Neiman Marcus 2010 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2010 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

• create liens; and

• enter into sale and lease back transactions.

The facility contains covenants limiting dividends and other restricted payments, investments, loans, advances and

acquisitions, and prepayments or redemptions of other indebtedness. These covenants permit such restricted actions in an unlimited

amount, subject to the satisfaction of certain payment conditions, principally that NMG must have pro forma excess availability under

the Asset-Based Revolving Credit Facility equal to at least 15% of the lesser of (a) the revolving commitments under the facility and

(b) the borrowing base, and NMG's delivering projections demonstrating that projected excess availability for the next six months will

be equal to such thresholds and that NMG has a pro forma ratio of consolidated EBITDA to consolidated Fixed Charges (as such

terms are defined in the credit agreement) of at least 1.0 to 1.0 (or 1.1 to 1.0 for dividends or other distributions with respect to any

equity interests in NMG, its parent or any subsidiary). The Asset-Based Revolving Credit Facility also contains customary affirmative

covenants and events of default, including a cross-default provision in respect of any other indebtedness that has an aggregate

principal amount exceeding $50 million.

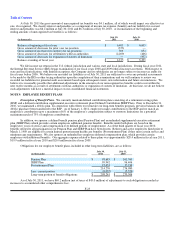

Senior Secured Term Loan Facility. In October 2005, NMG entered into a credit agreement and related security and other

agreements for a $1,975.0 million Senior Secured Term Loan Facility. In May 2011, NMG entered into an amendment and

restatement (the TLF Amendment) of the Senior Secured Term Loan Facility. The TLF Amendment increased the amount of

borrowings to $2,060.0 million and extended the maturity of the loans to May 16, 2018. Loans that were not extended under the TLF

Amendment were refinanced. The proceeds of the incremental borrowings under the term loan facility, along with cash on hand, were

used to repurchase or redeem the $752.4 million principal amount outstanding of Senior Notes. The TLF Amendment also provided

for an uncommitted incremental facility to request lenders to provide additional term loans, upon certain conditions, including that

NMG's secured leverage ratio (as defined in the TLF Amendment) is less than or equal to 4.50 to 1.00 on a pro forma basis after

giving effect to the incremental loans and the use of proceeds thereof. At July 30, 2011, the outstanding balance under the Senior

Secured Term Loan Facility was $2,060.0 million. The principal amount of the loans outstanding is due and payable in full on

May 16, 2018.

At July 30, 2011, borrowings under the Senior Secured Term Loan Facility bore interest at a rate per annum equal to, at

NMG's option, either (a) a base rate determined by reference to the higher of 1) the prime rate of Credit Suisse AG (the administrative

agent), 2) the federal funds effective rate plus 1¤2 of 1.00% and 3) the adjusted one-month LIBOR rate plus 1.00% or (b) an adjusted

LIBOR rate (for a period equal to the relevant interest period, and in any event, never less than 1.25%), subject to certain adjustments,

in each case plus an applicable margin. In addition to extending the maturity of a portion of the existing term loans under the Senior

Secured Term Loan Facility, the TLF Amendment changed the "applicable margin" used in calculating the interest rate under the term

loans. The interest rate on the outstanding borrowings pursuant to the Senior Secured Term Loan Facility was 4.75% at July 30,

2011. The applicable margin with respect to base rate borrowings is 2.50% and the applicable margin with respect to LIBOR

borrowings is 3.50%.

The credit agreement governing the Senior Secured Term Loan Facility requires NMG to prepay outstanding term loans with

50% (which percentage will be reduced to 25% if NMG's total leverage ratio is less than a specified ratio and will be reduced to 0% if

NMG's total leverage ratio is less than a specified ratio) of its annual excess cash flow (as defined in the credit agreement). For fiscal

year 2010, NMG was required to prepay $92.6 million of outstanding term loans pursuant to the annual excess cash flow

requirements. Of such amount, NMG paid $85.0 million in the fourth quarter of fiscal year 2010 and $7.6 million in the first quarter

of fiscal year 2011. We are not required to prepay any outstanding term loans pursuant to the annual excess cash flow requirements

for fiscal year 2011. NMG also must offer to prepay outstanding term loans at 100% of the principal amount to be prepaid, plus

accrued and unpaid interest, with the proceeds of certain asset sales under certain circumstances.

NMG may voluntarily prepay outstanding loans under the Senior Secured Term Loan Facility at any time without premium

or penalty other than customary "breakage" costs with respect to LIBOR loans. There is no scheduled amortization under the Senior

Secured Term Loan Facility.

All obligations under the Senior Secured Term Loan Facility are unconditionally guaranteed by the Company and each direct

and indirect domestic subsidiary of NMG that guarantees the obligations of NMG under its Asset-Based Revolving Credit Facility.

Currently, NMG conducts no operations through subsidiaries that do not guarantee the Senior Secured Term Loan Facility. All

obligations under the Senior Secured Term Loan Facility, and the guarantees of those obligations, are secured, subject to certain

exceptions, by substantially all of the assets of the Company, NMG and the subsidiary guarantors, including:

F-19