HSBC 2013 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2013 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

79

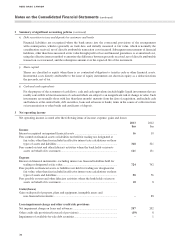

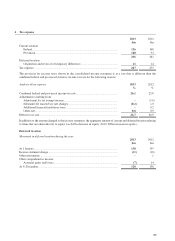

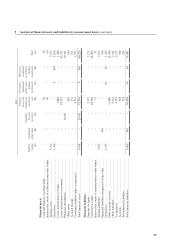

4 Employee compensation and benefits

a Total employee compensation

2013

$m

2012

$m

Wages and salaries ......................................................................................................... 504 525

Post-employee benefits .................................................................................................. 62 61

Other .............................................................................................................................. 48 73

614 659

b Post-employment benefits

We sponsor a number of defined benefit and defined contribution plans providing pension, other retirement and

post-employment benefits to eligible employees. Non-pension plans comprise of healthcare and other post-employment

benefits and are not funded.

Income statement charge 2013

$m

2012

$m

Defined benefit plans

Pension plans ........................................................................................................... 20 19

Non-pension plans ................................................................................................... 12 –

Defined contribution pension plans ............................................................................... 30 31

62 50

Curtailment and settlement gains and other amounts related to restructuring

included above ......................................................................................................... –11

Post-employment benets .............................................................................................. 62 61

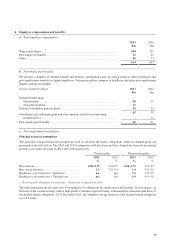

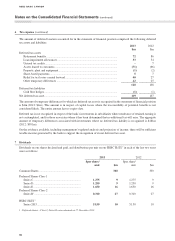

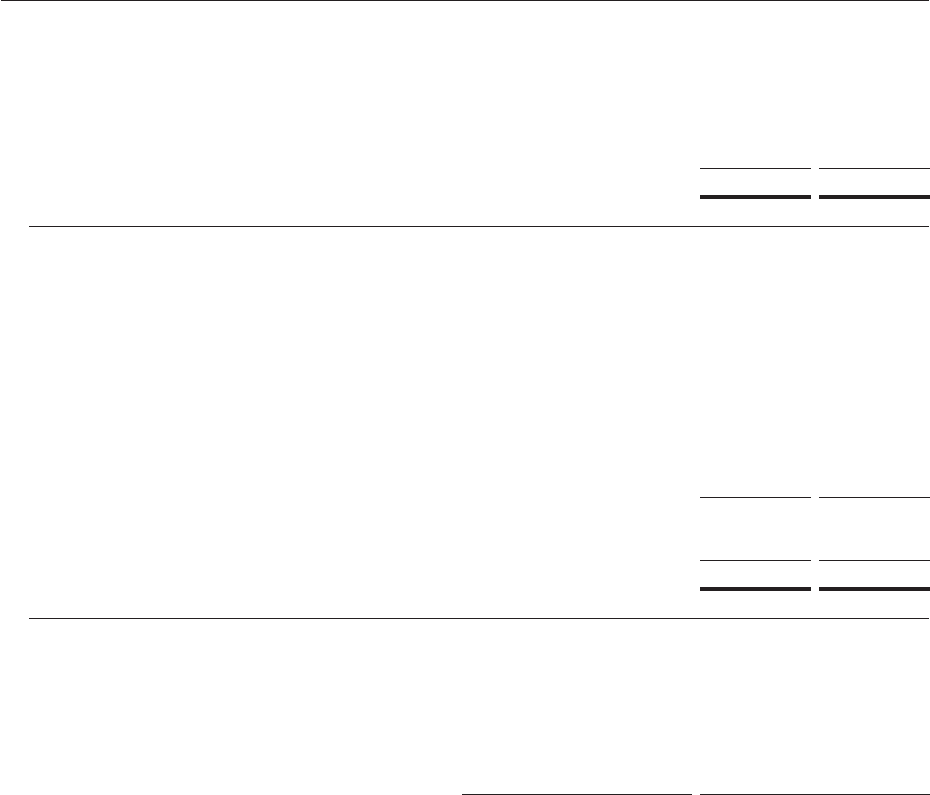

c Post-employment benefit plans

Principal actuarial assumptions

The principal actuarial financial assumptions used to calculate the bank’s obligations under its defined plans are

presented in the table below. The 2013 and 2012 assumptions will also form and have formed the basis for measuring

periodic costs under the plans in 2014 and 2013 respectively.

Pension plans Non-pension plans

2013

%

2012

%2013

%

2012

%

Discount rate ............................................................... 4.50–4.75 4.0–4.5 4.50–4.75 4.0–4.5

Rate of pay increase .................................................... 3.4 3.0–3.4 3.4 3.0–3.4

Healthcare cost trend rates – Initial rate ..................... n/a n/a 7.2 7.2–8.0

Healthcare cost trend rates – Ultimate rate1 ............... n/a n/a 4.9 4.9–5.0

1 The non-pension ‘Healthcare cost trend rates – Ultimate rate’ is applied from 2020.

The bank determines the discount rates to be applied to its obligations in consultation with the plans’ local actuaries, on

the basis of the current average yield of high quality Canadian corporate bonds, with maturities consistent with those of

the defined benefit obligations. At 31 December 2013, the weighted average duration of the defined benefit obligation

was 16.6 years.