HSBC 2013 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2013 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

77

2 Summary of significant accounting policies (continued)

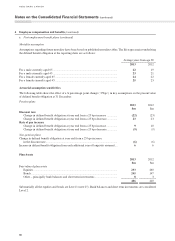

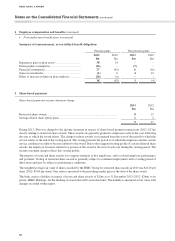

t Share-based payments

HSBC Holdings is the grantor of its equity instruments awarded to employees of the bank. The bank is required to fund

share-based payment arrangements awarded to its employees. The cost of share-based payment arrangements with

employees is measured by reference to the fair value of equity instruments on the date they are granted, and recognized as

an expense on a straight-line basis over the vesting period. The vesting period is the period during which all the specified

vesting conditions of the arrangement are to be satisfied. The fair value of equity instruments that are made available

immediately, with no vesting period attached to the award, are expensed immediately.

Fair value is determined by using appropriate valuation models, taking into account the terms and conditions of the

award. Vesting conditions include service conditions and performance conditions; any other features of the arrangement

are non-vesting conditions. Market performance conditions and non-vesting conditions are taken into account when

estimating the fair value of the award at the date of grant, so that an award is treated as vesting irrespective of whether

these conditions are satisfied, provided all other vesting conditions are satisfied.

Vesting conditions, other than market performance conditions, are not taken into account in the initial estimate of the

fair value at the grant date. They are taken into account by adjusting the number of equity instruments included in the

measurement of the transaction, so that the amount recognized for services received as consideration for the equity

instruments granted shall be based on the number of equity instruments that eventually vest. On a cumulative basis, no

expense is recognized for equity instruments that do not vest because of a failure to satisfy non-market performance or

service conditions.

A cancellation that occurs during the vesting period is treated as an acceleration of vesting, and recognized immediately

for the amount that would otherwise have been recognized for services over the vesting period.

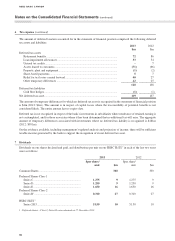

u Foreign currencies

Transactions in foreign currencies are recorded in the functional currency at the rate of exchange prevailing on the

date of the transaction. Monetary assets and liabilities denominated in foreign currencies are translated into the

functional currency at the rate of exchange in effect at the reporting date. Any resulting exchange differences are

included in the income statement.

Non-monetary assets and liabilities measured at fair value in a foreign currency are translated into the functional

currency using the rate of exchange at the date the fair value was determined. Any exchange component of a gain or

loss on a non-monetary item is recognized in other comprehensive income if the gain or loss on the non-monetary item

is recognized in other comprehensive income. Any exchange component of a gain or loss on a non-monetary item is

recognized in the income statement if the gain or loss on the non-monetary item is recognized in the income statement.

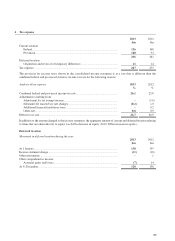

v Provisions

Provisions are recognized when it is probable that an outflow of economic benefits will be required to settle a current

legal or constructive obligation, which has arisen as a result of past events, and for which a reliable estimate can be

made of the amount of the obligation.

Contingent liabilities, which include certain guarantees and letters of credit pledged as collateral security, are possible

obligations that arise from past events whose existence will be confirmed only by the occurrence, or non-occurrence,

of one or more uncertain future events not wholly within the control of the bank; or are present obligations that have

arisen from past events but are not recognized because it is not probable that settlement will require the outflow of

economic benefits, or because the amount of the obligations cannot be reliably measured. Contingent liabilities are

not recognized in the financial statements but are disclosed unless the probability of settlement is remote.

w Financial guarantee contracts

Liabilities under financial guarantee contracts are recorded initially at their fair value, which is generally the fee

received or receivable. Subsequently, financial guarantee liabilities are measured at the higher of the initial fair value,

less cumulative amortization, and the best estimate of the expenditure required to settle the obligations.