HSBC 2013 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2013 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

36

– in the financial sector, charges over financial

instruments such as debt and equity securities in

support of trading facilities.

Our credit risk management policies include

appropriate guidelines on the acceptability of specific

classes of collateral or credit risk mitigation. Valuation

parameters are updated periodically depending on

the nature of the collateral. Full covering corporate

guarantees as well as bank and sovereign guarantees are

recognized as credit mitigants for capital purposes.

The bank does not disclose the fair value of collateral

held as security or other credit enhancements on loans

past due but not impaired or individually assessed

impaired loans, as it is not practical to do so.

Collateral held as security for financial assets other

than loans is determined by the nature of the instrument.

Government and other debt securities, including money

market instruments, are generally unsecured, with

the exception of asset-backed securities and similar

instruments, which are secured by pools of financial

assets.

The bank has policies in place to monitor the

existence of undesirable concentration of the collateral

supporting our credit exposures.

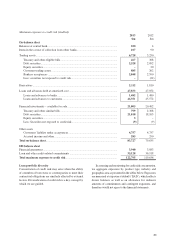

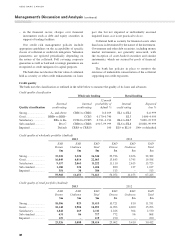

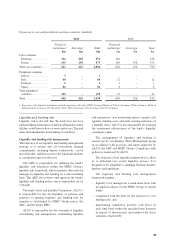

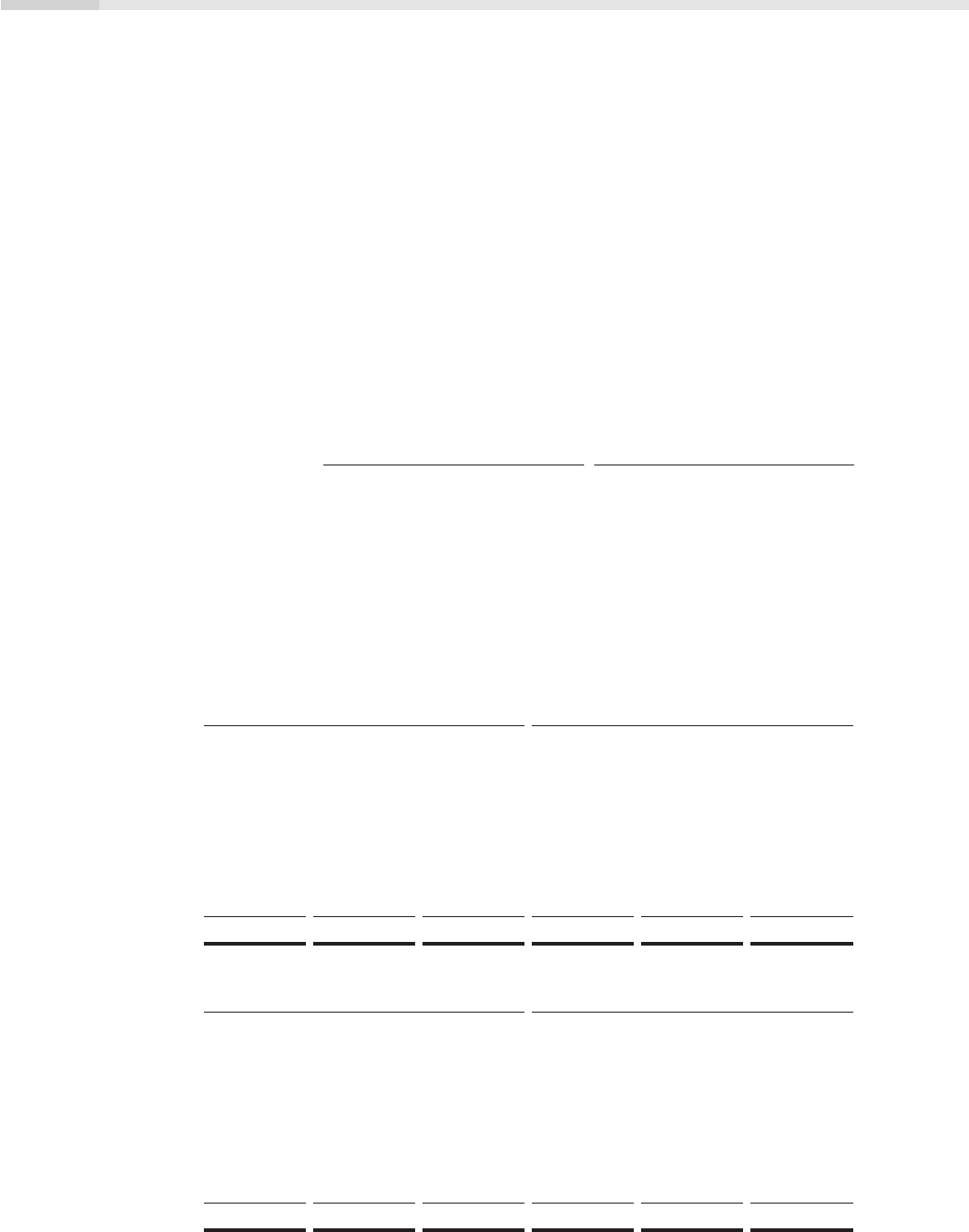

Credit quality

The bank uses the classification as outlined in the table below to measure the quality of its loans and advances.

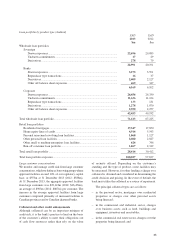

Credit quality classification

Wholesale lending Retail lending

Quality classification

External

credit rating Internal

credit rating

12 month

probability of

default % Internal

credit rating Expected

loss %

Strong ........................ A– and above CRR1 to CRR2 0–0.169 EL1 to EL2 0–0.999

Good .......................... BBB+ to BBB– CCR3 0.170–0.740 EL3 1.000–4.999

Satisfactory ............... BB+ to B+ CCR4 to CCR5 0.741–4.914 EL4 to EL5 5.000–19.999

Sub-standard ............. B to C CRR6 to CRR8 4.915–99.999 EL6 to EL8 20.000–99.999

Impaired .................... Default CRR9 to CRR10 100 EL9 to EL10 100+ or defaulted

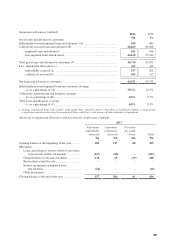

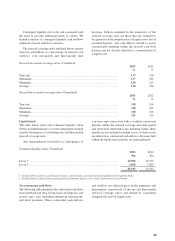

Credit quality of wholesale portfolio (Audited)

2013 2012

EAD

Drawn

$m

EAD

Undrawn

$m

EAD

Total

$m

EAD

Drawn

$m

EAD

Undrawn

$m

EAD

Total

$m

Strong ........................ 33,220 3,320 36,540 29,726 2,656 32,382

Good .......................... 16,049 6,014 22,063 13,843 5,745 19,588

Satisfactory ............... 9,157 2,065 11,222 11,110 2,615 13,725

Sub-standard ............. 1,180 224 1,404 880 137 1,017

Impaired .................... 354 30 384 513 – 513

59,960 11,653 71,613 56,072 11,153 67,225

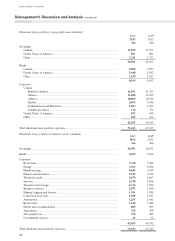

Credit quality of retail portfolio (Audited)

2013 2012

EAD

Drawn

$m

EAD

Undrawn

$m

EAD

Total

$m

EAD

Drawn

$m

EAD

Undrawn

$m

EAD

Total

$m

Strong ........................ 10,586 829 11,415 10,721 810 11,531

Good .......................... 10,148 3,904 14,052 11,093 4,200 15,293

Satisfactory ............... 1,842 269 2,111 2,226 304 2,530

Sub-standard ............. 631 86 717 772 96 868

Impaired .................... 119 –119 190 – 190

23,326 5,088 28,414 25,002 5,410 30,412

Management’s Discussion and Analysis (continued)

HSBC BANK CANADA

36