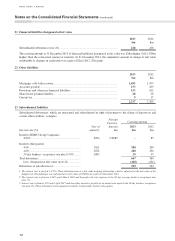

HSBC 2013 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2013 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

111

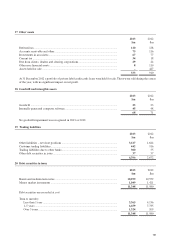

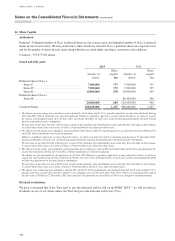

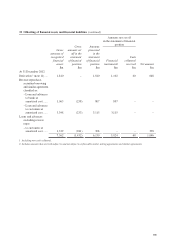

27 Non-controlling interest in trust and subsidiary

Non-controlling interest in trust and subsidiary comprises:

2013

$m

2012

$m

HSBC Canada Asset Trust ............................................................................................. 200 200

HSBC Mortgage Corporation (Canada) ......................................................................... –30

200 230

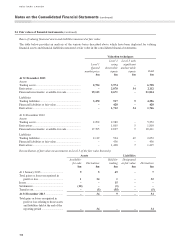

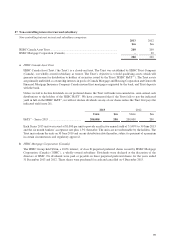

a HSBC Canada Asset Trust

HSBC Canada Asset Trust (‘the Trust’) is a closed-end trust. The Trust was established by HSBC Trust Company

(Canada), our wholly-owned subsidiary, as trustee. The Trust’s objective is to hold qualifying assets which will

generate net income for distribution to holders of securities issued by the Trust (‘HSBC HaTS™’). The Trust assets

are primarily undivided co-ownership interests in pools of Canada Mortgage and Housing Corporation and Genworth

Financial Mortgage Insurance Company Canada insured first mortgages originated by the bank, and Trust deposits

with the bank.

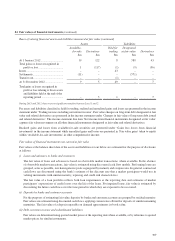

Unless we fail to declare dividends on our preferred shares, the Trust will make non-cumulative, semi-annual cash

distributions to the holders of the HSBC HaTS™. We have covenanted that if the Trust fails to pay the indicated

yield in full on the HSBC HaTS™, we will not declare dividends on any of our shares unless the Trust first pays the

indicated yield (note 26).

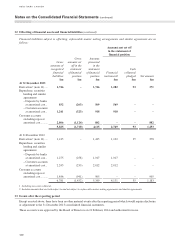

2013 2012

Units $m Units $m

HaTS™ – Series 2015 ............................................. 200,000 200 200,000 200

Each Series 2015 unit was issued at $1,000 per unit to provide an effective annual yield of 5.149% to 30 June 2015

and the six month bankers’ acceptance rate plus 1.5% thereafter. The units are not redeemable by the holders. The

Trust may redeem the units on 30 June 2010 and on any distribution date thereafter, subject to payment of a premium

in certain circumstances and regulatory approval.

b HSBC Mortgage Corporation (Canada)

The HSBC Group held $30m, a 100% interest, of class B perpetual preferred shares issued by HSBC Mortgage

Corporation (Canada) (‘HMC’), a wholly-owned subsidiary. Dividends were declared at the discretion of the

directors of HMC. No dividends were paid or payable on these perpetual preferred shares for the years ended

31 December 2013 and 2012. These shares were purchased for cash and cancelled on 4 December 2013.