,110)—

Balance at July 31, 2010 14,871 — 139,985 303,771

Amortization (12,740)— (1,110)—

Balance at July 30, 2011 $ 2,131 $ — $ 138,875 $ 303,771

Total at July 30, 2011 $ 270,829 $ 375,808 $ 1,233,070 $ 1,263,433

Total accumulated amortization at July 30, 2011 $ 305,661 $ 104,172 $ 2,775

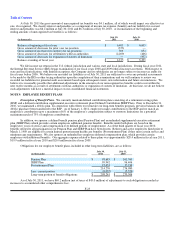

As more fully described below in Note 4 of the Notes to Consolidated Financial Statements, we recorded significant

impairment charges in fiscal year 2009 to writedown our tradenames and goodwill to estimated fair value.

F-15