HSBC 2013 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2013 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

1

Annual Report and Accounts 2013

HSBC BANK CANADA

Headlines

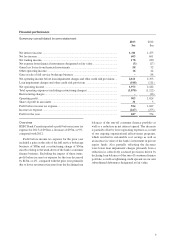

– Profit before income tax expense was $934m for the

year ended 31 December 2013, a decrease of 9.2%

compared with 2012.

– Profit attributable to common shareholders was

$616m for the year ended 31 December 2013, a

decrease of 9.8% compared with 2012.

– Return on average common equity was 14.5% for the

year ended 31 December 2013 compared with 16.6%

for 2012.

– The cost efficiency ratio was 49.5% for the year ended

31 December 2013 compared with 48.4% for 2012.

– Total assets were $84.3bn at 31 December 2013

compared with $80.7bn at 31 December 2012.

– Total assets under administration increased to

$21.4bn at 31 December 2013 from $19.5bn at

31 December 2012.

– Common equity tier 1 capital ratio was 11.0%, the

tier 1 ratio was 13.2% and the total capital ratio

was 15.0% at 31 December 2013, determined using

regulatory guidelines in accordance with the Basel II

and Basel III capital adequacy frameworks adopted

with effect from 1 January 2013.

Basis of Preparation of Financial Information

HSBC Bank Canada (‘the bank’, ‘we’, ‘our’) is an

indirectly wholly-owned subsidiary of HSBC Holdings

plc (‘HSBC Holdings’). Throughout Management’s

Discussion and Analysis (‘MD&A’), the HSBC Holdings

Group is defined as the ‘HSBC Group’ or the ‘Group’.

The MD&A is dated 21 February 2014, the date that our

consolidated financial statements and MD&A for the year

ended 31 December 2013 were approved by our Board of

Directors (‘the Board’).

The bank has prepared its consolidated financial

statements in accordance with International Financial

Reporting Standards (‘IFRS’) and accounting guidelines

as issued by the Office of the Superintendent of Financial

Institutions Canada (‘OSFI’), as required under Section

308(4) of the Bank Act. The information in this MD&A

is derived from our consolidated financial statements

or from the information used to prepare them. The

abbreviations ‘$m’ and ‘$bn’ represent millions and

billions of Canadian dollars, respectively. All tabular

amounts are in millions of dollars except where

otherwise stated.

The references to ‘notes’ throughout this MD&A

refer to notes on the consolidated financial statements

for the year ended 31 December 2013.

Table of Contents

2 Message from the President and

Chief Executive Officer

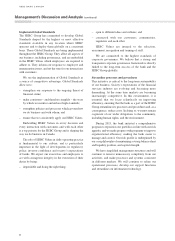

3 Management’s Discussion and Analysis

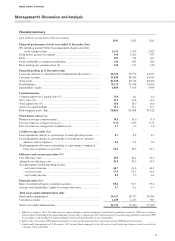

3 Financial summary

4 Use of non-IFRS financial measures

5 Who we are

5 Our purpose and strategic priorities

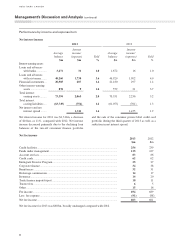

7 Financial performance

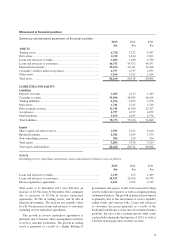

11 Movement in financial position

12 Global lines of business

18 Fourth quarter 2013 financial

performance

22 Summary quarterly performance

23 Economic outlook for 2014

24 Critical accounting policies

26 Changes in accounting policy

during 2013

27 Future accounting developments

27 Off-balance sheet arrangements

28 Disclosure controls and procedures and

internal control over financial reporting

29 Related party transactions

30 Risk management

50 Factors that may affect future results

52 Capital

54 Dividends

55 Statement of Management’s Responsibility

for Financial Information

56 Independent Auditors’ Report

57 Consolidated Financial Statements

63 Notes on the Consolidated Financial Statements

121 HSBC Group International Network

121 HSBC Bank Canada Subsidiaries

122 Executive Committee

122 Board of Directors