Neiman Marcus 2010 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2010 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Senior Subordinated Notes. NMG has outstanding $500.0 million aggregate principal amount of 10.375% Senior

Subordinated Notes under a senior subordinated indenture (Senior Subordinated Indenture). NMG's Senior Subordinated Notes

mature on October 15, 2015.

The Senior Subordinated Notes are fully and unconditionally guaranteed, on a joint and several unsecured, senior

subordinated basis, by each of NMG's wholly-owned domestic subsidiaries that guarantee NMG's obligations under its Senior Secured

Credit Facilities and by the Company. The Senior Subordinated Notes and the guarantees thereof are NMG's and the guarantors'

unsecured, senior subordinated obligations and rank (i) junior to all of NMG's and the guarantors' existing and future senior

indebtedness, including any borrowings under NMG's Senior Secured Credit Facilities, and the guarantees thereof and NMG's 2028

Debentures; (ii) equally with any of NMG's and the guarantors' future senior subordinated indebtedness; and (iii) senior to any of

NMG's and the guarantors' future subordinated indebtedness. In addition, the Senior Subordinated Notes are structurally subordinated

to all existing and future liabilities, including trade payables, of NMG's subsidiaries that are not providing guarantees.

NMG is not required to make any mandatory redemption or sinking fund payments with respect to the Senior Subordinated

Notes. The indenture governing the Senior Subordinated Notes contains a number of customary negative covenants and events of

defaults, including a cross-default provision in respect of any other indebtedness that has an aggregate principal amount exceeding $50

million, which, if any of them occurs, would permit or require the principal, premium, if any, interest and any other monetary

obligations on all outstanding Senior Subordinated Notes to be due and payable immediately, subject to certain exceptions.

From and after October 15, 2010, NMG may redeem the Senior Subordinated Notes, in whole or in part, at a redemption

price equal to 105.188% of principal amount, declining annually to 100% of principal amount on October 15, 2013, plus accrued and

unpaid interest, and Additional Interest (as defined in the Senior Subordinated Indenture), if any, thereon to the applicable redemption

date.

Upon the occurrence of a change of control (as defined in the Senior Subordinated Indenture), NMG will make an offer to

purchase all of the Senior Subordinated Notes at a price in cash equal to 101% of the aggregate principal amount thereof plus accrued

and unpaid interest, and Additional Interest, if any, to the date of purchase.

The fair value of NMG's Senior Subordinated Notes was approximately $523.8 million at July 30, 2011 and $517.5 million at

July 31, 2010 based on quoted market prices (Level 2).

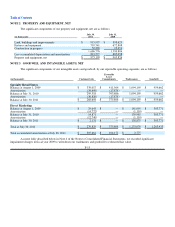

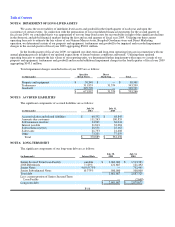

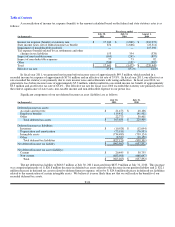

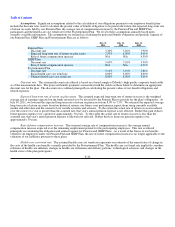

Maturities of Long-Term Debt. At July 30, 2011, annual maturities of long-term debt during the next five fiscal years and

thereafter are as follows (in millions):

2012 $ —

2013 —

2014 —

2015 —

2016 500.0

Thereafter 2,181.7

The above table does not reflect future excess cash flow prepayments, if any, that may be required under the Senior Secured

Term Loan Facility.

Loss on Debt Extinguishment. In connection with the Refinancing Transactions, we incurred a loss on debt extinguishment

of $70.4 million which included 1) costs of $37.9 million related to the tender for and redemption of our Senior Notes and 2) the

write-off of $32.5 million of debt issuance costs related to the extinguished debt facilities. The total loss on debt extinguishment was

recorded in the fourth quarter of fiscal year 2011 as a component of interest expense. In addition, we incurred debt issuance costs in

fiscal year 2011, primarily in connection with the Refinancing Transactions, of approximately $33.9 million which are being

amortized over the terms of the amended debt facilities.

F-21