HSBC 2013 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2013 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC BANK CANADA

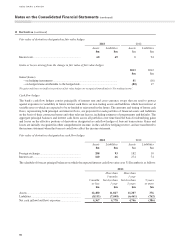

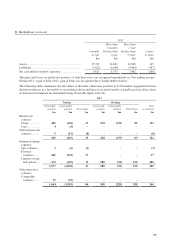

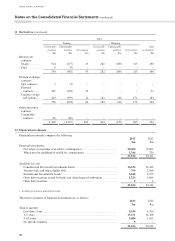

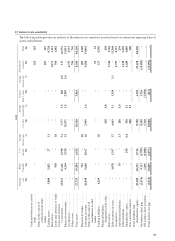

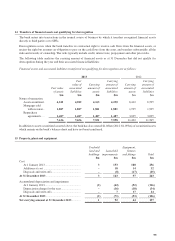

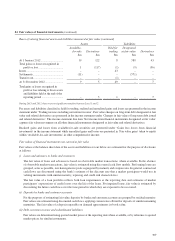

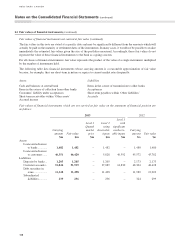

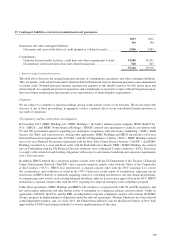

24 Fair values of financial instruments (continued)

Determination of fair value (continued)

Valuation techniques incorporate assumptions about factors that other market participants would use in their valuations.

A range of valuation techniques is employed, dependent upon the instrument type and available market data. Most

valuation techniques are based upon discounted cash flow analysis, in which expected future cash flows are calculated

and discounted to present value using a discounting curve. Prior to consideration of credit risk, the expected future cash

flows may be known, as would be the case for the fixed leg of an interest rate swap, or may be uncertain and require

projection, as would be the case for the floating leg of an interest rate swap. Projection utilizes market forward curves,

if available. In option models, the probability of different potential future outcomes must be considered. In addition, the

value of some products are dependent upon more than one market factor, and in these cases it will typically be necessary

to consider how movements in one market factor may impact the other market factors. The model inputs necessary to

perform such calculations include interest rate yield curves, exchange rates, volatilities, correlations, prepayment and

default rates. For interest rate derivatives with collateralized counterparties and in significant currencies, HSBC uses a

discounting curve that reflects the overnight interest rate (‘OIS discounting’).

The majority of valuation techniques employ only observable market data, and so the reliability of the fair value

measurement is high. However, certain financial instruments are valued on the basis of valuation techniques that

feature one or more significant market inputs that are unobservable, and for them, the derivation of fair value is more

judgmental. An instrument in its entirety is classified as valued using significant unobservable inputs if, in the opinion

of management, a significant proportion of the instrument’s carrying amount and/ or inception profit (‘day 1 gain and

loss’) is driven by unobservable inputs. ‘Unobservable’ in this context means that there is little or no current market data

available from which to determine the level at which an arm’s length transaction would be likely to occur. It generally

does not mean that there is no market data available at all upon which to base a determination of fair value (consensus

pricing data may, for example, be used). Furthermore, in some cases the majority of the fair value derived from a

valuation technique with significant unobservable inputs may be attributable to the observable inputs. Consequently, the

effect of uncertainty in the determining unobservable inputs will generally be restricted to uncertainty about the overall

fair value of the financial instrument being measured.

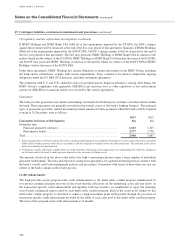

In certain circumstances, primarily where debt is hedged with interest rate derivatives or structured notes issued, the

bank uses fair value to measure the carrying value of its own debt in issue. The bank records its own debt in issue at

fair value, based on quoted prices in an active market for the specific instrument concerned, if available. When quoted

market prices are unavailable, the own debt in issue is valued using valuation techniques, the inputs for which are either

based upon quoted prices in an inactive market for the instrument, or are estimated by comparison with quoted prices

in an active market for similar instruments. In both cases, the fair value includes the effect of applying the credit spread

which is appropriate to the bank’s liabilities. For all issued debt securities, discounted cash flow modelling is used to

separate the change in fair value that may be attributed to the bank’s credit spread movements from movements in other

market factors such as benchmark interest rates or foreign exchange rates. Specifically, the change in fair value of issued

debt securities attributable to the bank’s own credit spread is computed as follows: for each security at each reporting

date, an externally verifiable price is obtained or a price is derived using credit spreads for similar securities for the

same issuer. Then, using discounted cash flow, each security is valued using a risk-free discount curve. The difference

in the valuations is attributable to the bank’s own credit spread. This methodology is applied consistently across all

securities. Structured notes issued and certain other hybrid instrument liabilities are included within trading liabilities

and are measured at fair value. The credit spread applied to these instruments is derived from the spreads at which the

bank issues structured notes.

Gains and losses arising from changes in the credit spread of liabilities issued by the bank reverse over the contractual

life of the debt, provided that the debt is not repaid early. All net positions in non-derivative financial instruments, and

all derivative portfolios, are valued at bid or offer prices as appropriate. Long positions are marked at bid prices; short

positions are marked at offer prices.

The fair value of a portfolio of financial instruments quoted in an active market is calculated as the product of the number

of units and its quoted price and no block discounts are made.

Transaction costs are not included in the fair value calculation, nor are the future costs of administering the over the

counter derivative portfolio. These, along with trade origination costs such as brokerage fees and post-trade costs, are

included either in ‘Fee expense’ or in ‘Total operating expenses’.

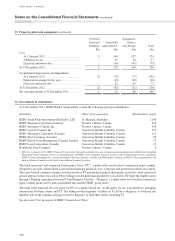

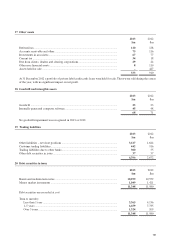

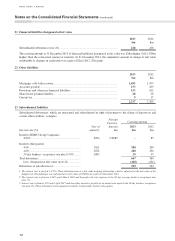

Notes on the Consolidated Financial Statements (continued)

104