HSBC 2013 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2013 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

23

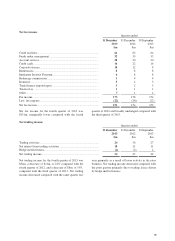

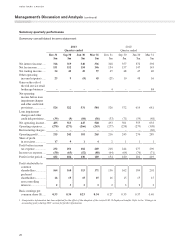

Comments on trends over the past eight quarters

Seasonal factors did not have a significant impact on

our results.

Net interest income declined from 2012 primarily

as a result of the run-off consumer finance portfolio. In

addition contributing to the decrease was lower interest

margins in a competitive low interest rate environment.

The decline in net interest income has been partially

offset by growth in deposit volumes which reduced our

cost of funding.

Net fee income trended upwards from 2012 due to

higher funds under management fees driven by customer

investment through our wealth management business.

Net trading income trended upwards through 2012

and downwards through 2013 in line with market

volatility.

Operating expenses continue to decrease from the

first quarter of 2012 primarily due to cost reductions

relating to the wind-down of the bank’s consumer

finance business and as a result of continued cost

reduction initiatives.

Economic outlook for 2014

At best, keeping pace with US

In 2014, the Canadian economy will, at best, keep pace

with the US expansion. As things stand, we expect Gross

Domestic Product (‘GDP’) growth of 2.3% in both

countries. There are three key areas that we focus on as

helping provide lift, or less of a restraint, to the US, but

which will act as potentially growth-limiting headwinds

to Canada. Those areas are housing, employment, and

fiscal policy.

In the US, the housing sector is starting to emerge

from its post bubble malaise. Meanwhile, in Canada,

the housing sector is poised to step back after having

helped lift the economy out of recession, and acting as

an economic pillar since.

Employment has been a key indicator of economic

rebound in Canada, versus the lacklustre performance

of the US economy in recent years. To wit, full-time

employment in Canada is 3.4% above its pre-recession

peak, but is still 4.1% below its pre-recession peak in

the US. There is more scope for job creation in the US.

Hence, we look for consumption spending in the US to

trend modestly upward in the next two years, from an

advance of 1.9% in 2013, toward an increase of 2.2% in

2015. In Canada, we expect consumption to advance at

2.2% in 2013, but to slow to a 1.9% increase in 2015.

Lastly, in the US fiscal drag is starting to decline,

while Canadian fiscal authorities are entering a critical

period with regard to returning to fiscal balance in the

next couple of years. As a result, we expect less of a

fiscal headwind in the US, and only a small addition to

GDP growth in Canada from fiscal policy. We see 2014

as a key year with regard to the Federal Government’s

plan to return to fiscal surplus in fiscal year 2015/16.

Strict expenditure controls will be necessary as we

anticipate sluggish nominal GDP growth, and thus

sluggish tax revenue growth.

Part and parcel of our outlook for a more moderate

contribution from consumers to Canadian GDP growth

is a further slowdown in the pace of expansion of

household credit. This will help stabilize the household

debt to personal disposable income ratio, which is a key

step in the process of the rebalancing of the household

sector. The household debt slowdown will affect home

renovation activity and existing home sales, both of

which are part of the residential investment component

of GDP, other consumer spending relate to renovations,

and auto sales. After nearly hitting a record high in 2012,

unit auto sales are on pace to achieve new highs in 2013.

A key factor behind the strength in auto sales is the

attraction of very long term, low rate loans. The problem

with these loans is that there is an elevated risk that

borrowers could find themselves in a negative equity

position if they choose to trade in their vehicle before

the loan is paid off. This could lead to a snowballing

effect in auto-related debt, at a time when interest rates

are not as low as they are at present. We look for auto

sales to slow in 2014, though only modestly given that

rates remain low.

Amid consumer restraint other sectors of the economy

are expected to step in to share the burden of GDP

growth, specifically business investment and exports.

We expect the rotation toward business investment

and exports, with a more moderate contribution from

consumer spending and housing, to feature prominently

in 2014. That said, the rebalancing toward business

investment and exports has been choppy, and is not yet

firmly entrenched.

On exports, we look to US domestic demand, and

commodity prices as the most important drivers. Calls

for a weaker Canadian dollar to boost exports are

misplaced. For exports to take on more of the burden

of growth, we require a solid increase in real exports or

an increase in the actual volume of goods and services