HSBC 2013 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2013 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC BANK CANADA

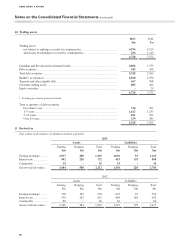

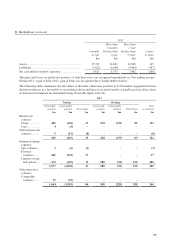

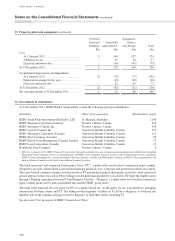

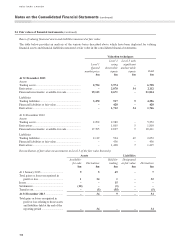

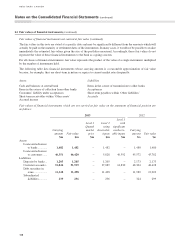

15 Property, plant and equipment (continued)

Freehold

land and

buildings

$m

Leasehold

improvements

$m

Equipment,

fixtures

and fittings

$m Total

$m

Cost

At 1 January 2012 ................................................. 3 144 127 274

Additions at cost ................................................... – 39 18 57

Disposals and write-offs ........................................ – (30) (45) (75)

At 31 December 2012 ................................................. 3 153 100 256

Accumulated depreciation and impairment

At 1 January 2012 ................................................. (2) (72) (77) (151)

Depreciation charge for the year ........................... – (18) (20) (38)

Disposals and write-offs ........................................ – 28 45 73

At 31 December 2012 ................................................. (2) (62) (52) (116)

Net carrying amount at 31 December 2012 ................ 1 91 48 140

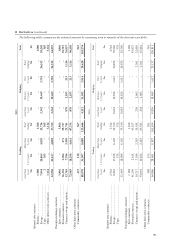

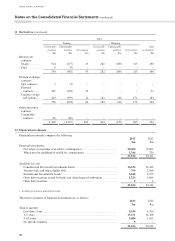

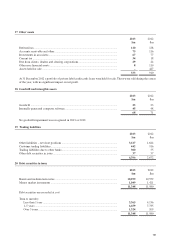

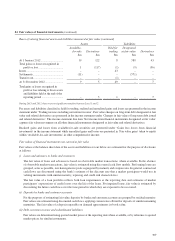

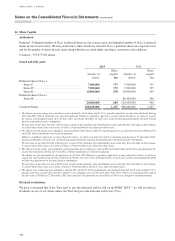

16 Investments in subsidiaries

At 31 December 2013, HSBC Bank Canada wholly-owned the following principal subsidiaries:

Subsidiary Place of incorporation Shareholders’ equity

HSBC South Point Investments (Barbados) LLP St. Michael, Barbados 1,148

HSBC Financial Corporation Limited1Toronto, Ontario, Canada 513

HSBC Securities (Canada) Inc. Toronto, Ontario, Canada 196

HSBC Capital (Canada) Inc. Vancouver, British Columbia, Canada 119

HSBC Mortgage Corporation (Canada) Vancouver, British Columbia, Canada 111

HSBC Trust Company (Canada)1Vancouver, British Columbia, Canada 68

HSBC Global Asset Management (Canada) Limited Vancouver, British Columbia, Canada 17

HSBC Loan Corporation (Canada) Vancouver, British Columbia, Canada 12

Household Trust Company1Toronto, Ontario, Canada 8

1 Effective 1 January 2014, HSBC Financial Corporation Ltd and its subsidiaries were reorganized and amalgamated with the bank including

Household Trust Company which was amalgamated with HSBC Trust Company Canada. As part of this reorganization a new subsidiary

HSBC Finance Mortgages Inc. was incorporated in Toronto, Ontario, Canada with Shareholder’s Equity of $425m. The reorganization will

have no financial impact on the bank’s consolidated financial position.

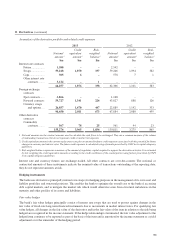

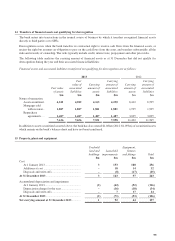

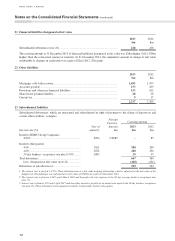

The bank sponsored and organized Performance Trust (‘PT’), a multi-seller asset-backed commercial paper conduit,

designed to provide collateralized asset-backed financing primarily to its corporate and institutional clients in Canada.

The asset-backed commercial paper structure involves PT purchasing financial instruments issued by client-sponsored

special purpose entities for cash or PT providing asset-backed financing directly to its clients. PT funds the eligible assets

through a Funding Agreement between PT and Regency Trust Inc. (‘Regency’), a multi-seller asset-backed commercial

paper conduit sponsored by and consolidated into another HSBC group entity.

The bank is the financial services agent for PT for a market-based fee. As the agent, we are responsible for arranging

transactions between clients and PT. The bank provides liquidity facilities of $1,035m to Regency to backstop the

liquidity risk of the commercial paper issued by Regency to fund their clients including PT.

See also note 27(a) in respect of HSBC Canada Asset Trust.

Notes on the Consolidated Financial Statements (continued)

100