HSBC 2013 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2013 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

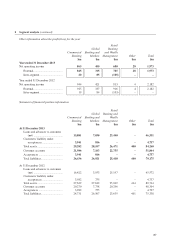

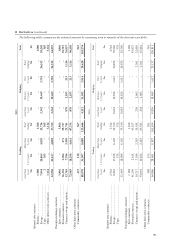

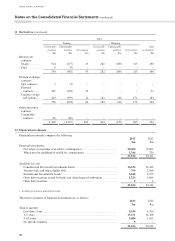

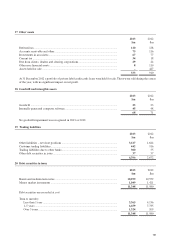

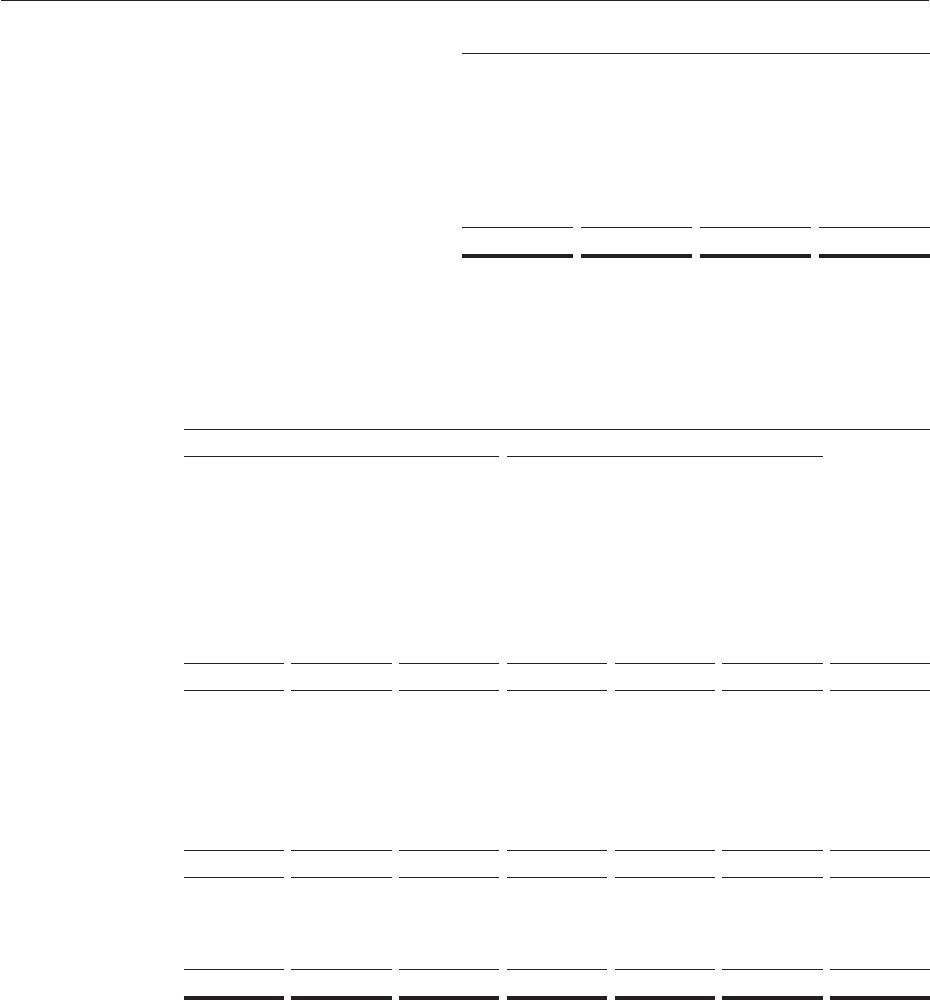

11 Derivatives (continued)

2012

3 months

or less

$m

More than

3 months

but less than

1 year

$m

More than

1 year

but less than

5 years

$m

5 years

or more

$m

Assets .......................................................................... 17,239 14,621 11,826 119

Liabilities .................................................................... (7,622) (6,048) (4,364) (387)

Net cash inflow/(outflow) exposure ............................ 9,617 8,573 7,462 (268)

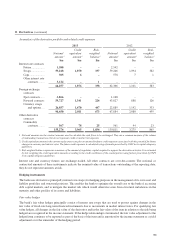

The gains and losses on ineffective portions of such derivatives are recognized immediately in ‘Net trading income’.

During 2013, a gain of $5m (2012: gain of $3m) was recognized due to hedge ineffectiveness.

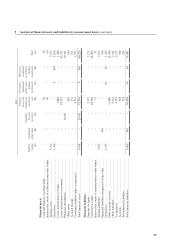

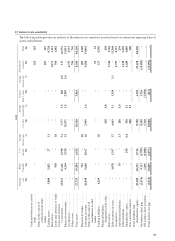

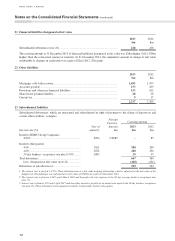

The following tables summarize the fair values of the bank’s derivative portfolio at 31 December segregated between

derivatives that are in a favourable or receivable position and those in an unfavourable or payable position. Fair values

of derivative instruments are determined using observable inputs (note 24).

2013

Trading Hedging

Favourable

position

$m

Unfavourable

position

$m

Net position

$m

Favourable

position

$m

Unfavourable

position

$m

Net position

$m

Total

net position

$m

Interest rate

contracts

Swaps .............. 483 (436) 47 220 (135) 85 132

Caps ................. 4 (4) – – – – –

Other interest rate

contracts .......... 5 (13) (8) – – – (8)

492 (453) 39 220 (135) 85 124

Foreign exchange

contracts

Spot contracts .. 3 (6) (3) – – – (3)

Forward

contracts ........ 602 (565) 37 – – – 37

Currency swaps

and options .... 472 (459) 13 288 (93) 195 208

1,077 (1,030) 47 288 (93) 195 242

Other derivative

contracts

Commodity

contracts ........ 35 (35) – – – – –

1,604 (1,518) 86 508 (228) 280 366

95