HSBC 2013 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2013 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC BANK CANADA

98

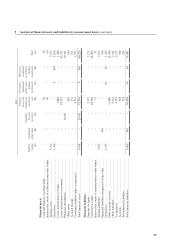

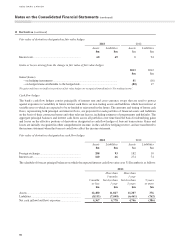

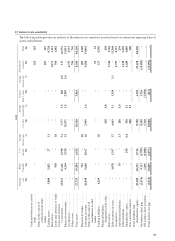

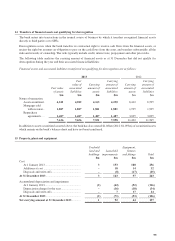

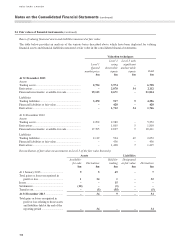

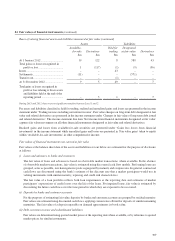

13 Interest rate sensitivity (continued)

2012

Floating

rate

$m

Within

3 months

$m

3–12

months

$m

Average

interest rate

%1–5 years

$m

Average

interest rate

%

Greater

than 5 years

$m

Average

interest rate

%

Non-interest

sensitive

$m Total

$m

Cash and balances at central

bank ................................. – – – – – 56 56

Items in the course of

collection from other

banks ............................... – – – – – 90 90

Trading assets ........................ 2,682 2,541 49 1.2 – – – 5,272

Derivatives ............................ – – – – – 1,810 1,810

Loans and advances to banks – 1,282 – 1.3 – – 198 1,480

Loans and advances

to customers .................... 27,183 8,885 2,505 3.4 6,625 4.0 79 4.9 295 45,572

Financial investments ............ – 743 4,017 1.5 14,388 1.6 1,263 2.3 – 20,411

Acceptances .......................... – – – – – 4,737 4,737

Other assets ........................... – – – – – 1,286 1,286

Total assets ............................ 29,865 13,451 6,571 21,013 1,342 8,472 80,714

Deposits by banks ................. – 1,556 1 0.9 – – 616 2,173

Customer accounts ................ 23,501 5,982 6,541 1.0 4,045 2.7 – 2.1 8,235 48,304

Items in the course of

transmission to other

banks ............................... – – – – – 71 71

Trading liabilities .................. 2,546 – – 1.0 – – 126 2,672

Financial liabilities

designated at fair value ... – – – 436 4.8 – – 436

Derivatives ............................ – – – – – 1,415 1,415

Debt securities in issue .......... – 2,931 2,836 2.3 6,120 3.0 93 4.1 – 11,980

Acceptances .......................... – – – – – 4,737 4,737

Subordinated liabilities ......... – 40 – 1.6 284 3.9 – – 324

Other liabilities ...................... – – – – – 3,226 3,226

Shareholders’ equity .............. – 22 65 600 5.6 – 4,459 5,146

Non controlling interest ........ – – – 200 5.2 – 30 230

Total liabilities and

shareholders’ equity ........ 26,047 10,531 9,443 11,685 93 22,915 80,714

On-balance sheet gap ............ 3,818 2,920 (2,872) 9,328 1,249 (14,443) –

Off-balance sheet positions ... – (2,907) 944 3,160 (1,197) – –

Total interest rate gap ............ 3,818 13 (1,928) 12,488 52 (14,443) –

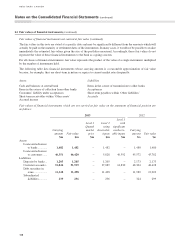

Notes on the Consolidated Financial Statements (continued)

HSBC BANK CANADA