HSBC 2013 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2013 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC BANK CANADA

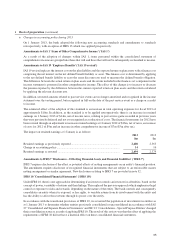

1 Basis of preparation (continued)

c Use of estimates and assumptions

The preparation of financial information requires the use of estimates and assumptions about future conditions.

The use of available information and the application of judgement are inherent in the formation of estimates.

Actual results in the future may differ from estimates upon which financial information is prepared. Management

believes that the bank’s critical accounting policies where judgement is necessarily applied are those which relate to

impairment of loans and advances and the valuation of financial instruments as described within the Management’s

Discussion and Analysis.

d Consolidation

The consolidated financial statements of the bank comprise the financial statements of the bank and its subsidiaries

as at 31 December 2013, 31 December 2012 and for the years then ended. Subsidiaries are consolidated from the date

that the bank gains control. The acquisition method of accounting is used when subsidiaries are acquired by the bank.

The cost of an acquisition is measured at the fair value of the consideration, including contingent consideration,

given at the date of exchange. Acquisition-related costs are recognized as an expense in the income statement in

the period in which they are incurred. The acquired identifiable assets, liabilities and contingent liabilities are

measured at their fair values at the date of acquisition. Goodwill is measured as the excess of the aggregation of the

consideration transferred, the amount of non-controlling interest and the fair value of the acquirer’s previously held

equity interest, if any, over the net of the amounts of identifiable assets acquired and liabilities assumed. The amount

of non-controlling interest is measured either at fair value or at the non-controlling interest’s proportionate share of

the acquiree’s identifiable net assets. Changes in a parent’s ownership interest in a subsidiary that do not result in a

loss of control are treated as transactions between equity holders and are reported in equity.

Entities that are controlled by the bank are consolidated until the date that control ceases.

In the context of Special Purpose Entities (‘SPE’), the following circumstances may indicate a relationship which,

in substance, the bank controls and consequently consolidates an SPE:

– the activities of the SPE are being conducted on behalf of the bank according to its specific business needs so

that the bank obtains the benefits from the SPE’s operation;

– the bank has the decision-making powers to obtain the majority of the benefits of the activities of the SPE or, by

setting up an ‘autopilot’ mechanism, the bank has delegated these decision-making powers;

– the bank has rights to obtain the majority of the benefits of the SPE and therefore may be exposed to risks

incidental to the activities of the SPE; or

– the bank retains the majority of the residual or ownership risks related to the SPE or its assets in order to obtain

benefits from its activities.

The bank performs a re-assessment of consolidation whenever there is a change in the substance of the relationship

between the bank and an SPE.

All inter-company transactions are eliminated on consolidation.

The consolidated financial statements of the bank also include the attributable share of the results and reserves

of associates.

64

Notes on the Consolidated Financial Statements (continued)

December 31, 2009 and 2008 (all tabular amounts are in millions of dollars unless stated otherwise)