HSBC 2013 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2013 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC BANK CANADA

112

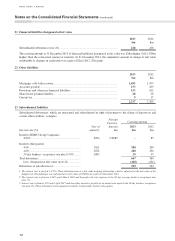

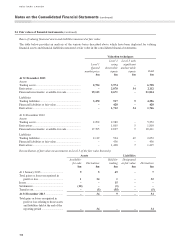

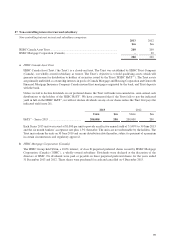

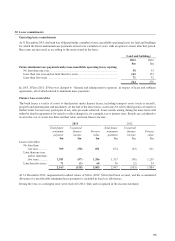

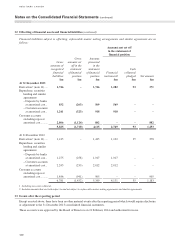

28 Notes on the statement of cash flows

Non-cash items included in profit before tax 2013

$m

2012

$m

Depreciation and amortization ....................................................................................... 48 54

Share-based payment expense ....................................................................................... 917

Loan impairment charges and other credit risk provisions ............................................ 188 211

Charge for defined benefit pension plans ...................................................................... 20 9

Gain on sale of full service retail brokerage business .................................................... –(88)

265 203

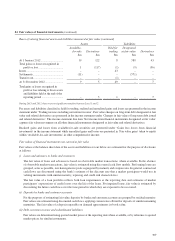

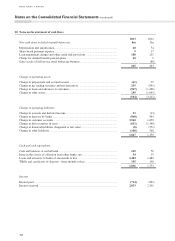

Change in operating assets

Change in prepayment and accrued income .................................................................. (41) 55

Change in net trading securities and net derivatives ...................................................... 235 (891)

Change in loans and advances to customers .................................................................. (967) (1,426)

Change in other assets .................................................................................................... 189 (1,049)

(584) (3,311)

Change in operating liabilities

Change in accruals and deferred income ....................................................................... 23 (33)

Change in deposits by banks .......................................................................................... (968) 844

Change in customer accounts ......................................................................................... 3,540 1,690

Change in debt securities in issue .................................................................................. (632) (1,348)

Change in financial liabilities designated at fair value .................................................. (8) (571)

Change in other liabilities .............................................................................................. (108) 568

1,847 1,150

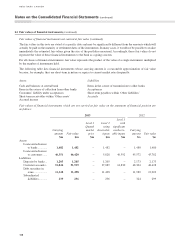

Cash and cash equivalents

Cash and balances at central bank ................................................................................. 165 56

Items in the course of collection from other banks, net ................................................. 54 19

Loans and advances to banks of one month or less ....................................................... 1,482 1,480

T-Bills and certificates of deposits – three months or less ............................................. 195 198

1,896 1,753

Interest

Interest paid .................................................................................................................... (714) (801)

Interest received ............................................................................................................. 2,033 2,301

Notes on the Consolidated Financial Statements (continued)