HSBC 2013 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2013 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

99

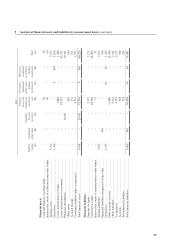

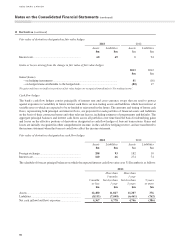

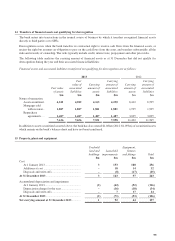

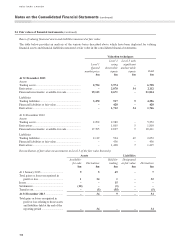

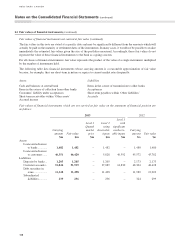

14 Transfers of financial assets not qualifying for derecognition

The bank enters into transactions in the normal course of business by which it transfers recognized financial assets

directly to third parties or to SPEs.

Derecognition occurs when the bank transfers its contractual right to receive cash flows from the financial assets, or

retains the right but assumes an obligation to pass on the cash flows from the asset, and transfers substantially all the

risks and rewards of ownership. The risks typically include credit, interest rate, prepayment and other price risks.

The following table analyzes the carrying amount of financial assets as at 31 December that did not qualify for

derecognition during the year and their associated financial liabilities:

Financial assets and associated liabilities transferred not qualifying for derecognition are as follows:

2013 2012

Fair value

of assets

$m

Fair

value of

associated

liabilities

$m

Carrying

amount of

assets

$m

Carrying

amount of

associated

liabilities

$m

Carrying

amount of

assets

$m

Carrying

amount of

associated

liabilities

$m

Nature of transaction

Assets securitized .. 4,242 4,282 4,163 4,230 6,412 6,525

Mortgages sold

with recourse ... 1,887 1,887 1,881 1,881 1,995 1,995

Repurchase

agreements .... 1,487 1,487 1,487 1,487 3,025 3,025

7,616 7,656 7,531 7,598 11,432 11,545

In addition to assets securitized as noted above, the bank has also created $1,084m (2012: $1,093m) of securitized assets

which remain on the bank’s balance sheet and have not been transferred.

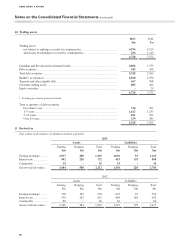

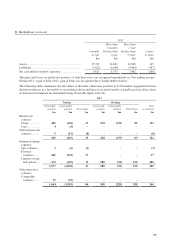

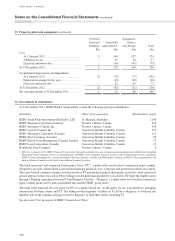

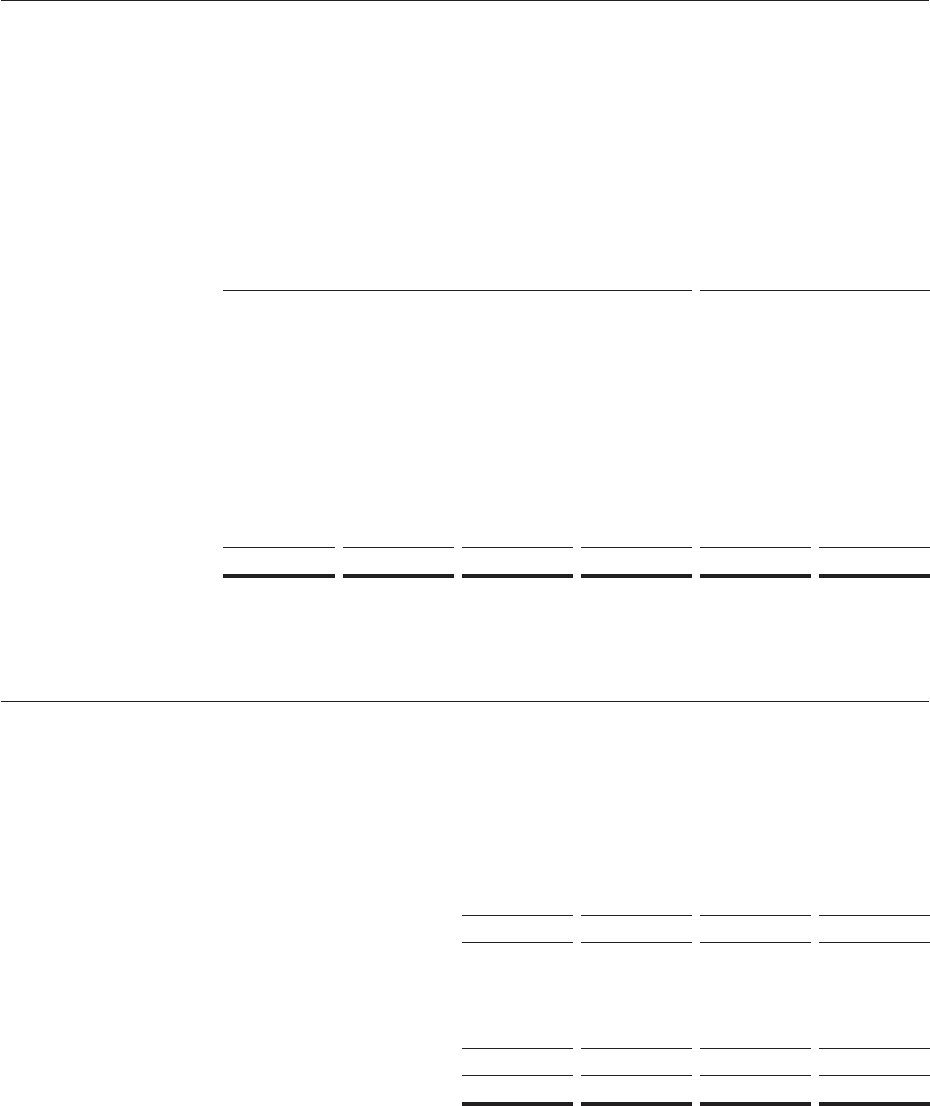

15 Property, plant and equipment

Freehold

land and

buildings

$m

Leasehold

improvements

$m

Equipment,

fixtures

and fittings

$m

Total

$m

Cost

At 1 January 2013 ................................................. 3 153 100 256

Additions at cost ................................................... – 18 14 32

Disposals and write-offs ........................................ – (8) (17) (25)

At 31 December 2013 ................................................ 3 163 97 263

Accumulated depreciation and impairment

At 1 January 2013 ................................................. (2) (62) (52) (116)

Depreciation charge for the year ........................... – (16) (18) (34)

Disposals and write-offs ........................................ – 7 17 24

At 31 December 2013 ................................................ (2) (71) (53) (126)

Net carrying amount at 31 December 2013 ............ 1 92 44 137