HSBC 2013 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2013 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

85

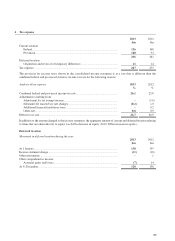

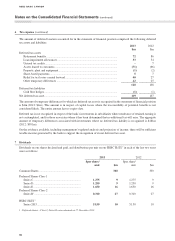

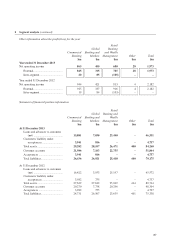

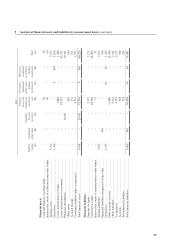

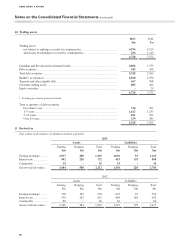

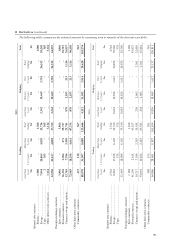

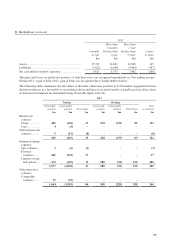

8 Segment analysis

We manage and report our operations according to the following global lines of business: Commercial Banking, Global

Banking and Markets, as well as Retail Banking and Wealth Management. Various estimate and allocation methodologies

are used in the preparation of the global lines of business financial information. We allocate expenses directly related to

earning revenues to the global lines of business that earned the related revenue. Expenses not directly related to earning

revenue, such as overhead expenses, are allocated to global lines of business using appropriate allocation formulas.

Global lines of business net interest income reflects internal funding charges and credits on the global lines of business

assets, liabilities and capital, at market rates, taking into account relevant terms. The offset of the net impact of these

charges and credits is reflected in Global Banking and Markets.

As a result of the bank’s previous decision to wind-down the consumer finance business in Canada and in order to

more appropriately reflect the bank’s active global lines of business, effective for 2013, results previously reported as

the ‘Consumer Finance’ segment have been included under Retail Banking and Wealth Management, with exception of

results relating to corporate credit cards, which are included under Commercial Banking. The results for the comparative

period have been restated to reflect this change. Profit before income tax relating to Consumer Finance of $88m

(2012: $73m) is included in Retail Banking and Wealth Management and $5m (2012: $4m) in Commercial Banking.

A description of each customer group is as follows:

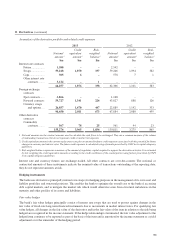

Commercial Banking

Commercial Banking is segmented into Corporate, to serve both large and mid-market companies with more sophisticated

financial needs, and Business Banking, to serve small and medium-sized enterprises (‘SME’s), enabling differentiated

coverage of our target customers. Client offering includes Credit and Lending; International trade and receivables

finance; Payments and Cash Management; and Global Banking and Markets.

Global Banking and Markets

Global Banking and Markets provides tailored financial solutions to major government, corporate and institutional clients

worldwide. Managed as a global business, Global Banking and Markets operates a long-term relationship management

approach to build a full understanding of clients’ financial requirements. Sector-focused client service teams comprising

of relationship managers and product specialists develop financial solutions to meet individual client needs. Global

Banking and Markets is managed as three principal business lines: Markets, Capital Financing and Banking.

Retail Banking and Wealth Management

Retail Banking and Wealth Management provides banking and wealth management services for our personal customers

to help them to manage their finances and protect and build their financial future. Customer offerings include: liability-

driven services (deposits and account services), asset-driven services (credit and lending), and fee-driven and other

services (financial advisory and asset management).

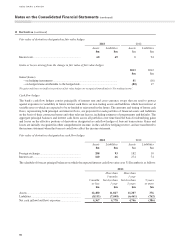

Other

‘Other’ contains the results of movements in fair value of own debt, income related to information technology services

provided to HSBC Group companies on an arm’s length basis with associated recoveries and other transactions which

do not directly relate to our global lines of business.