HSBC 2013 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2013 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

11

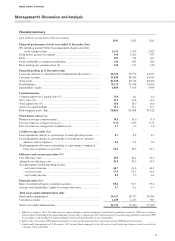

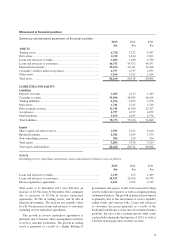

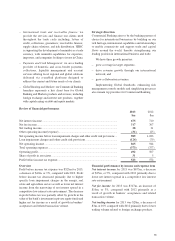

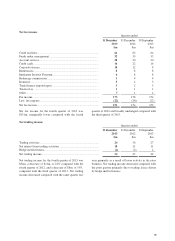

Movement in financial position

Summary consolidated statement of financial position

2013

$m

2012

$m 2011

$m

ASSETS

Trading assets ........................................................................................ 6,728 5,272 4,587

Derivatives ............................................................................................ 2,112 1,810 2,203

Loans and advances to banks ................................................................ 1,482 1,480 4,530

Loans and advances to customers ......................................................... 46,351 45,572 44,357

Financial investments ............................................................................ 21,814 20,411 19,168

Customer’s liability under acceptances................................................. 4,757 4,737 4,059

Other assets ........................................................................................... 1,016 1,432 1,164

Total assets ............................................................................................ 84,260 80,714 80,068

LIABILITIES AND EQUITY

Liabilities

Deposits by banks ................................................................................. 1,205 2,173 1,329

Customer accounts ................................................................................ 51,844 48,304 46,614

Trading liabilities .................................................................................. 4,396 2,672 2,996

Derivatives ............................................................................................ 1,746 1,415 1,746

Debt securities in issue .......................................................................... 11,348 11,980 13,327

Acceptances .......................................................................................... 4,757 4,737 4,059

Other liabilities ...................................................................................... 3,879 4,057 4,778

Total liabilities ...................................................................................... 79,175 75,338 74,849

Equity

Share capital and other reserves ............................................................ 1,959 2,452 2,610

Retained earnings .................................................................................. 2,926 2,694 2,379

Non-controlling interests ...................................................................... 200 230 230

Total equity ........................................................................................... 5,085 5,376 5,219

Total equity and liabilities ..................................................................... 84,260 80,714 80,068

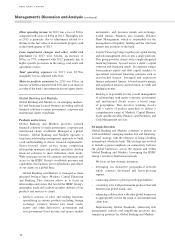

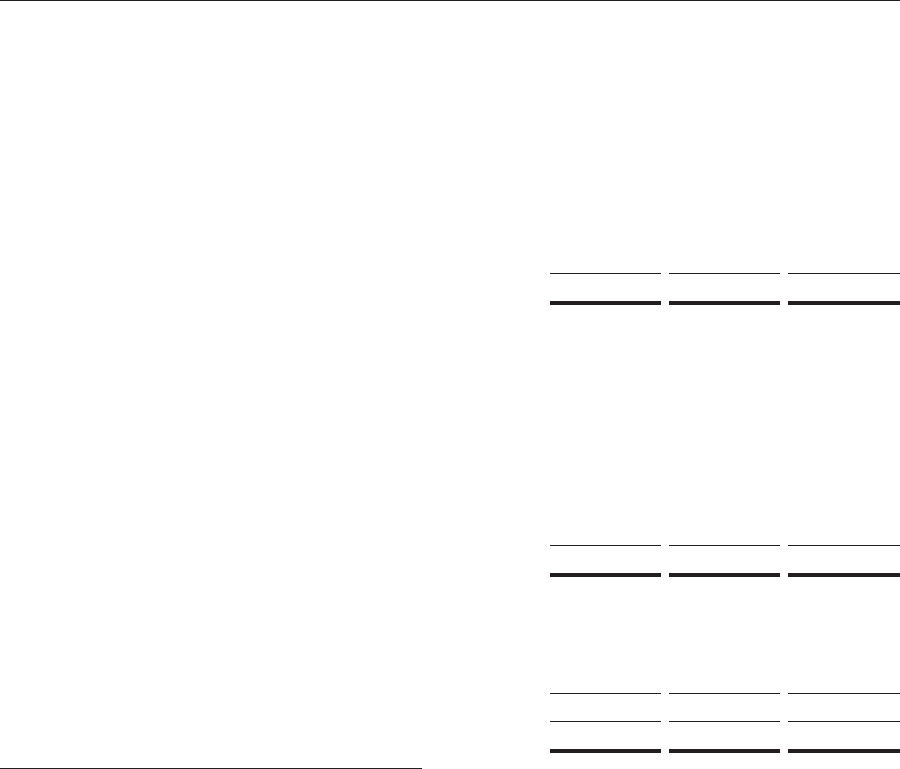

Assets

Excluding reverse repurchase agreements, loans and advances balances were as follows:

2013

$m

2012

$m 2011

$m

Loans and advances to banks ................................................................ 1,149 673 1,489

Loans and advances to customers ......................................................... 40,523 42,456 43,479

Reverse repurchase agreements ............................................................ 6,161 3,923 3,919

Total assets at 31 December 2013 were $84.3bn, an

increase of $3.5bn from 31 December 2012, primarily

due to increases of $2.2bn in reverse repurchase

agreements, $1.5bn in trading assets, and $1.4bn in

financial investments. The increase was partially offset

by a $1.9bn decrease in loans and advances to customers

excluding reverse repurchase agreements.

The growth in reverse repurchase agreements is

primarily due to balance sheet management activities

as well as customer facilitation. The growth in trading

assets is primarily as a result of a higher holding of

government and agency bonds from increased trading

activity in the rates business as well as a higher pending

settlement balances. The growth in financial investments

is primarily due to the investment of excess liquidity

within bonds and treasury bills. Loans and advances

to customers decreased primarily as a result of the

declining loan balances of the run-off consumer finance

portfolio, the sale of the consumer private label credit

card portfolio during the third quarter of 2013, as well as

a decline in mortgage and overdraft accounts.