HSBC 2013 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2013 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

115

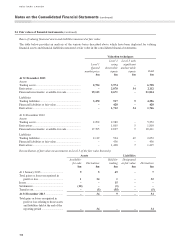

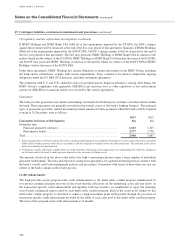

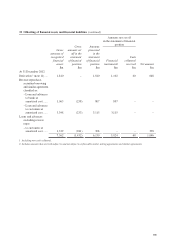

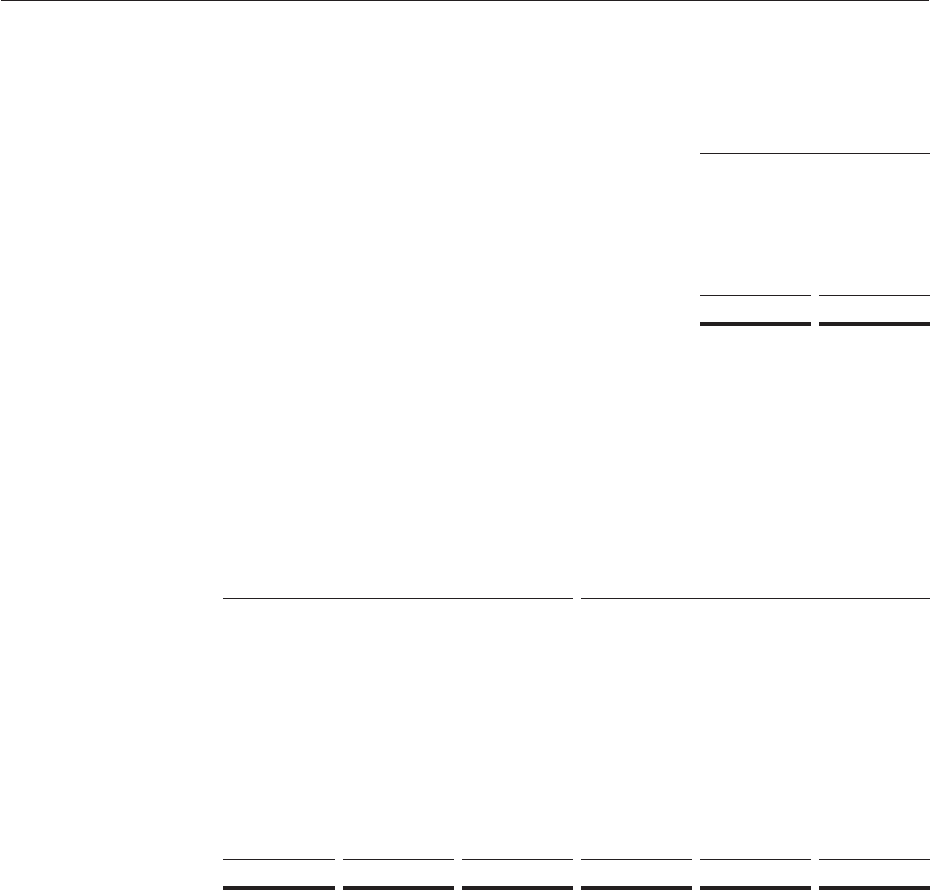

30 Lease commitments

Operating lease commitments

At 31 December 2013, the bank was obligated under a number of non-cancellable operating leases for land and buildings

for which the future minimum lease payments extend over a number of years, with an option to renew after that period.

Base rents are increased as according to the terms stated in the lease.

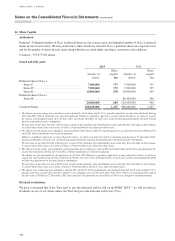

Land and buildings

2013

$m

2012

$m

Future minimum lease payments under non-cancellable operating leases expiring

No later than one year .............................................................................................. 50 53

Later than one year and no later than five years ...................................................... 143 153

Later than five years ................................................................................................. 71 72

264 278

In 2013, $52m (2012: $50m) was charged to ‘General and administrative expenses’ in respect of lease and sublease

agreements, all of which related to minimum lease payments.

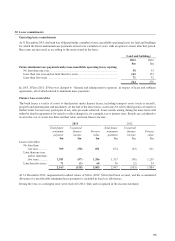

Finance lease receivables

The bank leases a variety of assets to third parties under finance leases, including transport assets (such as aircraft),

property and general plant and machinery. At the end of the lease terms, assets may be sold to third parties or leased for

further terms. Lessees may participate in any sales proceeds achieved. Lease rentals arising during the lease terms will

either be fixed in quantum or be varied to reflect changes in, for example, tax or interest rates. Rentals are calculated to

recover the cost of assets less their residual value, and earn finance income.

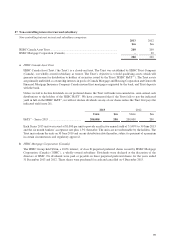

2013 2012

Total future

minimum

payment

$m

Unearned

finance

income

$m

Present

value

$m

Total future

minimum

payment

$m

Unearned

finance

income

$m

Present

value

$m

Lease receivables:

No later than

one year ............. 709 (58) 651 674 (63) 611

Later than one year

and no later than

five years ............. 1,383 (97) 1,286 1,317 (98) 1,219

Later than five years .. 71 (3) 68 56 (2) 54

2,163 (158) 2,005 2,047 (163) 1,884

At 31 December 2013, unguaranteed residual values of $11m (2012: $11m) had been accrued, and the accumulated

allowance for uncollectible minimum lease payments is included in loan loss allowances.

During the year, no contingent rents were received (2012: $nil) and recognized in the income statement.