HSBC 2013 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2013 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

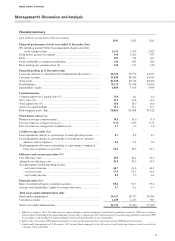

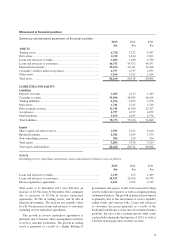

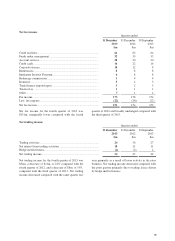

Liabilities

Excluding repurchase agreements, deposits and customer accounts balances were as follows:

2013

$m

2012

$m 2011

$m

Deposits by banks ................................................................................. 636 1,156 1,222

Customer accounts ................................................................................ 50,926 46,292 46,205

Repurchase agreements ......................................................................... 1,487 3,029 516

Total liabilities at 31 December 2013 were $79.2bn, an

increase of $3.8bn from 31 December 2012, primarily

due to increases of $4.6bn in customer accounts

excluding repurchase agreements and $1.7bn in trading

liabilities. The increase was partially offset by decreases

of $1.5bn in repurchase agreements, $0.6bn in debt

securities in issue and $0.5bn in deposits by banks

excluding repurchase agreements.

The increase in customer accounts is primarily due

to growth in savings, deposits and current accounts.

The increase in trading liabilities is primarily as

a result of increased activity in the rates business.

Repurchase agreements decreased primarily as a result

of reduced customer facilitating activity and balance

sheet management activities. Debt securities in issue

decreased primarily as a result of the maturity of $2.6bn

in secured funding and bearer deposit notes, partially

offset by replacement wholesale term funding of $2.0bn.

Deposits by banks excluding repurchase agreements

decreased primarily due to a reduction in treasury

money market term deposits.

Equity

Total equity at 31 December 2013 was $5.1bn, a

decrease of $0.3bn from 31 December 2012, primarily

due to the purchase and cancellation of $346m preferred

share capital and $30m in non-controlling interests in

accordance with the bank’s capital plan. The decrease in

equity was partially offset by profits generated in the year.

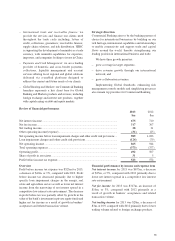

Global lines of business

We manage and report our operations around the

following global lines of business: Commercial

Banking; Global Banking and Markets, and, Retail

Banking and Wealth Management.

As a result of the bank’s previous decision to

wind-down the consumer finance business in Canada

and in order to more appropriately reflect the bank’s

active global lines of business, effective for 2013,

results previously reported as the ‘Consumer Finance’

segment have been included under Retail Banking and

Wealth Management, with exception of results relating

to corporate credit cards, which are included under

Commercial Banking. The results for the comparative

period have been restated to reflect this change.

Commercial Banking

Commercial Banking offers a full range of commercial

financial services and tailored solutions to more

than 30 thousand customers ranging from small

and medium-sized enterprises (‘SMEs’) to publicly

quoted companies.

Products and services

We segment our Commercial Banking business into

Corporate, to serve both large and mid-market companies

with more sophisticated financial needs, and Business

Banking, to serve SMEs, enabling differentiated

coverage of our target customers. This allows us to

provide continuous support to companies as they grow

both domestically and internationally, and ensures a clear

focus on internationally aspirant customers.

We place particular emphasis on international

connectivity to meet the needs of our business

customers. We aim to be recognized as the leading

international trade and business bank by focusing on

target segments, repositioning towards international

business and enhancing collaboration across the Group.

This will be underpinned by reducing complexity and

operational risk and driving efficiency gains through

adopting a global operating model.

– Credit and Lending: we offer a broad range of

domestic and cross-border financing, including

overdrafts, term loans, leasing, and syndicated,

leveraged, acquisition and project finance.

HSBC BANK CANADA

Management’s Discussion and Analysis (continued)

12