Neiman Marcus 2010 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2010 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Competition

The specialty retail industry is highly competitive and fragmented. We compete for customers with specialty retailers,

traditional and high-end department stores, national apparel chains, vendor-owned proprietary boutiques, individual specialty apparel

stores and direct marketing firms. We compete for customers principally on the basis of quality and fashion, customer service, value,

assortment and presentation of merchandise, marketing and customer loyalty programs and, in the case of Neiman Marcus and

Bergdorf Goodman, store ambiance. Retailers that compete with us for distribution of luxury fashion brands include Saks Fifth

Avenue, Nordstrom, Bloomingdales, Barney's New York, vendor boutiques and other national, regional and local retailers.

We believe we differ from other national retailers by our omni-channel retailing model, distinctive merchandise assortment,

which we believe is more upscale than other high-end department stores, excellent customer service, prime real estate locations and

elegant shopping environment. We believe we differentiate ourselves from regional and local high-end luxury retailers through our

diverse product selection, strong national brand, loyalty programs, customer service, prime shopping locations and strong vendor

relationships that allow us to offer the top merchandise from each vendor. Vendor-owned proprietary boutiques and specialty stores

carry a much smaller selection of brands and merchandise, lack the overall shopping experience we provide and have a limited

number of retail locations.

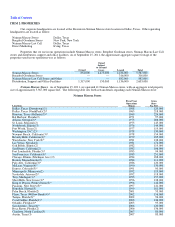

Employees

As of September 15, 2011, we had approximately 14,900 employees. Neiman Marcus stores (including Last Call) had

approximately 11,800 employees, Bergdorf Goodman stores had approximately 1,100 employees, Direct Marketing had

approximately 1,500 employees and Neiman Marcus Group had approximately 500 employees. Our staffing requirements fluctuate

during the year as a result of the seasonality of the retail industry. We hire additional temporary associates and increase the hours of

part-time employees during seasonal peak selling periods. Except for approximately 13% of the Bergdorf Goodman employees, none

of our employees are subject to a collective bargaining agreement. We believe that our relations with our employees are good.

Seasonality

Our business, like that of most retailers, is affected by seasonal fluctuations in customer demand, product offerings and

working capital expenditures. For additional information on seasonality, see Item 7, "Management's Discussion and Analysis of

Financial Condition and Results of Operations—Executive Overview—Seasonality."

Regulation

The credit card operations that are conducted under our arrangements with HSBC are subject to numerous federal and state

laws that impose disclosure and other requirements upon the origination, servicing and enforcement of credit accounts and limitations

on the maximum amount of finance charges that may be charged by a credit provider. In addition to our proprietary credit cards,

credit to our customers is also provided primarily through third parties. Any regulation or change in the regulation of credit

arrangements that would materially limit the availability of credit to our customer base could adversely affect our results of operations

or financial condition.

Our practices, as well as our competitors, are subject to review in the ordinary course of business by the Federal Trade

Commission and are subject to numerous federal and state laws. Additionally, we are subject to certain customs, truth-in-advertising

and other laws, including consumer protection regulations that regulate retailers generally and/or govern the importation, promotion

and sale of merchandise. We undertake to monitor changes in these laws and believe that we are in material compliance with all

applicable state and federal regulations with respect to such practices.

9