HSBC 2013 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2013 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC BANK CANADA

120

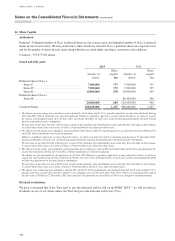

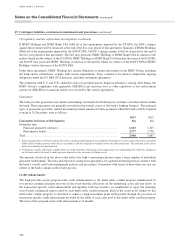

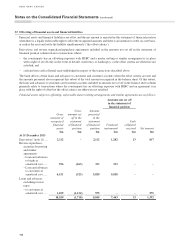

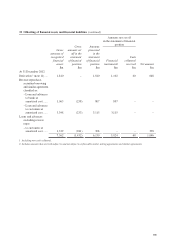

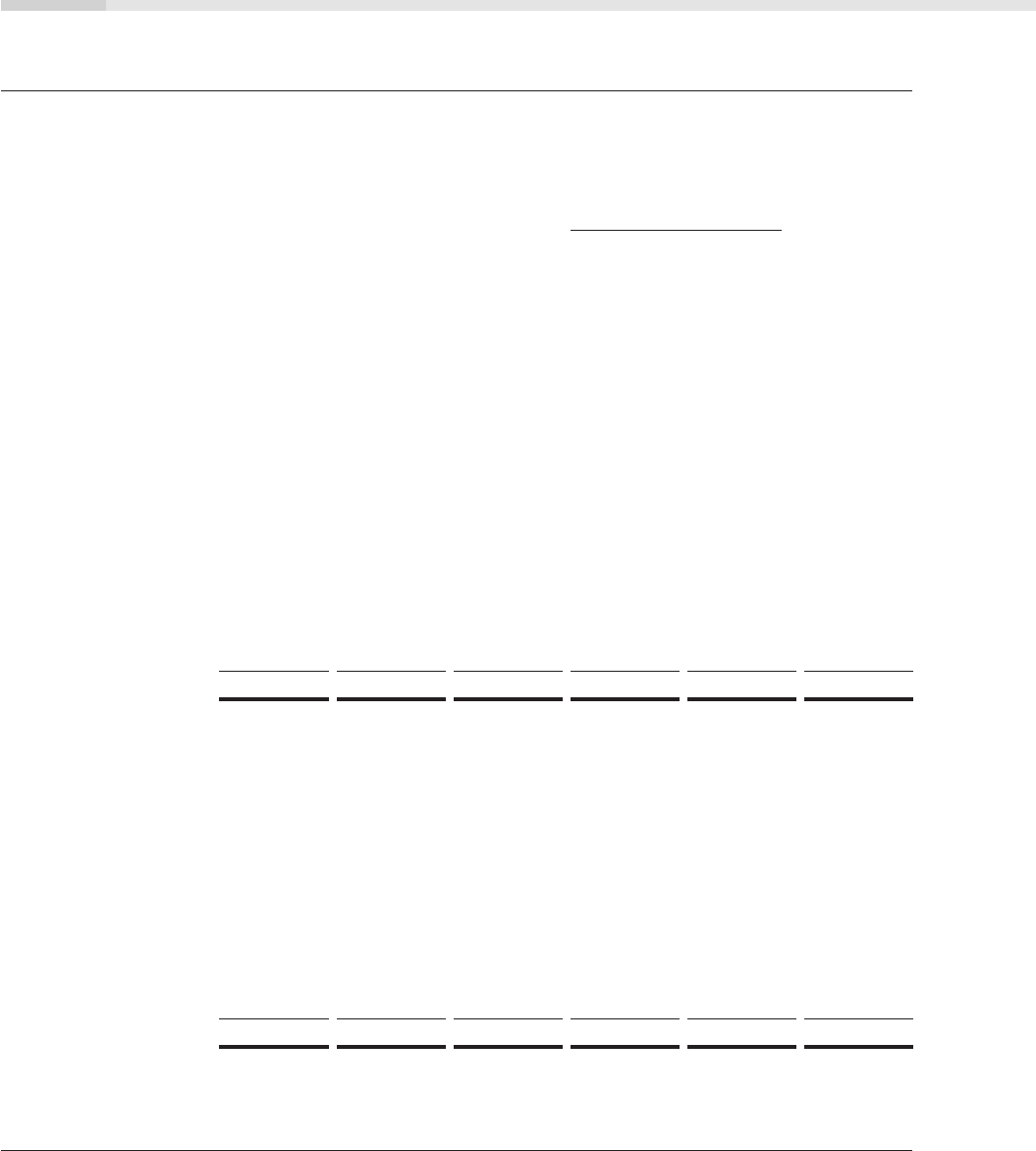

32 Offsetting of financial assets and financial liabilities (continued)

Financial liabilities subject to offsetting, enforceable master netting arrangements and similar agreements are as

follows:

Amounts not set off

in the statement of

financial position

Gross

amounts of

recognized

financial

liabilities

$m

Gross

amounts set

off in the

statement

of financial

position

$m

Amounts

presented

in the

statement

of financial

position

$m

Financial

instruments

$m

1

Cash

collateral

pledged

$m

Net amount

$m

At 31 December 2013

Derivatives2 (note 11) ..... 1,746 – 1,746 1,282 93 371

Repurchase, securities

lending and similar

agreements

– Deposits by banks

at amortized cost .. 832 (263) 569 569 – –

– Customer accounts

at amortized cost .. 1,241 (323) 918 918 – –

Customer accounts

excluding repos at

amortized cost .......... 2,006 (1,124) 882 – – 882

5,825 (1,710) 4,115 2,769 93 1,253

At 31 December 2012

Derivatives2 (note 11) ..... 1,415 – 1,415 1,102 35 278

Repurchase, securities

lending and similar

agreements

– Deposits by banks

at amortized cost .. 1,275 (258) 1,017 1,017 – –

– Customer accounts

at amortized cost .. 2,245 (233) 2,012 2,012 – –

Customer accounts

excluding repos at

amortized cost .......... 1,846 (941) 905 – – 905

6,781 (1,432) 5,349 4,131 35 1,183

1 Including non-cash collateral.

2 Includes amounts that are both subject to and not subject to enforceable master netting agreements and similar agreements.

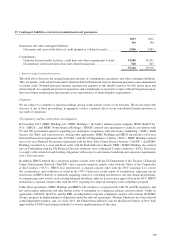

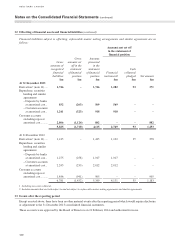

33 Events after the reporting period

Except as noted above, there have been no other material events after the reporting period which would require disclosure

or adjustment to the 31 December 2013 consolidated financial statements.

These accounts were approved by the Board of Directors on 21 February 2014 and authorized for issue.

Notes on the Consolidated Financial Statements (continued)