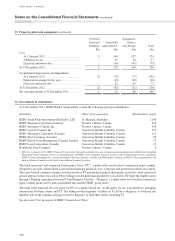

HSBC 2013 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2013 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

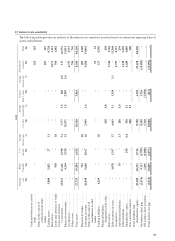

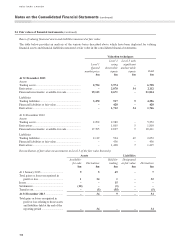

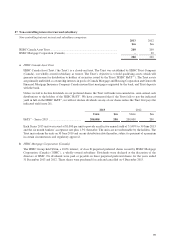

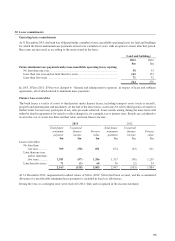

24 Fair values of financial instruments (continued)

Bases of valuing financial assets and liabilities measured at fair value (continued)

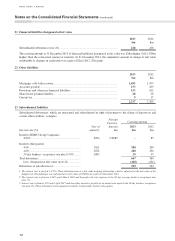

Assets Liabilities

Available-

for-sale

$m Derivatives

$m

Held for

trading

$m

Designated

at fair value

$m Derivatives

$m

At 1 January 2012 ............................... 19 122 8 580 43

Total gains or losses recognized in

profit or loss .................................. 1 (117) (1) (9) (36)

Issues ................................................... – – 43 – –

Settlements .......................................... (11) – – (571) –

Transfer out ......................................... – – (1) – –

At 31 December 2012 ......................... 9 5 49 – 7

Total gains or losses recognized in

profit or loss relating to those assets

and liabilities held at the end of the

reporting period ................................ – 5 1 – 7

During 2013 and 2012, there were no significant transfers between Level 1 and 2.

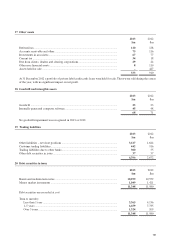

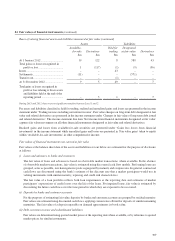

For assets and liabilities classified as held for trading, realized and unrealized gains and losses are presented in the income

statement under ‘Trading income excluding net interest income’. Fair value changes on long-term debt designated at fair

value and related derivatives are presented in the income statement under ‘Changes in fair value of long-term debt issued

and related derivatives’. The income statement line item ‘Net income from financial instruments designated at fair value’

captures fair value movements on all other financial instruments designated at fair value and related derivatives.

Realized gains and losses from available-for-sale securities are presented under ‘Gains less losses from financial

investments’ in the income statement while unrealized gains and losses are presented in ‘Fair value gains’ taken to equity

within ‘Available-for-sale investments’ in other comprehensive income.

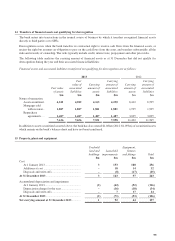

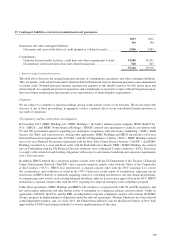

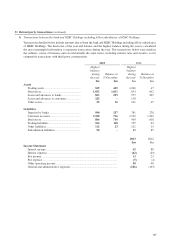

Fair values of financial instruments not carried at fair value

Fair values at the balance sheet date of the assets and liabilities set out below are estimated for the purpose of disclosure

at follows:

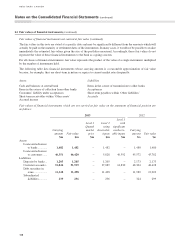

i) Loans and advances to banks and customers

The fair value of loans and advances is based on observable market transactions, where available. In the absence

of observable market transactions, fair value is estimated using discounted cash flow models. Performing loans are

grouped, as far as possible, into homogeneous pools segregated by maturity and coupon rates. In general, contractual

cash flows are discounted using the bank’s estimate of the discount rate that a market participant would use in

valuing instruments with similar maturity, repricing and credit risk characteristics.

The fair value of a loan portfolio reflects both loan impairments at the reporting date and estimates of market

participants’ expectations of credit losses over the life of the loans. For impaired loans, fair value is estimated by

discounting the future cash flows over the time period in which they are expected to be recovered.

ii) Deposits by banks and customer accounts

For the purposes of estimating fair value, deposits by banks and customer accounts are grouped by residual maturity.

Fair values are estimated using discounted cash flows, applying current rates offered for deposits of similar remaining

maturities. The fair value of a deposit repayable on demand approximates its book value.

iii) Debt securities in issue and subordinated liabilities

Fair values are determined using quoted market prices at the reporting date where available, or by reference to quoted

market prices for similar instruments.

107