HSBC 2013 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2013 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC BANK CANADA

118

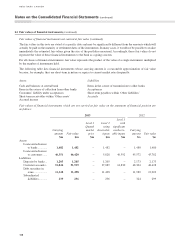

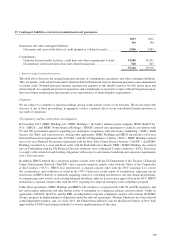

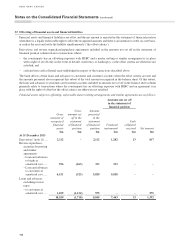

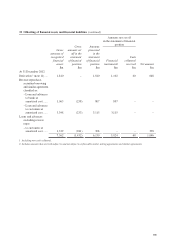

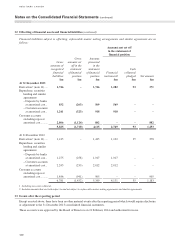

32 Offsetting of financial assets and financial liabilities

Financial assets and financial liabilities are offset and the net amount is reported in the statement of financial position

when there is a legally enforceable right to offset the recognized amounts and there is an intention to settle on a net basis,

or realize the asset and settle the liability simultaneously (‘the offset criteria’).

Derivatives and reverse repurchase/repurchase agreements included in the amounts not set off in the statement of

financial position column relate to transactions where:

– the counterparty has an offsetting exposure with HSBC and a master netting or similar arrangement is in place

with a right of set off only in the event of default, insolvency or bankruptcy, or the offset criteria are otherwise not

satisfied; and

– cash and non-cash collateral received/pledged in respect of the transactions described above.

The bank offsets certain loans and advances to customers and customer accounts when the offset criteria are met and

the amounts presented above represent this subset of the total amounts recognized in the balance sheet. Of this subset,

the loans and advances to customers and customer accounts included in amounts not set off in the balance sheet column

primarily relate to transactions where the counterparty has an offsetting exposure with HSBC and an agreement is in

place with the right of offset but the offset criteria are otherwise not satisfied.

Financial assets subject to offsetting, enforceable master netting arrangements and similar agreements are as follows:

Amounts not set off

in the statement of

financial position

Gross

amounts of

recognized

financial

assets

$m

Gross

amounts set

off in the

statement

of financial

position

$m

Amounts

presented

in the

statement

of financial

position

$m

Financial

instruments

$m

1

Cash

collateral

received

$m

Net amount

$m

At 31 December 2013

Derivatives2 (note 11) ..... 2,112 – 2,112 1,282 13 817

Reverse repurchase,

securities borrowing

and similar

agreements:

– Loan and advances

to banks at

amortized cost ....... 596 (263) 333 333 – –

– Loan and advances

to customers at

amortized cost ....... 6,151 (323) 5,828 5,828 – –

Loans and advances

excluding reverse

repos

– to customers at

amortized cost ....... 1,699 (1,124) 575 – – 575

10,558 (1,710) 8,848 7,443 13 1,392

Notes on the Consolidated Financial Statements (continued)