HSBC 2013 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2013 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

113

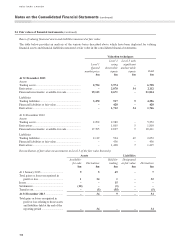

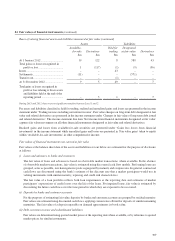

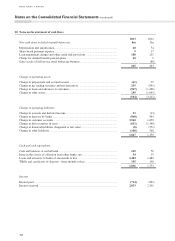

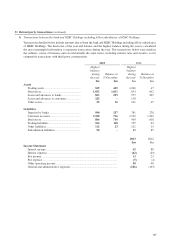

29 Contingent liabilities, contractual commitments and guarantees

2013

$m

2012

$m

Guarantees and other contingent liabilities

Guarantees and irrevocable letters of credit pledged as collateral security ............. 3,940 3,083

Commitments

Undrawn formal standby facilities, credit lines and other commitments to lend1 ... 34,588 36,291

Documentary credits and short-term trade-related transactions .............................. 540 627

35,128 36,918

1 Based on original contractual maturity.

The table above discloses the nominal principal amounts of commitments, guarantees and other contingent liabilities.

They are mainly credit-related instruments which include both financial and non-financial guarantees and commitments

to extend credit. Nominal principal amounts represent the amounts at risk should contracts be fully drawn upon and

clients default. As a significant portion of guarantees and commitments is expected to expire without being drawn upon,

the total of these nominal principal amounts is not representative of future liquidity requirements.

Litigation

We are subject to a number of legal proceedings arising in the normal course of our business. We do not expect the

outcome of any of these proceedings, in aggregate, to have a material effect on our consolidated financial position or

our result of operations.

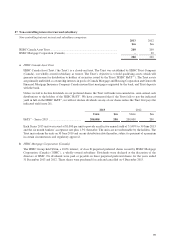

US regulatory and law enforcement investigations

In December 2012, HSBC Holdings plc (‘HSBC Holdings’), the bank’s ultimate parent company, HSBC Bank USA,

N.A. (‘HBUS’), and HSBC North America Holdings (‘HNAH’) entered into agreements to achieve a resolution with

US and UK government agencies regarding past inadequate compliance with anti-money laundering (‘AML’), Bank

Secrecy Act (BSA) and sanctions laws. Among other agreements, HSBC Holdings and HBUS entered into a five-year

Deferred Prosecution Agreement (the ‘US DPA’) with the US Department of Justice (‘DOJ’), HSBC Holdings entered

into a two-year Deferred Prosecution Agreement with the New York County District Attorney (‘DANY’), and HSBC

Holdings consented to a cease and desist order with the Federal Reserve Board (‘FRB’). HSBC Holdings also entered

into an Undertaking with the UK Financial Services Authority (now a Financial Conduct Authority (‘FCA’) Direction)

to comply with certain forward-looking obligations with respect to anti-money laundering and sanctions requirements

over a five-year term.

In addition, HBUS entered into a monetary penalty consent order with the US Department of the Treasury’s Financial

Crimes Enforcement Network (‘FinCEN’) and a separate monetary penalty order with the Office of the Comptroller

of the Currency (‘OCC’). HBUS also entered into a separate consent order with the OCC requiring it to correct

the circumstances and conditions as noted in the OCC’s then most recent report of examination, imposing certain

restrictions on HBUS directly or indirectly acquiring control of, or holding an interest in, any new financial subsidiary,

or commencing a new activity in its existing financial subsidiary, unless it receives prior approval from the OCC. HBUS

entered into a separate consent order with the OCC requiring it to adopt an enterprise wide compliance program.

Under these agreements, HSBC Holdings and HBUS will continue to cooperate fully with US and UK regulatory and

law enforcement authorities and take further action to strengthen its compliance policies and procedures. Under its

agreements with DOJ, the FCA, and the FRB, an independent corporate compliance monitor will evaluate the HSBC

Group’s progress in implementing its obligations under the relevant agreements. Michael Cherkasky has been selected

as the independent monitor, and, on 1 July, 2013, the United States District Court for the Eastern District of New York

approved the US DPA and retained authority to oversee implementation of the same.