HSBC 2013 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2013 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

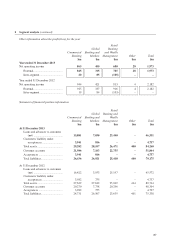

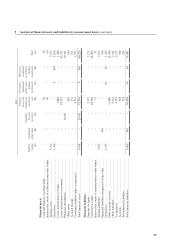

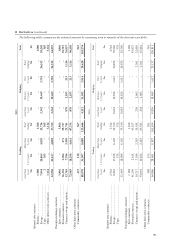

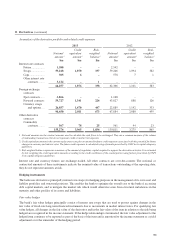

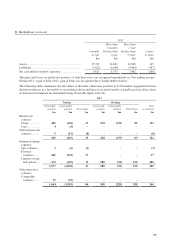

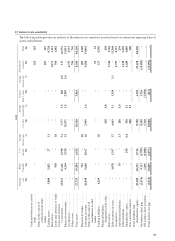

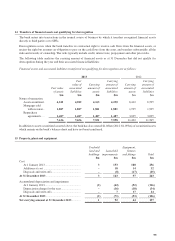

11 Derivatives (continued)

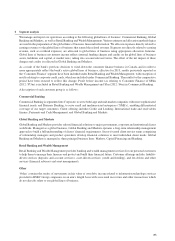

Use of derivatives

The bank utilizes derivatives for three primary purposes: to create risk management solutions for clients, for proprietary

trading purposes, and to manage and hedge the bank’s own risks. Derivatives (except for derivatives which are designated

as effective hedging instruments as defined in IAS 39) are held for trading. The held for trading classification includes

two types of derivatives: those used in sales and trading activities, and those used for risk management purposes but

which for various reasons do not qualify for hedge accounting. The second category includes derivatives managed in

conjunction with financial instruments designated at fair value. These activities are described more fully below.

The bank’s derivative activities give rise to significant open positions in portfolios of derivatives. These positions are

managed constantly to ensure that they remain within acceptable risk levels in accordance with the bank’s approved risk

management policies, with matching deals being used to achieve this where necessary. When entering into derivative

transactions, the bank employs the same credit risk management procedures that are used for traditional lending to assess

and approve potential credit exposures.

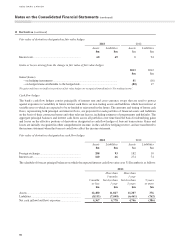

Trading derivatives

Most of the bank’s derivative transactions relate to sales and trading activities. Sales activities include the structuring

and marketing of derivative products to customers to enable them to take, transfer, modify or reduce current or expected

risks. Trading activities in derivatives are entered into principally for the purpose of generating prots from short-term

uctuations in price or margin. Positions may be traded actively or be held over a period of time to benet from expected

changes in currency rates, interest rates, equity prices or other market parameters. Trading includes market-making,

positioning and arbitrage activities. Market-making entails quoting bid and offer prices to other market participants for

the purpose of generating revenues based on spread and volume; positioning means managing market risk positions in

the expectation of beneting from favourable movements in prices, rates or indices; arbitrage involves identifying and

proting from price differentials between markets and products.

As mentioned above, other derivatives classied as held for trading include non-qualifying hedging derivatives,

ineffective hedging derivatives and the components of hedging derivatives that are excluded from assessing hedge

effectiveness. Non-qualifying hedging derivatives are entered into for risk management purposes but do not meet the

criteria for hedge accounting. These include derivatives managed in conjunction with nancial instruments designated

at fair value.

Gains and losses from changes in the fair value of derivatives, including the contractual interest, that do not qualify for

hedge accounting are reported in ‘Net trading income’, except for derivatives managed in conjunction with nancial

instruments designated at fair value, where gains and losses are reported in ‘Net income from nancial instruments

designated at fair value’, together with the gains and losses on the hedged items. Where the derivatives are managed

with debt securities in issue, the contractual interest is shown in ‘interest expense’ together with the interest payable on

the issued debt.

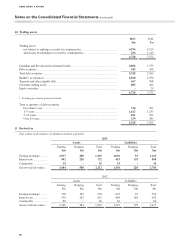

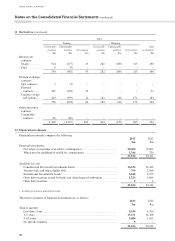

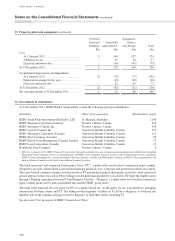

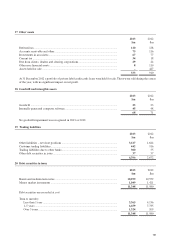

Notes on the Consolidated Financial Statements (continued)

HSBC BANK CANADA

92