HSBC 2013 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2013 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC BANK CANADA

63

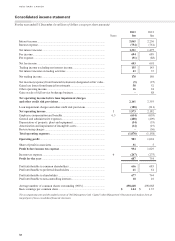

Notes on the Consolidated Financial Statements

31 December 2013 and 2012 (all tabular amounts are in millions of dollars unless stated otherwise)

1 Basis of preparation

a Compliance with International Financial Reporting Standards

HSBC Bank Canada (‘the bank’, ‘we’, ‘our’) is an indirectly wholly-owned subsidiary of HSBC Holdings plc

(‘the Parent’, ‘HSBC Holdings’). In these consolidated financial statements, HSBC Group means the Parent and

its subsidiary companies. From 1 January 2011, the bank has prepared its consolidated financial statements in

accordance with International Financial Reporting Standards (‘IFRS’) and accounting guidelines as issued by the

Office of the Superintendent of Financial Institutions Canada (‘OSFI’), as required under Section 308(4) of the

Bank Act.

IFRS comprise accounting standards as issued by the International Accounting Standards Board (‘IASB’) and its

predecessor body as well as interpretations issued by the IFRS Interpretations Committee and its predecessor body.

b Presentation of information

i) The bank’s consolidated financial statements are presented in Canadian dollars which is also its functional

currency. The abbreviation “$m” represents millions of dollars. All tabular amounts are in millions of dollars

except where otherwise noted. Certain prior period amounts have been reclassified to conform with the current

period presentation.

Disclosures required under IFRS 7 ‘Financial Instruments: Disclosures’ (‘IFRS 7’) concerning the nature and

extent of risks relating to financial instruments have been included in the audited sections of ‘Risk Management

and Capital’ within Management’s Discussion and Analysis.

Capital disclosures and Loans and advances under IAS 1 ‘Presentation of financial statements’ (‘IAS 1’) have

been included in the audited sections of ‘Risk Management’ within Management’s Discussion and Analysis.

ii) In 2013, the bank adopted a revised disclosure convention for the presentation of impaired loans and advances

which affects the disclosure of the impaired loan portfolio. The revised disclosure convention introduces a more

stringent approach to the assessment of whether renegotiated loans are presented as impaired. This reflects HSBC

Group standards and developments in industry best practice disclosure.

Under the revised disclosure convention, renegotiated consumer finance loans and advances that have been

subject to a change in contractual cash flows as a result of a concession which the lender would not otherwise

consider, and where it is probable that without the concession the borrower would be unable to meet its

contractual payment obligations in full, unless the concession is insignificant and there are no other indicators

of impairment, are included as impaired loans and advances. Renegotiated loans remain classified as impaired

until there is sufficient evidence to demonstrate a significant reduction in the risk of non-payment of future cash

flows, and there are no other indicators of impairment.

Management believes that this revised approach better reflects the nature of risks and inherent credit quality

in our loan portfolio as it applies stricter requirements for the performance of renegotiated loans before they

may be presented as no longer impaired. The revised disclosure convention affects the disclosure presentation

of impaired loans but does not affect the accounting policy for the recognition of impairment allowances as

disclosed in Note 2(f) and accordingly there is no impact on the income statement.

iii) As a result of changing market practices in response to regulatory and accounting changes, as well as general

market developments, the bank revised its methodology for estimating the credit valuation adjustment (‘CVA’)

and debit valuation adjustment (‘DVA’) for derivatives from 1 January 2013. Previously, the probability of

default (‘PD’) used in the CVA calculation was based on the bank’s internal credit rating for the counterparty

taking into account how credit ratings may deteriorate over the duration of the exposure based on historical rating

transition matrices. The revised methodology maximizes the use of the PDs based on market-observable data,

such as credit default swap (‘CDS’) spreads. Where CDS spreads are not available, PDs are estimated having

regard to market practice, considering relevant data including both CDS indices and historical rating transition

matrices. In addition, the bank aligned its methodology for estimating the debit valuation adjustment (‘DVA’) to

be consistent with that applied for CVA. Historically, the bank considered that a zero spread was appropriate in

respect of own credit risk and consequently did not adjust derivative liabilities for its own credit risk.