HSBC 2013 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2013 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.51

and counterparties. As well, expectations in the bond

and money markets about inflation and central bank

monetary policy have an impact on the level of interest

rates. Changes in market expectations and monetary

policy are difficult to anticipate and predict. Fluctuations

in interest rates that result from these changes can have

an impact on our earnings. The current prolonged low

interest rate policies have had a negative impact on

results and a continuation of such policies would likely

continue to pressure earnings.

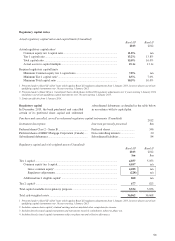

Changes in laws, regulations and approach

to supervision

Regulators in Canada are very active on a number of

fronts, including consumer protection, capital markets

activities, anti-money laundering, and the oversight and

strengthening of risk management. Regulations are in

place to protect our customers and the public interest.

Considerable changes in laws and regulations that relate

to the financial services industry have been proposed and

enacted, including changes related to capital and liquidity

requirements. Changes in laws and regulations, including

their interpretation and application, and changes in

approaches to supervision could adversely affect our

earnings. For example, such changes could limit the

products or services we can provide and the manner in

which we provide them and, potentially, lower our ability

to compete, while also increasing the costs of compliance.

As such, they could have a negative impact on earnings

and return on equity. These changes could also affect the

levels of capital and liquidity we choose to maintain.

In addition to the factors outlined here, our failure

to comply with laws and regulations could result in

sanctions and financial penalties that could adversely

affect our strategic flexibility, reputation and earnings.

Level of competition

The level of competition among financial services

companies is high. Furthermore, non-financial

companies have increasingly been offering services

traditionally provided by banks. Customer loyalty and

retention can be influenced by a number of factors,

including service levels, prices for products or services,

our reputation and the actions of our competitors.

Changes in these factors or any subsequent loss of

market share could adversely affect our earnings.

Changes to our credit rating

Credit ratings are important to our ability to raise both

capital and funding to support our business operations.

Maintaining strong credit ratings allows us to access the

capital markets at competitive pricing. Should our credit

ratings experience a material downgrade, our costs of

funding would likely increase significantly and our

access to funding and capital through capital markets

could be reduced.

Operational and infrastructure risks

We are exposed to many operational risks including:

the risk of fraud by employees or others, unauthorized

transactions by employees, and operational or human

error. We face the risk of loss due to cyber-attack and

also face the risk that computer or telecommunications

systems could fail, despite our efforts to maintain these

systems in good working order. Some of our services

(such as online banking) or operations may face the risk

of interruption or other security risks arising from the

risks related to the use of the internet in these services

or operations, which may impact our customers and

infrastructure. Given the high volume of transactions

we process on a daily basis, certain errors may be

repeated or compounded before they are discovered

and rectified. Shortcomings or failures of our internal

processes, employees or systems, or those provided by

third parties, including any of our financial, accounting

or other data processing systems, could lead to financial

loss and damage to our reputation. In addition, despite

the contingency plans we have in place, our ability

to conduct business may be adversely affected by

a disruption in the infrastructure that supports both

our operations and the communities in which we do

business, including but not limited to disruption caused

by public health emergencies or terrorist acts.